How to Wv it 101q Form

What is the WV IT 101Q?

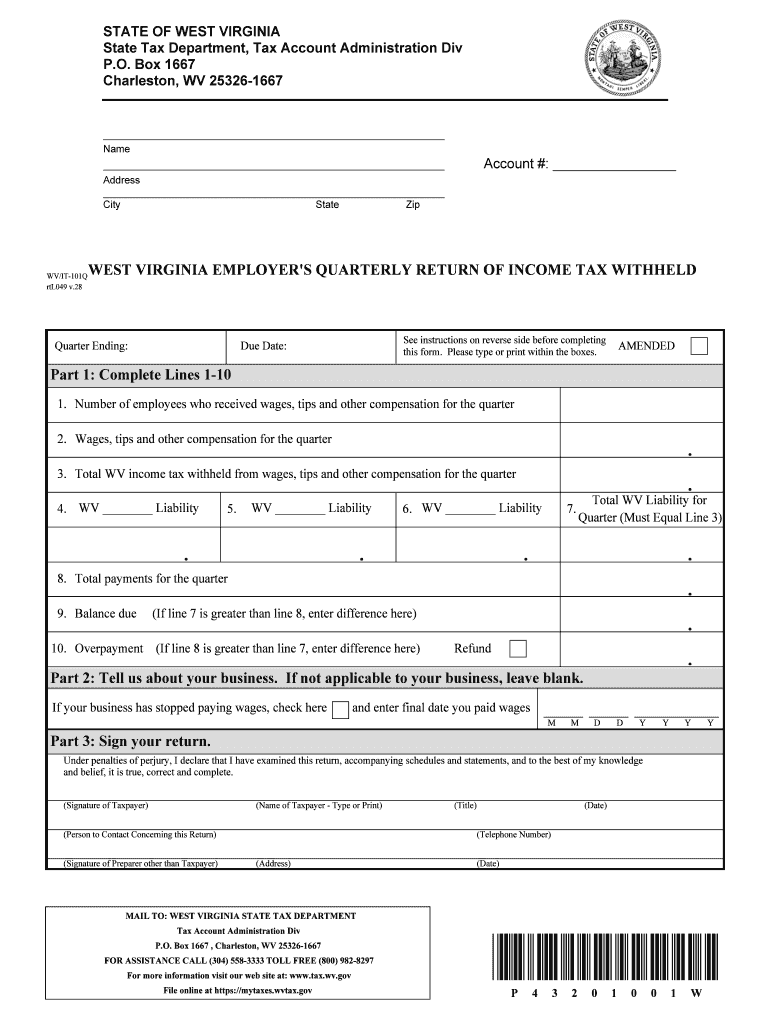

The WV IT 101Q is a quarterly tax form used by businesses and individuals in West Virginia to report income and calculate tax liabilities. This form is essential for ensuring compliance with state tax regulations. It captures various income sources and deductions, allowing taxpayers to accurately determine their tax obligations for each quarter. Understanding the purpose of the WV IT 101Q is crucial for timely and correct tax submissions.

Steps to Complete the WV IT 101Q

Completing the WV IT 101Q involves several key steps:

- Gather necessary financial documents, including income statements and previous tax returns.

- Fill out the form with accurate income figures and applicable deductions.

- Ensure all calculations are correct to avoid discrepancies.

- Review the completed form for accuracy and completeness.

- Submit the form by the designated deadline to avoid penalties.

Filing Deadlines / Important Dates

Filing deadlines for the WV IT 101Q are critical for compliance. Typically, the form must be submitted by the last day of the month following the end of each quarter. For example, the deadlines are:

- First Quarter: April 30

- Second Quarter: July 31

- Third Quarter: October 31

- Fourth Quarter: January 31 of the following year

Missing these deadlines may result in penalties and interest on unpaid taxes.

Legal Use of the WV IT 101Q

The WV IT 101Q is legally binding when completed and submitted according to state regulations. It must be signed by the taxpayer or an authorized representative. The form's legal standing is reinforced by compliance with the Electronic Signatures in Global and National Commerce (ESIGN) Act, which allows for electronic submissions and signatures, provided that certain conditions are met.

Form Submission Methods

Taxpayers can submit the WV IT 101Q through various methods:

- Online submission via the West Virginia State Tax Department's website.

- Mailing a paper copy to the appropriate tax office.

- In-person submission at designated tax offices.

Choosing the right submission method can enhance efficiency and ensure timely processing of the tax form.

Penalties for Non-Compliance

Failure to file the WV IT 101Q on time can lead to significant penalties. These may include:

- Late filing penalties, which can accumulate over time.

- Interest on unpaid taxes, increasing the overall liability.

- Potential legal action for persistent non-compliance.

It is essential to adhere to filing requirements to avoid these consequences.

Quick guide on how to complete how to wv it 101q

Accomplish How To Wv It 101q effortlessly on any device

Online document management has become increasingly favored by companies and individuals. It offers an ideal eco-friendly option to conventional printed and signed documents, as you can easily locate the right form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, alter, and electronically sign your files swiftly without delays. Manage How To Wv It 101q on any platform with airSlate SignNow Android or iOS applications and enhance any document-centered workflow today.

How to change and eSign How To Wv It 101q with ease

- Locate How To Wv It 101q and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of your documents or redact sensitive details with tools that airSlate SignNow specifically provides for such tasks.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal authority as a conventional wet ink signature.

- Verify the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or errors that require printing fresh document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Modify and eSign How To Wv It 101q and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the how to wv it 101q

How to make an electronic signature for a PDF online

How to make an electronic signature for a PDF in Google Chrome

The best way to create an eSignature for signing PDFs in Gmail

How to make an electronic signature from your smartphone

The best way to generate an eSignature for a PDF on iOS

How to make an electronic signature for a PDF file on Android

People also ask

-

What is airSlate SignNow and how does it support West Virginia quarterly document management?

airSlate SignNow is a robust eSignature solution designed to facilitate the efficient sending and signing of documents. For businesses in West Virginia, it simplifies quarterly reporting and documentation processes, ensuring compliance and easy tracking of important paperwork.

-

How much does airSlate SignNow cost for West Virginia quarterly users?

Pricing for airSlate SignNow varies depending on the plan you choose. For West Virginia quarterly users, it's essential to consider factors like document volume and team size, which can affect overall costs. Our pricing is competitive, making it a cost-effective choice for businesses in the region.

-

What features does airSlate SignNow offer for West Virginia quarterly compliance?

airSlate SignNow includes features specifically tailored for compliance with West Virginia quarterly regulations, such as customizable templates and automated workflows. These tools enable businesses to streamline their document processes, reducing the chance of errors and ensuring adherence to legal standards.

-

Can I integrate airSlate SignNow with other applications for my West Virginia quarterly needs?

Yes, airSlate SignNow offers seamless integrations with various applications popular among West Virginia businesses. This compatibility allows users to enhance their quarterly operations by linking SignNow with CRM systems, accounting software, and more, thereby simplifying workflows.

-

What are the benefits of using airSlate SignNow for West Virginia quarterly document signing?

Using airSlate SignNow for your West Virginia quarterly document signing can signNowly reduce turnaround times and improve efficiency. The platform's user-friendly interface ensures that all team members can navigate the process easily, making it quicker to complete essential tasks.

-

Is airSlate SignNow secure for handling West Virginia quarterly business documents?

Absolutely, airSlate SignNow prioritizes the security of your documents, employing bank-level encryption to protect sensitive information during quarterly transactions. This ensures that businesses in West Virginia can confidently manage their important documents without the risk of data bsignNowes.

-

Can I track my West Virginia quarterly documents sent through airSlate SignNow?

Yes, airSlate SignNow allows you to track all documents sent for eSignature, including those related to your West Virginia quarterly activities. This tracking feature provides transparency and helps you maintain an organized overview of your document statuses, ensuring nothing falls through the cracks.

Get more for How To Wv It 101q

- In loco parentis arizona forms

- Voluntary termination of parental rights n c form

- Hawaii board of nursing application form

- Hc5 optical form online

- Dsop fund withdrawal form

- Sanderson farms application form

- Tulip online licensure application systemtexas health and human services form

- Human rights tulip nomination form es pdf studocu

Find out other How To Wv It 101q

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT

- Can I Electronic signature Delaware Courts Document

- How Do I Electronic signature Illinois Courts Document

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document

- How Can I Electronic signature New Jersey Courts Document

- Can I Electronic signature Oregon Sports Form

- How To Electronic signature New York Courts Document

- How Can I Electronic signature Oklahoma Courts PDF

- How Do I Electronic signature South Dakota Courts Document

- Can I Electronic signature South Dakota Sports Presentation