F1120 Form 2020

What is the F1120 Form

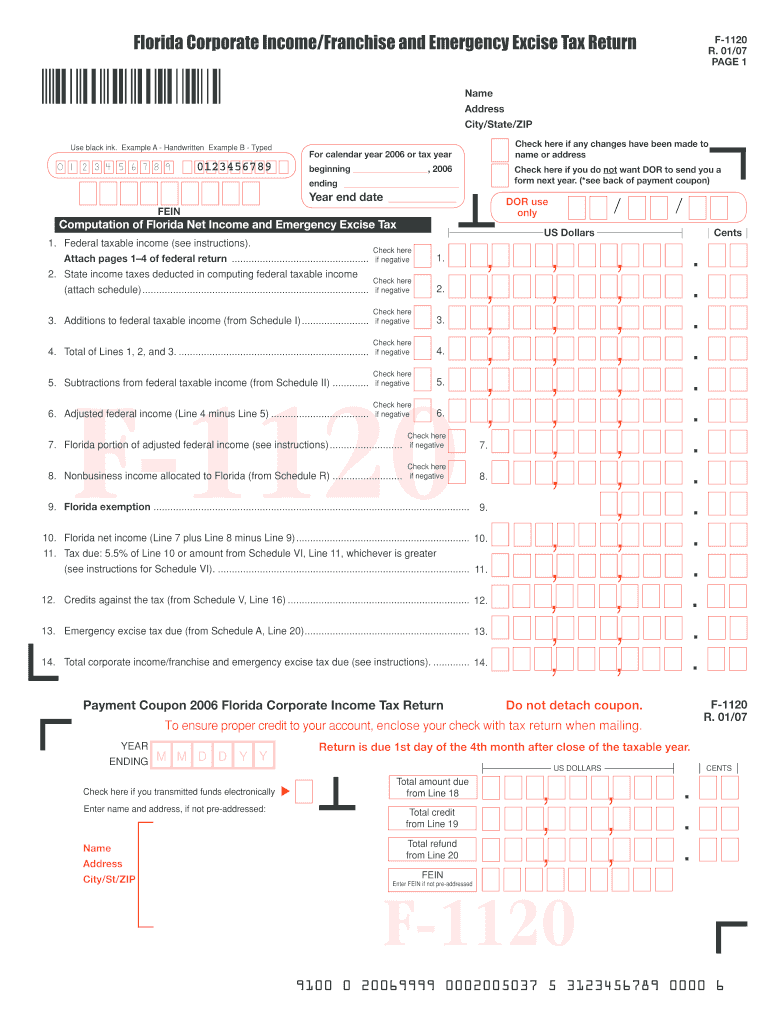

The F1120 Form is a tax document used by corporations in the United States to report their income, gains, losses, deductions, and credits. This form is essential for corporations to calculate their federal income tax liability. It is typically filed annually and is a critical component of corporate tax compliance. Understanding its purpose and requirements is vital for any corporation to ensure accurate reporting and adherence to IRS regulations.

Steps to complete the F1120 Form

Completing the F1120 Form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents, including income statements, balance sheets, and records of deductions. Next, follow these steps:

- Enter the corporation's name, address, and Employer Identification Number (EIN) at the top of the form.

- Report total income, including sales, dividends, and interest, in the appropriate sections.

- Deduct allowable expenses, such as operating costs and salaries, to determine taxable income.

- Calculate the tax owed based on the applicable corporate tax rate.

- Complete any additional schedules required for specific deductions or credits.

- Review the form for accuracy before submission.

How to obtain the F1120 Form

The F1120 Form can be obtained directly from the IRS website, where it is available for download in PDF format. Additionally, it can be accessed through various tax preparation software that supports corporate tax filings. Ensure you are using the most current version of the form to comply with the latest IRS requirements.

Legal use of the F1120 Form

The F1120 Form is legally binding when completed accurately and submitted in accordance with IRS guidelines. Corporations must ensure that all information reported is truthful and complete to avoid penalties. Electronic filing options are available, which can streamline the submission process while maintaining compliance with legal standards.

Filing Deadlines / Important Dates

Corporations must be aware of key deadlines for filing the F1120 Form. Generally, the form is due on the fifteenth day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the deadline is April 15. It is advisable to file early to avoid any potential issues with processing or compliance.

Form Submission Methods (Online / Mail / In-Person)

The F1120 Form can be submitted through various methods, including electronic filing, mailing a paper form, or in-person submission at designated IRS offices. Electronic filing is often preferred for its efficiency and faster processing times. If choosing to mail the form, ensure it is sent to the correct IRS address based on the corporation's location and filing status.

Quick guide on how to complete f1120 form 2007

Effortlessly manage F1120 Form on any device

Digital document management has gained signNow traction among companies and individuals alike. It serves as an excellent eco-friendly option to conventional printed and signed papers, allowing you to access the suitable form and securely store it online. airSlate SignNow equips you with all the necessary resources to create, edit, and eSign your documents quickly and seamlessly. Administer F1120 Form across any platform using the airSlate SignNow apps for Android or iOS and streamline your document-related processes today.

The easiest method to modify and eSign F1120 Form with ease

- Find F1120 Form and select Get Form to begin.

- Take advantage of our tools to finalize your document.

- Mark important sections of your documents or redact sensitive information using the specialized tools that airSlate SignNow provides for this purpose.

- Generate your signature with the Sign feature, which only takes seconds and carries the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to preserve your changes.

- Select your preferred method for delivering your form, whether by email, SMS, or shareable link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management requirements in just a few clicks from any device you choose. Alter and eSign F1120 Form and ensure excellent communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct f1120 form 2007

Create this form in 5 minutes!

How to create an eSignature for the f1120 form 2007

The way to create an electronic signature for your PDF file in the online mode

The way to create an electronic signature for your PDF file in Chrome

How to make an eSignature for putting it on PDFs in Gmail

The way to make an electronic signature right from your smartphone

The best way to create an electronic signature for a PDF file on iOS devices

The way to make an electronic signature for a PDF on Android

People also ask

-

What is the F1120 Form and why is it important?

The F1120 Form is the official tax form used by corporations to report their income, deductions, and tax liability to the IRS. It's important because accurately completing the F1120 Form is crucial for compliance and can impact a corporation's tax obligations. Using airSlate SignNow can streamline your document workflow, ensuring you file the F1120 Form efficiently.

-

How does airSlate SignNow help with the F1120 Form?

airSlate SignNow simplifies the process of preparing and submitting the F1120 Form by providing an intuitive platform for document creation and electronic signatures. Our solution allows users to easily fill out, sign, and send the F1120 Form, reducing the risk of errors and enhancing efficiency. With robust features, you can manage your tax documents effortlessly.

-

Is airSlate SignNow cost-effective for managing the F1120 Form?

Yes, airSlate SignNow offers a cost-effective solution for businesses needing to manage the F1120 Form. Our pricing plans are designed to accommodate organizations of all sizes, ensuring you get the tools necessary to handle your tax documents without breaking the bank. You can also save time and money by reducing paper usage and streamlining workflows.

-

What are the key features of airSlate SignNow for handling the F1120 Form?

Key features of airSlate SignNow that benefit users handling the F1120 Form include electronic signatures, template creation, and document tracking. These features ensure that the F1120 Form is completed and signed securely, while also providing you visibility into the document status throughout the signing process. Our platform enhances collaboration among your team members.

-

Can I integrate airSlate SignNow with other software for the F1120 Form?

Absolutely! airSlate SignNow supports integrations with various software applications, including accounting and financial tools, to facilitate the F1120 Form process. This allows for seamless data transfer and document management, ensuring that all information is consistent and easily accessible. Enhance your usability by integrating the tools you already use.

-

What types of businesses can benefit from using airSlate SignNow for the F1120 Form?

Businesses of any size, from startups to large corporations, can benefit from using airSlate SignNow for the F1120 Form. Our user-friendly platform caters to various industries, ensuring that all companies can efficiently manage their tax documentation. Regardless of your sector, our solution provides the flexibility you need to streamline the process.

-

How secure is airSlate SignNow when handling the F1120 Form?

Security is a top priority at airSlate SignNow, especially when dealing with sensitive documents like the F1120 Form. Our platform employs robust encryption and compliance measures to protect your data, ensuring unauthorized access is prevented. You can have peace of mind while managing your tax documents securely.

Get more for F1120 Form

Find out other F1120 Form

- How Can I Sign New Jersey Car Dealer Arbitration Agreement

- How Can I Sign Ohio Car Dealer Cease And Desist Letter

- How To Sign Ohio Car Dealer Arbitration Agreement

- How To Sign Oregon Car Dealer Limited Power Of Attorney

- How To Sign Pennsylvania Car Dealer Quitclaim Deed

- How Can I Sign Pennsylvania Car Dealer Quitclaim Deed

- Sign Rhode Island Car Dealer Agreement Safe

- Sign South Dakota Car Dealer Limited Power Of Attorney Now

- Sign Wisconsin Car Dealer Quitclaim Deed Myself

- Sign Wisconsin Car Dealer Quitclaim Deed Free

- Sign Virginia Car Dealer POA Safe

- Sign Wisconsin Car Dealer Quitclaim Deed Fast

- How To Sign Wisconsin Car Dealer Rental Lease Agreement

- How To Sign Wisconsin Car Dealer Quitclaim Deed

- How Do I Sign Wisconsin Car Dealer Quitclaim Deed

- Sign Wyoming Car Dealer Purchase Order Template Mobile

- Sign Arizona Charity Business Plan Template Easy

- Can I Sign Georgia Charity Warranty Deed

- How To Sign Iowa Charity LLC Operating Agreement

- Sign Kentucky Charity Quitclaim Deed Myself