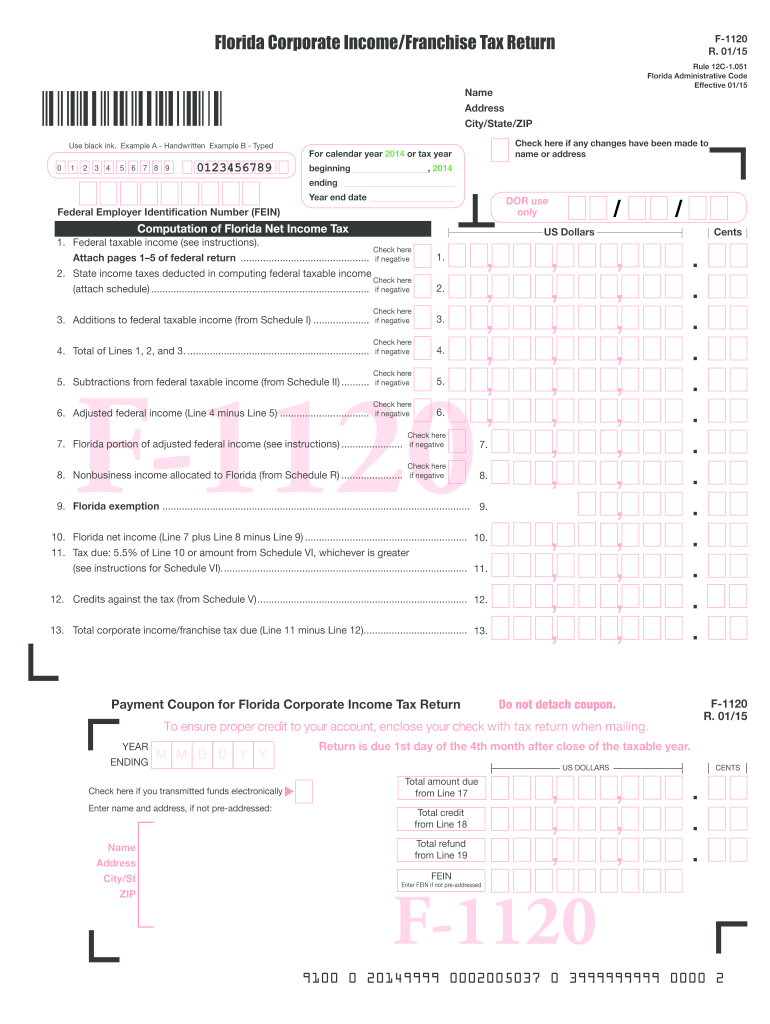

Computation of Florida Net Income Tax 2020

What is the Computation Of Florida Net Income Tax

The Computation of Florida Net Income Tax refers to the process used to determine the amount of tax owed by individuals or entities based on their net income in Florida. Unlike many other states, Florida does not impose a personal income tax; however, certain types of income, such as corporate income, may be subject to taxation. Understanding how to compute this tax is crucial for compliance with state regulations and for accurate financial planning.

Steps to complete the Computation Of Florida Net Income Tax

Completing the Computation of Florida Net Income Tax involves several key steps:

- Gather all necessary financial documents, including income statements, expense records, and any applicable deductions.

- Calculate total income by summing all sources of revenue.

- Determine allowable deductions, which may include business expenses, contributions, and other eligible costs.

- Subtract the total deductions from total income to arrive at the net income.

- Apply the appropriate tax rate to the net income to compute the tax owed, if applicable.

Legal use of the Computation Of Florida Net Income Tax

The legal use of the Computation of Florida Net Income Tax is essential for ensuring compliance with state tax laws. This computation must be performed accurately to avoid penalties or legal issues. Businesses and individuals should retain documentation of their calculations and any supporting materials, as these may be required in case of an audit or review by state tax authorities.

Required Documents

To accurately complete the Computation of Florida Net Income Tax, several documents are typically required:

- Income statements, including W-2s or 1099 forms.

- Records of business expenses, such as receipts and invoices.

- Documentation of any deductions claimed, including charitable contributions.

- Previous tax returns, if applicable, for reference and consistency.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Computation of Florida Net Income Tax is crucial for compliance. Generally, tax returns must be filed by April fifteenth of each year for the previous tax year. Extensions may be available, but it is important to file any necessary forms to avoid late penalties. Keeping track of these dates ensures timely submission and reduces the risk of incurring fines.

Form Submission Methods (Online / Mail / In-Person)

The Computation of Florida Net Income Tax can be submitted through various methods, depending on the specific requirements of the form:

- Online submission via the Florida Department of Revenue’s website for electronic filing.

- Mailing a paper form to the designated address provided by the state.

- In-person submission at local tax offices, if required.

Quick guide on how to complete computation of florida net income tax

Easily Prepare Computation Of Florida Net Income Tax on Any Device

Managing documents online has gained popularity among businesses and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary forms and securely store them online. airSlate SignNow provides you with all the resources needed to create, modify, and electronically sign your documents swiftly without delays. Handle Computation Of Florida Net Income Tax on any platform using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to Modify and eSign Computation Of Florida Net Income Tax with Ease

- Obtain Computation Of Florida Net Income Tax and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight essential sections of your documents or redact sensitive information with tools specifically designed by airSlate SignNow for that task.

- Create your eSignature using the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review all information and then click the Done button to save your changes.

- Select your preferred method to send your form: via email, text message (SMS), invitation link, or download it to your computer.

No more worrying about lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and eSign Computation Of Florida Net Income Tax and ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct computation of florida net income tax

Create this form in 5 minutes!

How to create an eSignature for the computation of florida net income tax

The best way to generate an eSignature for your PDF in the online mode

The best way to generate an eSignature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

The way to create an eSignature straight from your smart phone

How to create an electronic signature for a PDF on iOS devices

The way to create an eSignature for a PDF document on Android OS

People also ask

-

What is the Computation Of Florida Net Income Tax?

The Computation Of Florida Net Income Tax involves calculating taxable income by considering various income sources and allowable deductions specific to Florida. This computation is essential for individuals and businesses to determine their tax liability accurately. Utilizing services like airSlate SignNow can streamline the documentation needed for this calculation.

-

How can airSlate SignNow assist with the Computation Of Florida Net Income Tax?

airSlate SignNow provides a user-friendly platform for eSigning and sending tax documents, making the Computation Of Florida Net Income Tax more efficient. This tool allows users to gather signatures and securely manage documents, reducing the time and hassle associated with traditional signing and filing processes.

-

Is there a cost associated with using airSlate SignNow for computation-related documents?

Yes, airSlate SignNow offers flexible pricing plans that cater to different business needs. These plans provide access to features necessary for the Computation Of Florida Net Income Tax, ensuring a cost-effective solution for handling tax documentation and eSigning tasks.

-

Can I integrate airSlate SignNow with other tax software for better computation?

Absolutely, airSlate SignNow seamlessly integrates with various tax software platforms, enhancing the efficiency of the Computation Of Florida Net Income Tax. This integration allows you to manage documents and eSign directly within your preferred software, streamlining your overall tax preparation process.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow offers robust features such as document templates, customizable workflows, and real-time tracking, which are beneficial for the Computation Of Florida Net Income Tax. These features facilitate efficient document handling, ensuring that you can manage your tax-related documents with ease.

-

How secure is airSlate SignNow for handling tax-related documents?

airSlate SignNow prioritizes security, using advanced encryption and secure storage to safeguard your documents. This is crucial when dealing with sensitive information related to the Computation Of Florida Net Income Tax, ensuring that your data remains protected throughout the signing and filing process.

-

Can airSlate SignNow help with electronic filing of Florida net income tax documents?

While airSlate SignNow focuses on document signing and management, it simplifies the process leading up to electronic filing of Florida net income tax documents. By using airSlate SignNow to organize and eSign your documents, you can streamline the preparation phase for electronic submission.

Get more for Computation Of Florida Net Income Tax

Find out other Computation Of Florida Net Income Tax

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online