Op 236 Form

What is the Op 236

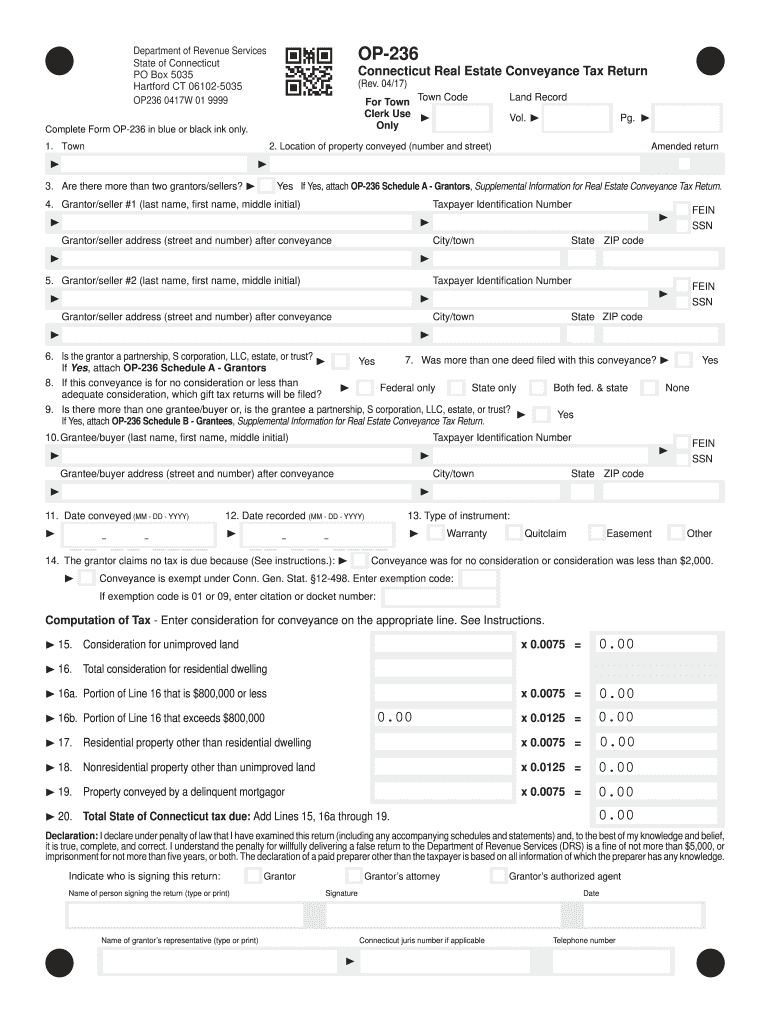

The Op 236, officially known as the Connecticut Op 236 form, is a crucial document used primarily for tax purposes in the state of Connecticut. This form is typically associated with the conveyance of real property and is essential for reporting the sale or transfer of real estate. The information provided on the Op 236 helps the state assess the appropriate tax obligations related to the transaction. Understanding this form is vital for both buyers and sellers to ensure compliance with state tax regulations.

How to use the Op 236

Using the Op 236 involves a series of steps that ensure accurate completion and submission. First, gather all necessary information regarding the property being transferred, including the property address, sale price, and details about the parties involved in the transaction. Next, fill out the form with precise information, ensuring that all required fields are completed. Once the form is filled out, it should be signed by the appropriate parties. After signing, the Op 236 can be submitted to the relevant state authority, either in person or by mail, depending on the specific requirements.

Steps to complete the Op 236

Completing the Op 236 form involves several key steps:

- Gather necessary documents, including the property deed and any prior tax information.

- Fill out the form with accurate details about the property and transaction.

- Ensure all parties involved in the transaction sign the form where required.

- Review the completed form for any errors or omissions.

- Submit the form to the appropriate local tax authority.

Legal use of the Op 236

The Op 236 is legally binding when completed correctly and submitted to the state. It serves as a formal declaration of the transfer of property and the associated tax obligations. To ensure its legal standing, it must be filled out accurately, signed by all necessary parties, and submitted within the required timeframe. Compliance with state regulations is critical to avoid penalties or issues with property ownership.

Key elements of the Op 236

Several key elements must be included in the Op 236 for it to be valid:

- Property description, including address and parcel number.

- Sale price of the property being transferred.

- Names and contact information of both the buyer and seller.

- Signatures of all parties involved in the transaction.

- Date of the transaction.

Form Submission Methods

The Op 236 can be submitted through various methods, depending on local regulations. Common submission methods include:

- In-person delivery to the local tax assessor's office.

- Mailing the completed form to the appropriate authority.

- Online submission, if available, through state tax portals.

Quick guide on how to complete op 236

Complete Op 236 seamlessly on any device

Online document management has become popular among businesses and individuals. It offers a perfect eco-friendly substitute for traditional printed and signed papers, as you can locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage Op 236 on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

The easiest way to edit and eSign Op 236 effortlessly

- Locate Op 236 and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow.

- Generate your eSignature with the Sign tool, which only takes seconds and holds the same legal value as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the concerns of missing or lost files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your preference. Edit and eSign Op 236 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the op 236

How to generate an eSignature for your PDF file in the online mode

How to generate an eSignature for your PDF file in Chrome

How to make an eSignature for putting it on PDFs in Gmail

How to make an electronic signature right from your smartphone

The best way to create an electronic signature for a PDF file on iOS devices

How to make an electronic signature for a PDF on Android

People also ask

-

What is ct op 236 and how does it relate to airSlate SignNow?

Ct op 236 refers to a specific feature within airSlate SignNow that streamlines the document signing process. This functionality allows users to efficiently send and eSign documents, making it an essential tool for businesses looking to enhance their workflow and improve efficiency.

-

How much does airSlate SignNow cost with ct op 236 features?

The pricing for airSlate SignNow varies depending on the plan selected, but it is designed to be cost-effective while offering powerful features like ct op 236. You can find customized pricing options based on your business needs and the number of users, ensuring you only pay for what you need.

-

What features does ct op 236 offer for document management?

Ct op 236 includes advanced features such as automatic reminders, custom templates, and real-time tracking of document status. These capabilities enhance document management and ensure that you never miss an important deadline while streamlining your signing process.

-

How can businesses benefit from using ct op 236 in airSlate SignNow?

By leveraging ct op 236, businesses can signNowly reduce turnaround times for document signatures and improve overall productivity. This feature simplifies the eSigning process, allowing teams to focus more on core tasks rather than administrative delays.

-

Does airSlate SignNow with ct op 236 support integrations with other tools?

Yes, airSlate SignNow, including its ct op 236 features, supports integrations with a wide variety of applications such as CRM systems, email platforms, and cloud storage solutions. This ensures a seamless experience, allowing you to work with your preferred tools without disruptions.

-

Is it easy to set up ct op 236 in airSlate SignNow?

Absolutely! Setting up ct op 236 in airSlate SignNow is straightforward and user-friendly. Our intuitive interface and comprehensive tutorials will guide you through the setup process, ensuring you can start eSigning documents quickly and efficiently.

-

Can I try airSlate SignNow with ct op 236 before making a purchase?

Yes, airSlate SignNow offers a free trial that includes access to the ct op 236 features. This allows potential customers to explore the functionality and effectiveness of our eSigning solution before committing to a paid plan.

Get more for Op 236

Find out other Op 236

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template

- How To eSign South Dakota Plumbing Quitclaim Deed

- How To eSign South Dakota Plumbing Affidavit Of Heirship

- eSign South Dakota Plumbing Emergency Contact Form Myself

- eSign Texas Plumbing Resignation Letter Free

- eSign West Virginia Orthodontists Living Will Secure

- Help Me With eSign Texas Plumbing Business Plan Template

- Can I eSign Texas Plumbing Cease And Desist Letter

- eSign Utah Plumbing Notice To Quit Secure

- eSign Alabama Real Estate Quitclaim Deed Mobile

- eSign Alabama Real Estate Affidavit Of Heirship Simple

- eSign California Real Estate Business Plan Template Free