Research Tax Credit Form Ga 2019

What is the Research Tax Credit Form Ga

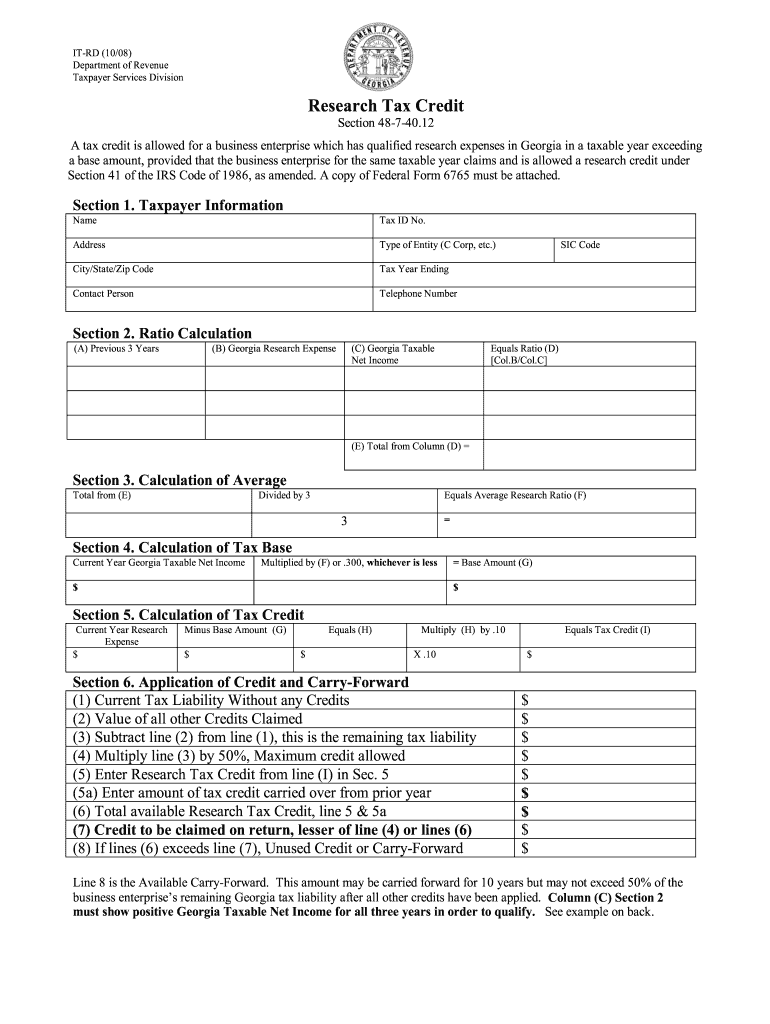

The Research Tax Credit Form Ga is a document used by businesses in Georgia to claim tax credits for qualified research activities. This form allows eligible companies to receive financial incentives for investing in research and development (R&D). The credits can significantly reduce a business's tax liability, encouraging innovation and technological advancement within the state. Understanding the purpose and benefits of this form is essential for businesses looking to maximize their tax savings.

How to use the Research Tax Credit Form Ga

Using the Research Tax Credit Form Ga involves several steps to ensure proper completion and submission. First, businesses must determine their eligibility based on the criteria set forth by the Georgia Department of Revenue. Once eligibility is confirmed, the next step is to gather all necessary documentation that supports the claim, such as project descriptions and expense records. After compiling the required information, businesses can fill out the form, detailing their research activities and associated costs. Finally, the completed form should be submitted according to the specified guidelines to ensure timely processing.

Steps to complete the Research Tax Credit Form Ga

Completing the Research Tax Credit Form Ga requires careful attention to detail. Here are the key steps:

- Review eligibility criteria to confirm that your business qualifies for the credit.

- Collect documentation related to your research activities, including project descriptions and financial records.

- Fill out the form accurately, ensuring all required fields are completed and calculations are correct.

- Double-check the form for any errors or omissions before submission.

- Submit the form through the appropriate channels, whether online or via mail, as specified by the Georgia Department of Revenue.

Legal use of the Research Tax Credit Form Ga

The legal use of the Research Tax Credit Form Ga hinges on compliance with state regulations and guidelines. Businesses must ensure that their claims are based on legitimate research activities that meet the definition provided by the Georgia Department of Revenue. Proper documentation must be maintained to support the claims made on the form. Failure to adhere to these legal requirements can result in penalties or denial of the tax credit. Therefore, understanding the legal framework surrounding the form is crucial for businesses seeking to utilize it effectively.

Eligibility Criteria

To qualify for the Research Tax Credit Form Ga, businesses must meet specific eligibility criteria established by the state. Generally, the criteria include:

- The business must be registered and operating in Georgia.

- Eligible research activities must be conducted within the state.

- Expenses claimed must be directly related to qualified research activities as defined by the Georgia Department of Revenue.

- The business must maintain adequate documentation to support the claim.

Understanding these criteria is essential for businesses to determine their eligibility and ensure compliance when filing the form.

Form Submission Methods

The Research Tax Credit Form Ga can be submitted through various methods, providing flexibility for businesses. The primary submission methods include:

- Online submission via the Georgia Department of Revenue's e-filing system, which offers a streamlined process.

- Mailing the completed form to the designated address provided by the Georgia Department of Revenue.

- In-person submission at local tax offices, if preferred.

Choosing the appropriate submission method can help ensure timely processing and compliance with state requirements.

Quick guide on how to complete research tax credit form ga 2008

Effortlessly prepare Research Tax Credit Form Ga on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to obtain the appropriate form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly, without delays. Manage Research Tax Credit Form Ga on any device with airSlate SignNow apps for Android or iOS and enhance any document-related process today.

How to edit and electronically sign Research Tax Credit Form Ga with ease

- Locate Research Tax Credit Form Ga and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a standard handwritten signature.

- Review the information and click the Done button to save your modifications.

- Choose your preferred method to share your form, whether by email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced documents, tiresome form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Research Tax Credit Form Ga and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct research tax credit form ga 2008

Create this form in 5 minutes!

How to create an eSignature for the research tax credit form ga 2008

The way to create an eSignature for your PDF file online

The way to create an eSignature for your PDF file in Google Chrome

The best way to make an eSignature for signing PDFs in Gmail

How to create an eSignature right from your mobile device

The best way to generate an electronic signature for a PDF file on iOS

How to create an eSignature for a PDF on Android devices

People also ask

-

What is the Research Tax Credit Form Ga?

The Research Tax Credit Form Ga is a document that businesses use to claim tax credits for qualified research activities in Georgia. This form allows eligible companies to benefit from tax incentives and helps reduce their overall tax burden. To ensure you're maximizing your credits, it's vital to fill out this form accurately.

-

How can airSlate SignNow help with the Research Tax Credit Form Ga?

airSlate SignNow simplifies the process of completing and eSigning the Research Tax Credit Form Ga. With our user-friendly interface, you can easily collaborate with your team and submit the form electronically without hassle. This saves you time and ensures that your documentation is secure and compliant.

-

Is there a cost associated with using airSlate SignNow for the Research Tax Credit Form Ga?

Yes, airSlate SignNow offers various pricing plans to cater to different business needs. Each plan provides access to features that can assist with the Research Tax Credit Form Ga. Consider the plan that best fits your requirements to ensure you have the right tools to manage your documents efficiently.

-

What features does airSlate SignNow offer for the Research Tax Credit Form Ga?

airSlate SignNow provides features like eSigning, document templates, and real-time tracking for the Research Tax Credit Form Ga. These tools enhance efficiency by allowing users to create personalized versions of the form swiftly. Additionally, the platform ensures all your documents are stored securely.

-

Can I integrate airSlate SignNow with other software for the Research Tax Credit Form Ga?

Yes, airSlate SignNow offers integrations with various software solutions, enabling you to streamline the process of submitting the Research Tax Credit Form Ga. Whether you need to connect with CRM systems or document management software, our platform is designed to work seamlessly with your existing tools.

-

What are the benefits of using airSlate SignNow for my Research Tax Credit Form Ga?

Using airSlate SignNow for your Research Tax Credit Form Ga offers numerous benefits, such as enhanced security, improved workflow efficiency, and better compliance. Our platform allows you to eSign documents quickly and maintain a clear audit trail for all submissions. This can signNowly reduce the administrative burden on your team.

-

How secure is my data when using airSlate SignNow for the Research Tax Credit Form Ga?

Security is a top priority at airSlate SignNow. When you use our platform for the Research Tax Credit Form Ga, your data is protected with industry-standard encryption, ensuring that all your information remains confidential and secure. You can trust us to handle your sensitive documents with care.

Get more for Research Tax Credit Form Ga

- Mass volume and density practice problems review worksheet form

- Starbucks employee handbook pdf form

- Bill of sale receipt form

- Breastfeeding log pdf form

- Hijama consent form

- Sc ins5242b pdf service canada medical certificate for form

- Alabama law enforcement agency driver license divi form

- Hot chile pepper eating contest application form

Find out other Research Tax Credit Form Ga

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe