Form Be 10a

What is the Form 10A?

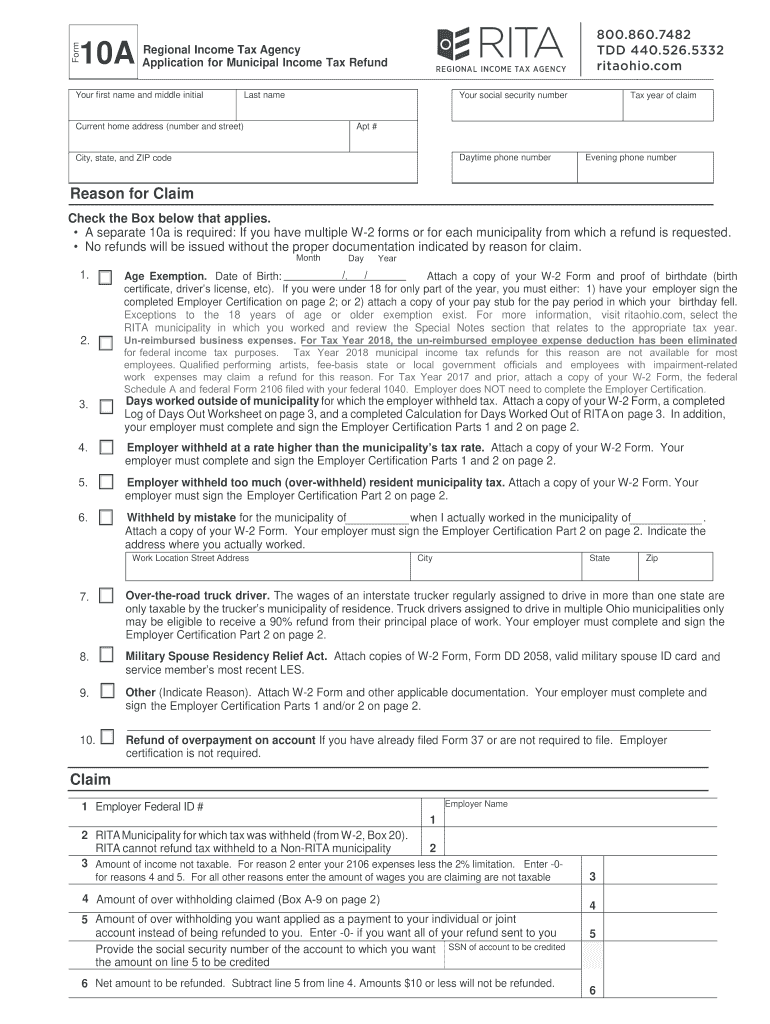

The Form 10A, often referred to as the RITA Form 10A, is a tax document used by residents of Ohio to report income earned in municipalities that have a local income tax. This form is essential for individuals who are required to file their income tax returns with the Regional Income Tax Agency (RITA). The purpose of the form is to ensure compliance with local tax regulations and to accurately calculate the tax owed based on income earned within the jurisdiction.

Steps to Complete the Form 10A

Completing the Form 10A involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary documents, such as W-2s, 1099s, and other income statements. Next, follow these steps:

- Enter your personal information, including your name, address, and Social Security number.

- Report your total income from all sources, ensuring that you include income earned in municipalities with local taxes.

- Calculate your taxable income by applying any allowable deductions or credits.

- Determine the amount of local tax owed based on the applicable tax rate for your municipality.

- Review all entries for accuracy before submitting the form.

Legal Use of the Form 10A

The Form 10A is legally binding when completed accurately and submitted in accordance with Ohio tax laws. To ensure its legal validity, it is crucial to adhere to the guidelines set forth by the RITA and to maintain compliance with local tax regulations. This includes providing truthful information and retaining copies of submitted forms for future reference. Failure to comply with these regulations may result in penalties or legal repercussions.

Filing Deadlines / Important Dates

Filing deadlines for the Form 10A are typically aligned with the federal tax filing deadlines. For most individuals, this means that the form must be submitted by April 15 of each year. However, if the deadline falls on a weekend or holiday, it may be extended to the next business day. It is important to stay informed about any changes to these dates, as well as any extensions that may be granted by the RITA.

Form Submission Methods

The Form 10A can be submitted through various methods to accommodate different preferences. Options include:

- Online submission through the RITA website, which allows for quick processing and confirmation.

- Mailing a hard copy of the form to the appropriate RITA office address.

- In-person submission at designated RITA offices, providing an opportunity for immediate assistance if needed.

Required Documents

When completing the Form 10A, certain documents are necessary to ensure accurate reporting. Required documents include:

- W-2 forms from employers, detailing wages and tax withholdings.

- 1099 forms for any freelance or contract work.

- Documentation of any deductions or credits claimed, such as receipts or statements.

Penalties for Non-Compliance

Failure to file the Form 10A or inaccuracies in reporting can lead to significant penalties. These may include fines, interest on unpaid taxes, and potential legal action by the RITA. It is essential to file the form accurately and on time to avoid these consequences and ensure compliance with local tax laws.

Quick guide on how to complete form be 10a

Handle Form Be 10a easily on any device

Digital document management has become prevalent among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents quickly without delays. Manage Form Be 10a on any platform with airSlate SignNow's Android or iOS applications and enhance any document-oriented workflow today.

The simplest way to edit and electronically sign Form Be 10a with ease

- Find Form Be 10a and click on Get Form to proceed.

- Utilize the tools we offer to fill out your form.

- Emphasize relevant sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Generate your signature with the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you want to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Form Be 10a and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form be 10a

How to make an electronic signature for your PDF in the online mode

How to make an electronic signature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

The best way to create an eSignature right from your smart phone

The best way to generate an electronic signature for a PDF on iOS devices

The best way to create an eSignature for a PDF on Android OS

People also ask

-

What is a 10a form and how can airSlate SignNow help?

A 10a form is a specific document type that users often need to fill out and sign for various purposes. With airSlate SignNow, you can easily create, send, and eSign your 10a form, streamlining the entire process and ensuring compliance.

-

What features does airSlate SignNow offer for managing the 10a form?

airSlate SignNow provides a comprehensive suite of features for managing the 10a form, including customizable templates, secure eSigning, and document tracking. These tools help ensure your forms are filled out correctly and signed in a timely manner.

-

How does airSlate SignNow ensure the security of my 10a form?

Security is a top priority for airSlate SignNow. Your 10a form is protected with advanced encryption protocols and complies with industry standards, ensuring that all sensitive information remains safe during the signing process.

-

Can I integrate airSlate SignNow with other applications for my 10a form workflows?

Yes, airSlate SignNow offers seamless integrations with various applications, allowing you to easily incorporate the 10a form into your existing workflows. This enhances your productivity by connecting with CRM systems, cloud storage, and more.

-

What are the pricing options for using airSlate SignNow for my 10a form needs?

airSlate SignNow offers flexible pricing plans to meet diverse business needs. Whether you're a small business or a large enterprise, you can choose a plan that suits your requirements for managing the 10a form effectively.

-

How can airSlate SignNow improve the efficiency of completing a 10a form?

With its user-friendly interface and streamlined eSigning capabilities, airSlate SignNow signNowly enhances the efficiency of completing a 10a form. You can quickly prepare, send, and receive signed documents without the need for physical paperwork.

-

Is it easy to collaborate with others on a 10a form using airSlate SignNow?

Absolutely! airSlate SignNow allows for easy collaboration on your 10a form. You can invite multiple parties to review, edit, and sign the document in real-time, simplifying teamwork and communication.

Get more for Form Be 10a

Find out other Form Be 10a

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free

- eSign Colorado Doctors Operating Agreement Computer

- Help Me With eSign Florida Doctors Lease Termination Letter

- eSign Florida Doctors Lease Termination Letter Myself

- eSign Hawaii Doctors Claim Later

- eSign Idaho Construction Arbitration Agreement Easy

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed

- eSign Louisiana Doctors Letter Of Intent Fast

- eSign Maine Doctors Promissory Note Template Easy

- eSign Kentucky Construction Claim Online

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online