Form Oic 1 2013

What is the Form Oic 1

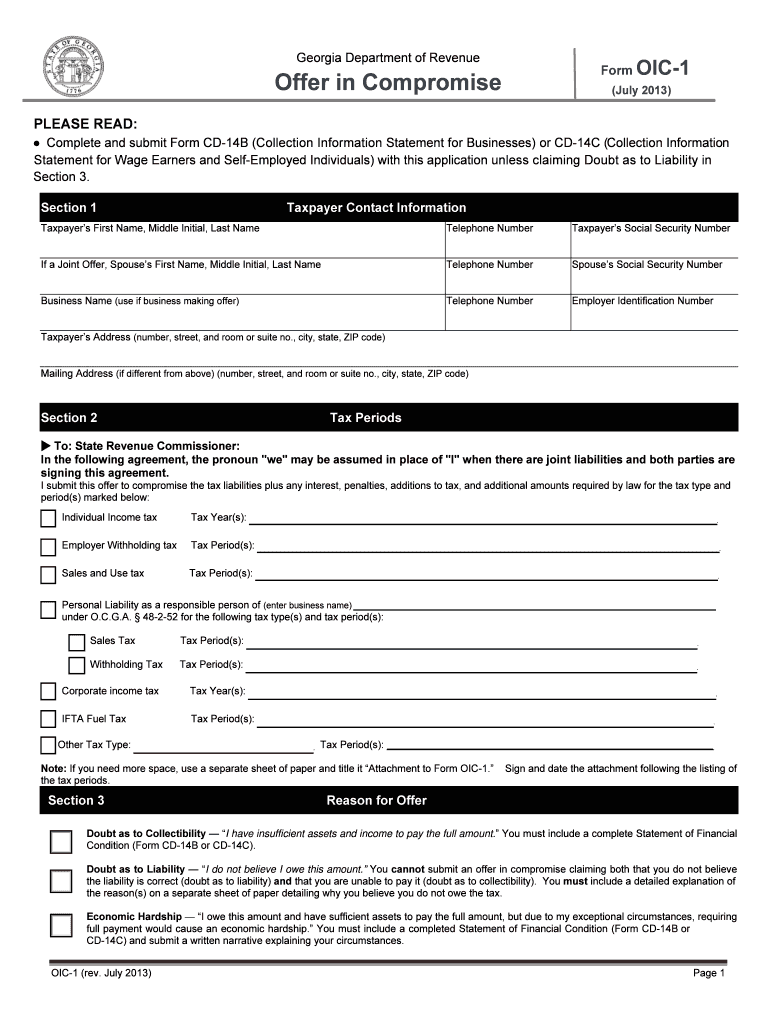

The Form OIC 1, or Offer in Compromise, is a tax form used by individuals and businesses to settle their tax debts with the Internal Revenue Service (IRS) for less than the full amount owed. This form is particularly useful for taxpayers who are experiencing financial hardship and cannot pay their tax liabilities in full. By submitting this form, taxpayers can request a compromise based on their ability to pay, income, expenses, and asset equity. The IRS evaluates these factors to determine whether to accept the offer, providing a potential path to financial relief.

How to use the Form Oic 1

Using the Form OIC 1 involves several key steps. First, ensure that you meet the eligibility criteria, which typically include having filed all required tax returns and having a tax liability that is not currently under appeal. Next, gather all necessary financial documentation, including income statements, expense reports, and asset information. Once you have completed the form, submit it to the IRS along with the required payment, which may include an application fee and an initial payment based on your offer. It is important to keep copies of all submitted documents for your records.

Steps to complete the Form Oic 1

Completing the Form OIC 1 involves a systematic approach. Start by filling out your personal information, including your name, address, and Social Security number. Next, provide details about your tax liability, including the tax periods involved. You will then need to outline your financial situation, detailing your income, expenses, and assets. After completing the form, review it for accuracy and completeness. Finally, submit the form along with the appropriate payment to the IRS. Following these steps can help ensure a smoother process when seeking a tax compromise.

Legal use of the Form Oic 1

The legal use of the Form OIC 1 is governed by IRS regulations and guidelines. To ensure compliance, it is essential to provide accurate and truthful information on the form. Misrepresentation or omission of facts can lead to penalties or rejection of the offer. The IRS has specific criteria for evaluating offers, and understanding these criteria can enhance the likelihood of acceptance. It is advisable to consult with a tax professional to navigate the legal aspects of submitting the form and to ensure that all requirements are met.

Eligibility Criteria

To qualify for submitting the Form OIC 1, you must meet certain eligibility criteria set by the IRS. These criteria typically include being current on all tax filings, not being in an open bankruptcy case, and having a tax liability that you cannot pay in full. Additionally, the IRS requires that you provide a complete financial disclosure, demonstrating your inability to pay the full amount owed. Meeting these criteria is crucial for the IRS to consider your offer for compromise.

Filing Deadlines / Important Dates

Filing deadlines for the Form OIC 1 can vary based on individual circumstances. It is important to be aware of any specific deadlines related to your tax situation, such as the expiration of the statute of limitations for tax collection. Generally, submitting the form as soon as possible after determining your eligibility can be beneficial. Keeping track of important dates related to your tax liabilities and the submission of the form can help ensure compliance and avoid additional penalties.

Required Documents

When submitting the Form OIC 1, certain documents are required to support your offer. These typically include proof of income, such as pay stubs or bank statements, documentation of monthly expenses, and details about your assets, including real estate and vehicles. Additionally, you may need to provide a copy of your tax returns for the past few years. Compiling these documents ahead of time can streamline the submission process and strengthen your case for compromise.

Quick guide on how to complete form oic 1 2013

Easily prepare Form Oic 1 on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed paperwork, allowing you to access the correct format and securely keep it online. airSlate SignNow equips you with all the necessary tools to rapidly create, modify, and electronically sign your documents without delays. Handle Form Oic 1 on any device using the airSlate SignNow Android or iOS applications and simplify any document-based workflow today.

How to modify and electronically sign Form Oic 1 effortlessly

- Locate Form Oic 1 and click Get Form to begin.

- Utilize the instruments we offer to fill out your form.

- Emphasize essential sections of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet-ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method of sharing the form, whether by email, text message (SMS), invitation link, or downloading it to your computer.

Put an end to the worries of lost or misplaced documents, tedious form navigation, or errors that require reprinting. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign Form Oic 1 and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form oic 1 2013

Create this form in 5 minutes!

How to create an eSignature for the form oic 1 2013

The way to create an eSignature for a PDF in the online mode

The way to create an eSignature for a PDF in Chrome

The best way to create an eSignature for putting it on PDFs in Gmail

The way to make an electronic signature from your smart phone

The best way to generate an eSignature for a PDF on iOS devices

The way to make an electronic signature for a PDF file on Android OS

People also ask

-

What is Form Oic 1 and how can it help my business?

Form Oic 1 is a crucial document used for initiating an Offer in Compromise with the IRS. By leveraging airSlate SignNow, businesses can easily fill out and eSign Form Oic 1, streamlining the submission process. This efficient solution saves time and reduces errors, ensuring that your forms are processed smoothly.

-

What features does airSlate SignNow offer for Form Oic 1?

airSlate SignNow offers a variety of features specifically designed to enhance the experience of completing Form Oic 1. Our platform provides templates, easy document sharing, and secure eSignature capabilities. These features help you manage your documents swiftly and securely, maximizing efficiency.

-

How does using airSlate SignNow for Form Oic 1 improve efficiency?

Using airSlate SignNow for Form Oic 1 signNowly enhances efficiency by automating the document workflow. You can easily send, receive, and track your Form Oic 1 submissions in real-time. This automation minimizes manual tasks, allowing you to focus on more critical aspects of your business.

-

What are the pricing options for airSlate SignNow when managing Form Oic 1?

airSlate SignNow offers flexible pricing plans that cater to different business needs, including those handling Form Oic 1. Our pricing tiers are designed to provide affordable solutions without sacrificing quality or features. Contact us for a detailed breakdown of plans and pick the one that works best for your organization.

-

Are there any integrations available for using Form Oic 1 effectively?

Yes, airSlate SignNow integrates seamlessly with various business tools and applications, enhancing your ability to manage Form Oic 1. Integration with platforms like Google Drive, Salesforce, and other document management systems simplify your workflow. This connectivity allows you to access and submit Form Oic 1 easily from platforms you already use.

-

How secure is the information shared in Form Oic 1 with airSlate SignNow?

Security is a top priority at airSlate SignNow when handling Form Oic 1. Our platform employs advanced encryption protocols and compliance with industry standards to protect your sensitive information. You can trust that your data remains safe during the preparation and submission of Form Oic 1.

-

Can I track the status of my Form Oic 1 submissions?

Absolutely! airSlate SignNow provides tracking features that allow you to monitor the status of your Form Oic 1 submissions. You will receive notifications and updates in real-time, ensuring that you are always informed about the progress of your documents.

Get more for Form Oic 1

Find out other Form Oic 1

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online