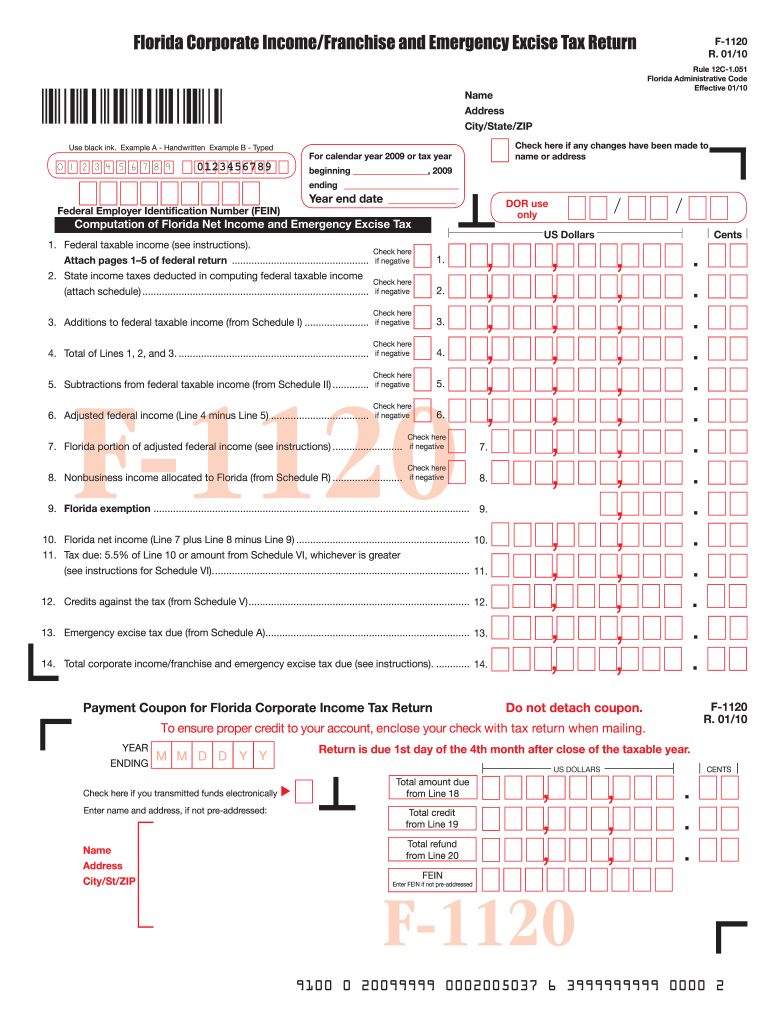

F 1120 Form 2020

What is the F 1120 Form

The F 1120 Form is a federal tax return form used by corporations in the United States to report their income, gains, losses, deductions, and credits. This form is essential for C corporations, which are separate legal entities from their owners, allowing them to pay taxes on their profits. The information provided on the F 1120 Form helps the Internal Revenue Service (IRS) determine the corporation's tax liability. It is crucial for businesses to accurately complete this form to ensure compliance with federal tax regulations.

How to use the F 1120 Form

Using the F 1120 Form involves several steps that require careful attention to detail. First, gather all necessary financial records, including income statements, balance sheets, and any supporting documentation for deductions and credits. Next, fill out the form by entering your corporation's income, expenses, and other relevant financial information in the designated sections. It is important to follow the instructions provided by the IRS to ensure accuracy. Once completed, the form can be submitted electronically or via mail, depending on your preference and the requirements set forth by the IRS.

Steps to complete the F 1120 Form

Completing the F 1120 Form can be streamlined by following these steps:

- Gather all financial documents, including income statements, balance sheets, and previous tax returns.

- Download the latest version of the F 1120 Form from the IRS website.

- Begin filling out the form, starting with the corporation's name, address, and Employer Identification Number (EIN).

- Report total income, including gross receipts and any other income sources.

- Detail allowable deductions, such as business expenses, salaries, and benefits.

- Calculate the corporation's taxable income by subtracting deductions from total income.

- Determine the tax liability based on the applicable corporate tax rate.

- Review the completed form for accuracy and ensure all required signatures are present.

- Submit the form electronically or by mail, according to IRS guidelines.

Legal use of the F 1120 Form

The F 1120 Form is legally binding when completed and submitted according to IRS regulations. Corporations must ensure that all information provided is accurate and truthful to avoid penalties. The form serves as an official record of the corporation's financial activities for the tax year, and any discrepancies can lead to audits or legal consequences. It is essential for corporations to maintain compliance with all relevant tax laws to uphold the integrity of their business operations.

Filing Deadlines / Important Dates

Corporations must be aware of the filing deadlines associated with the F 1120 Form to avoid penalties. Generally, the form is due on the fifteenth day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the form is typically due by April 15. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. Corporations can also file for an extension, allowing for additional time to submit the form, but any taxes owed must still be paid by the original deadline.

Required Documents

To complete the F 1120 Form accurately, corporations need to gather several key documents:

- Income statements detailing revenue and expenses.

- Balance sheets showing assets, liabilities, and equity.

- Records of any deductions and credits claimed.

- Previous tax returns for reference.

- Any supporting documentation for specific items reported on the form.

Form Submission Methods (Online / Mail / In-Person)

The F 1120 Form can be submitted through various methods, providing flexibility for corporations. Electronic submission is encouraged as it allows for faster processing and confirmation of receipt. Corporations can use IRS e-file services or authorized e-file providers to submit the form online. Alternatively, the form can be mailed to the appropriate IRS address, which varies based on the corporation's location and whether a payment is included. In-person submission is generally not available for the F 1120 Form, making electronic and mail options the most viable methods.

Quick guide on how to complete 2010 f 1120 form

Effortlessly prepare F 1120 Form on any device

Digital document management has become increasingly popular among businesses and individuals alike. It offers an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your files promptly without any hindrances. Manage F 1120 Form on any device using the airSlate SignNow applications for Android or iOS and streamline any document-related processes today.

How to alter and electronically sign F 1120 Form effortlessly

- Find F 1120 Form and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the documents or redact sensitive information with features specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and click the Done button to save your modifications.

- Choose how you wish to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign F 1120 Form and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2010 f 1120 form

Create this form in 5 minutes!

How to create an eSignature for the 2010 f 1120 form

The best way to generate an electronic signature for your PDF document online

The best way to generate an electronic signature for your PDF document in Google Chrome

The way to make an electronic signature for signing PDFs in Gmail

The best way to make an electronic signature straight from your smart phone

The way to make an electronic signature for a PDF document on iOS

The best way to make an electronic signature for a PDF document on Android OS

People also ask

-

What is the F 1120 Form?

The F 1120 Form is a tax return document that U.S. corporations use to report their income, gains, and losses to the IRS. By correctly filling out the F 1120 Form, businesses ensure compliance with federal tax laws. Understanding how to prepare this form is crucial for any corporation looking to accurately assess its tax obligations.

-

How can airSlate SignNow assist with the F 1120 Form?

airSlate SignNow simplifies the process of completing and sending the F 1120 Form. Our platform enables businesses to securely eSign and manage documents efficiently. This streamlines your tax filing process, saving time and reducing the likelihood of errors.

-

What features does airSlate SignNow offer for handling documents like the F 1120 Form?

AirSlate SignNow offers a variety of features including document templates, secure eSigning, and automatic reminders. These tools make it easier to manage the F 1120 Form and other important documents. Additionally, our platform allows for easy collaboration among team members during the completion of the form.

-

Is there a cost associated with using airSlate SignNow for the F 1120 Form?

Yes, airSlate SignNow offers multiple pricing plans that cater to different business needs. Each plan provides features that enhance efficiency when working with documents such as the F 1120 Form. We recommend visiting our pricing page for detailed information about the various options available.

-

Can I integrate airSlate SignNow with other software for the F 1120 Form?

Absolutely! airSlate SignNow can integrate seamlessly with various applications, simplifying the workflow for completing the F 1120 Form. This integration allows users to import data and manage documents more effectively, ultimately enhancing productivity.

-

What are the benefits of using airSlate SignNow for eSigning the F 1120 Form?

Using airSlate SignNow for eSigning the F 1120 Form offers numerous benefits, including enhanced security and compliance. Our solution ensures that your documents are legally binding, saving time and eliminating the hassle of physical signatures. Plus, users can access documents from anywhere, making it perfect for remote teams.

-

How user-friendly is airSlate SignNow for completing the F 1120 Form?

airSlate SignNow is designed with user experience in mind, making it very intuitive for businesses to work on the F 1120 Form. Our straightforward interface guides users through the signing and document management processes. Even those unfamiliar with digital tools will find it easy to navigate.

Get more for F 1120 Form

- Imm 5604 f dclaration pour parenttuteur lgal qui n form

- Federal law mandates that some beneficiaries pay a higher premium for medicare part b coverage based on their osaunion form

- R38 tax claim use form r38 to claim a tax refund when you have overpaid tax and to authorise a representative to receive the

- Family care plan counseling checklist da form 5304 jul

- Four quadrant graphing puzzle answer key form

- Power of attorney format

- Keepass id form

- Sample clergy annual housing allowance declaration form

Find out other F 1120 Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors