Dr 15 Florida Sales Tax Form 2011

What is the Dr 15 Florida Sales Tax Form

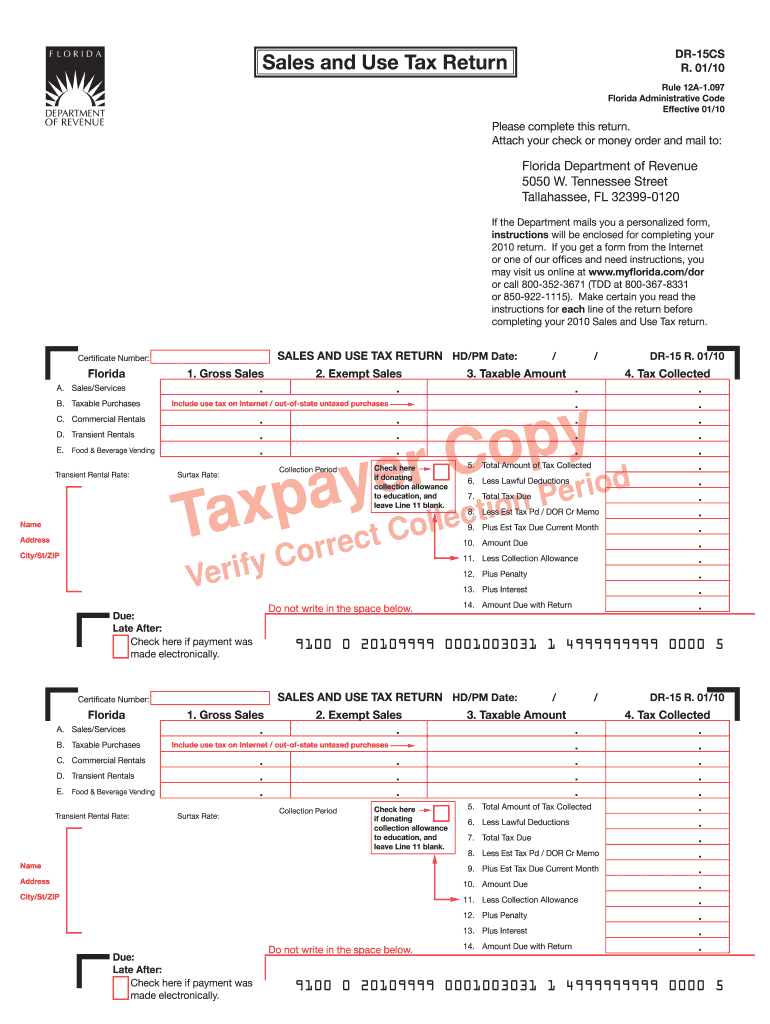

The Dr 15 Florida Sales Tax Form is a crucial document used by businesses in Florida to report and remit sales tax to the Florida Department of Revenue. This form is essential for ensuring compliance with state tax regulations and accurately reflecting the sales tax collected during a specific reporting period. It is typically used by retailers, wholesalers, and service providers who are required to collect sales tax on taxable transactions.

How to use the Dr 15 Florida Sales Tax Form

To effectively use the Dr 15 Florida Sales Tax Form, businesses must first gather all relevant sales data for the reporting period. This includes total sales, taxable sales, and any exemptions that apply. The form requires detailed entries of these figures, allowing businesses to calculate the total sales tax owed. Once completed, the form must be submitted to the Florida Department of Revenue, along with any payment due. It's important to ensure that all information is accurate to avoid penalties.

Steps to complete the Dr 15 Florida Sales Tax Form

Completing the Dr 15 Florida Sales Tax Form involves several key steps:

- Gather sales records for the reporting period.

- Calculate total sales and taxable sales.

- Identify any applicable exemptions.

- Fill in the form with accurate figures.

- Review the form for accuracy.

- Submit the form electronically or by mail, along with the payment if applicable.

Legal use of the Dr 15 Florida Sales Tax Form

The legal use of the Dr 15 Florida Sales Tax Form is governed by Florida state tax laws. Proper completion and timely submission of this form are essential for compliance. Failure to adhere to these regulations can result in penalties, including fines and interest on unpaid taxes. It is important for businesses to understand their obligations under state law to maintain good standing and avoid legal issues.

Key elements of the Dr 15 Florida Sales Tax Form

The Dr 15 Florida Sales Tax Form includes several key elements that must be accurately filled out:

- Business identification information, including name and address.

- Reporting period for which sales tax is being reported.

- Total sales and taxable sales amounts.

- Details of any exemptions claimed.

- Total sales tax collected and amount due.

Form Submission Methods (Online / Mail / In-Person)

The Dr 15 Florida Sales Tax Form can be submitted through various methods to accommodate different business needs. Businesses can choose to file the form electronically through the Florida Department of Revenue's online portal, which is often the quickest method. Alternatively, the form can be mailed to the appropriate address provided by the Department of Revenue. In-person submission is also an option for those who prefer direct interaction. Each method has its own guidelines and deadlines, so it is important to choose the one that best fits the business's operational needs.

Quick guide on how to complete dr 15 florida sales tax 2010 form

Accomplish Dr 15 Florida Sales Tax Form seamlessly on any device

Digital document management has gained traction among organizations and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and safely store it online. airSlate SignNow equips you with all the resources you require to create, modify, and eSign your documents swiftly without interruptions. Manage Dr 15 Florida Sales Tax Form on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to alter and eSign Dr 15 Florida Sales Tax Form with ease

- Find Dr 15 Florida Sales Tax Form and click on Obtain Form to begin.

- Utilize the features we provide to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Signature tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Complete button to save your changes.

- Select your preferred method to share your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your requirements in document management in just a few clicks from any device of your choice. Edit and eSign Dr 15 Florida Sales Tax Form to ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the dr 15 florida sales tax 2010 form

The way to create an electronic signature for your PDF file online

The way to create an electronic signature for your PDF file in Google Chrome

How to make an eSignature for signing PDFs in Gmail

The way to make an eSignature straight from your mobile device

The best way to create an electronic signature for a PDF file on iOS

The way to make an eSignature for a PDF document on Android devices

People also ask

-

What is the Dr 15 Florida Sales Tax Form?

The Dr 15 Florida Sales Tax Form is a document used by businesses in Florida to report and pay sales tax to the state. It provides details on taxable sales, exemptions, and the total amount due. Understanding how to accurately fill out this form is crucial for compliance and avoiding penalties.

-

How can airSlate SignNow help with the Dr 15 Florida Sales Tax Form?

airSlate SignNow streamlines the process of preparing and submitting the Dr 15 Florida Sales Tax Form by providing easy-to-use templates and eSignature capabilities. This solution ensures that your documents are signed and sent securely and efficiently. Plus, you can track the status of your form submissions in real time.

-

Is there a cost associated with using airSlate SignNow for the Dr 15 Florida Sales Tax Form?

Yes, airSlate SignNow offers various pricing plans to suit different business needs, including those that assist with compliance like the Dr 15 Florida Sales Tax Form. These plans are competitively priced and designed to provide cost-effective solutions for businesses of all sizes. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for eSigning the Dr 15 Florida Sales Tax Form?

With airSlate SignNow, you can eSign the Dr 15 Florida Sales Tax Form seamlessly. Features include drag-and-drop document upload, customizable signature fields, and multi-party signing options. This user-friendly platform ensures that all parties can sign documents from any device, enhancing efficiency and speed.

-

Can I integrate airSlate SignNow with other software to manage the Dr 15 Florida Sales Tax Form?

Yes, airSlate SignNow can easily integrate with various software applications to help you manage the Dr 15 Florida Sales Tax Form more effectively. Popular integrations include CRM platforms, accounting software, and document management systems. These integrations help streamline your workflow and ensure all relevant data is synced.

-

What are the benefits of using airSlate SignNow for the Dr 15 Florida Sales Tax Form?

Using airSlate SignNow for the Dr 15 Florida Sales Tax Form offers several benefits, such as increased accuracy, time savings, and enhanced document security. The platform minimizes the risk of errors and ensures compliance with state regulations. Additionally, it allows for quicker turnaround times, freeing up resources for other business tasks.

-

How secure is airSlate SignNow when submitting the Dr 15 Florida Sales Tax Form?

Security is a priority at airSlate SignNow. When submitting the Dr 15 Florida Sales Tax Form, your documents are encrypted and stored in secure servers. The platform follows industry-standard security protocols, ensuring that sensitive information remains protected throughout the signing process.

Get more for Dr 15 Florida Sales Tax Form

Find out other Dr 15 Florida Sales Tax Form

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template

- How To eSign South Dakota Plumbing Quitclaim Deed

- How To eSign South Dakota Plumbing Affidavit Of Heirship

- eSign South Dakota Plumbing Emergency Contact Form Myself

- eSign Texas Plumbing Resignation Letter Free

- eSign West Virginia Orthodontists Living Will Secure

- Help Me With eSign Texas Plumbing Business Plan Template

- Can I eSign Texas Plumbing Cease And Desist Letter

- eSign Utah Plumbing Notice To Quit Secure