Form W 4 Employee's Withholding Allowance Certificate 2019

What is the Form W-4 Employee's Withholding Allowance Certificate

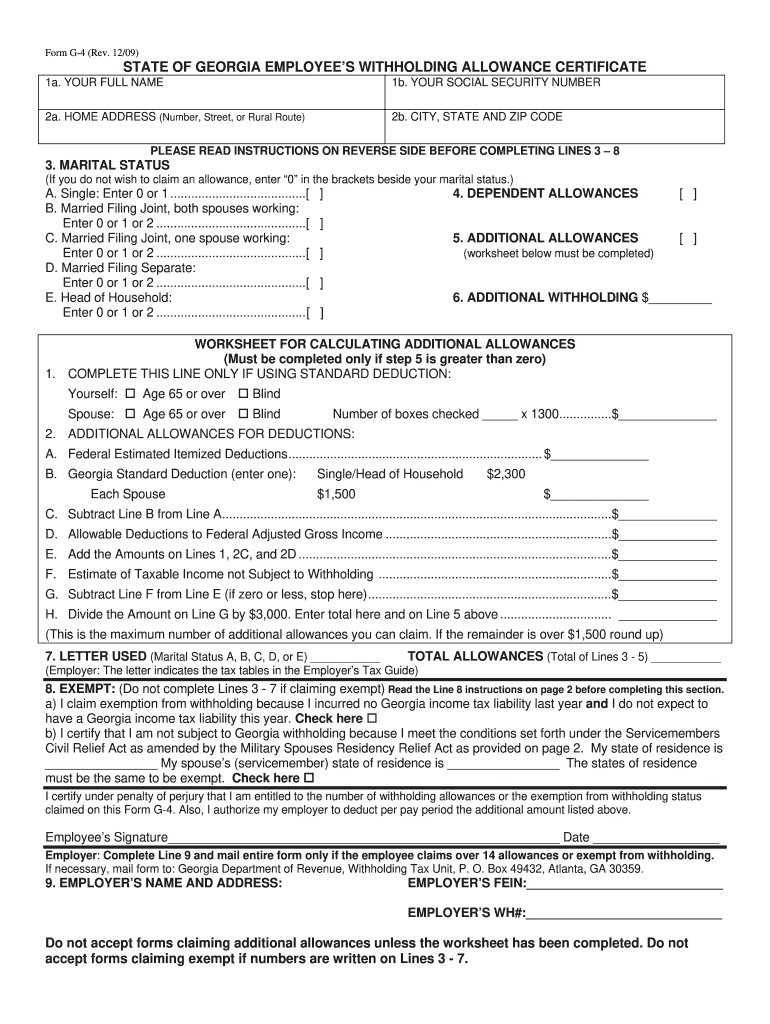

The Form W-4 Employee's Withholding Allowance Certificate is a crucial document used by employees in the United States to inform their employers about their tax withholding preferences. This form enables employees to specify the number of allowances they wish to claim, which directly affects the amount of federal income tax withheld from their paychecks. Understanding this form is essential for ensuring accurate tax withholding and avoiding any unexpected tax liabilities at the end of the year.

How to use the Form W-4 Employee's Withholding Allowance Certificate

Using the Form W-4 is straightforward. Employees need to fill out the form accurately to reflect their personal financial situation. This includes information such as marital status, number of dependents, and any additional income or deductions. Once completed, the form should be submitted to the employer's payroll department. It is important to review and update the form whenever there are significant life changes, such as marriage, divorce, or the birth of a child, to ensure tax withholding remains appropriate.

Steps to complete the Form W-4 Employee's Withholding Allowance Certificate

Completing the Form W-4 involves several steps:

- Provide your personal information, including name, address, Social Security number, and filing status.

- Indicate the number of allowances you are claiming based on your personal circumstances.

- Consider any additional amount you want withheld from your paycheck, if applicable.

- Sign and date the form to validate your information.

After filling out the form, submit it to your employer's HR or payroll department for processing.

Key elements of the Form W-4 Employee's Withholding Allowance Certificate

Several key elements are essential when filling out the Form W-4:

- Personal Information: This includes your name, address, and Social Security number.

- Filing Status: You must select your filing status, such as single, married, or head of household.

- Allowances: The number of allowances you claim will determine your withholding rate.

- Additional Withholding: You can specify an extra amount to be withheld from each paycheck.

Legal use of the Form W-4 Employee's Withholding Allowance Certificate

The Form W-4 is legally binding once signed and submitted to your employer. It is essential to provide accurate information to avoid penalties or under-withholding issues. Employers are required to use the information provided on the W-4 to calculate the appropriate amount of federal income tax to withhold from employee paychecks. Failure to comply with IRS regulations regarding this form may result in legal consequences for both the employee and employer.

Form Submission Methods (Online / Mail / In-Person)

Employees can submit the Form W-4 through various methods:

- Online: Many employers offer digital systems for submitting the W-4 electronically.

- Mail: Employees can print the completed form and mail it to their employer's HR department.

- In-Person: The form can also be submitted directly to the payroll or HR office at the workplace.

Choosing the appropriate submission method may depend on the employer's policies and the employee's preferences.

Quick guide on how to complete form w 4 employees withholding allowance certificate

Finalize Form W 4 Employee's Withholding Allowance Certificate seamlessly on any gadget

Digital document management has become increasingly preferred by companies and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to access the correct template and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents rapidly without delays. Handle Form W 4 Employee's Withholding Allowance Certificate on any device using airSlate SignNow Android or iOS applications and enhance any document-focused process now.

How to adjust and eSign Form W 4 Employee's Withholding Allowance Certificate with ease

- Find Form W 4 Employee's Withholding Allowance Certificate and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important portions of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a handwritten signature.

- Review the details and click the Done button to save your changes.

- Choose how you wish to send your form: via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or mistakes that necessitate reprinting copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your preferred device. Modify and eSign Form W 4 Employee's Withholding Allowance Certificate and ensure excellent communication at any phase of the form completion process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form w 4 employees withholding allowance certificate

Create this form in 5 minutes!

How to create an eSignature for the form w 4 employees withholding allowance certificate

The way to generate an electronic signature for your PDF file online

The way to generate an electronic signature for your PDF file in Google Chrome

The way to make an eSignature for signing PDFs in Gmail

How to create an electronic signature from your mobile device

The best way to make an electronic signature for a PDF file on iOS

How to create an electronic signature for a PDF file on Android devices

People also ask

-

What is the Form W 4 Employee's Withholding Allowance Certificate?

The Form W 4 Employee's Withholding Allowance Certificate is a tax form used in the United States that allows employees to declare their tax withholding allowances. This helps ensure the correct amount of federal income tax is withheld from an employee's paycheck. Understanding how to fill out the Form W 4 can maximize your take-home pay and avoid underpayment penalties.

-

How can airSlate SignNow help with the Form W 4 Employee's Withholding Allowance Certificate?

airSlate SignNow streamlines the process of completing and signing the Form W 4 Employee's Withholding Allowance Certificate. Our platform allows users to fill out and eSign this important document electronically, ensuring it’s submitted quickly and securely. This eliminates the need for printing and scanning, making it a convenient solution for both employees and employers.

-

Is there a cost associated with using airSlate SignNow for the Form W 4 Employee's Withholding Allowance Certificate?

Yes, airSlate SignNow offers various pricing plans that cater to different user needs, from individuals to large businesses. Each plan includes features to help with document management, including the Form W 4 Employee's Withholding Allowance Certificate. You can start with a free trial to explore the functionalities before committing to a subscription.

-

What features does airSlate SignNow offer for managing the Form W 4 Employee's Withholding Allowance Certificate?

airSlate SignNow provides a variety of features such as document templates, eSignature capabilities, and audit trails specifically for the Form W 4 Employee's Withholding Allowance Certificate. Our platform also supports advanced customization, allowing businesses to tailor the form to their specific needs. Additionally, you can track the status of documents in real-time.

-

Can I integrate airSlate SignNow with other software for handling the Form W 4 Employee's Withholding Allowance Certificate?

Yes, airSlate SignNow offers seamless integrations with various business tools and software, enhancing the handling of the Form W 4 Employee's Withholding Allowance Certificate. Whether you're using HR systems, payroll software, or CRM platforms, our integrations allow for efficient workflows and resource management. This way, you can automate processes related to the W 4 form submission.

-

What security measures does airSlate SignNow have for the Form W 4 Employee's Withholding Allowance Certificate?

airSlate SignNow takes security seriously, especially for sensitive documents such as the Form W 4 Employee's Withholding Allowance Certificate. Our platform uses robust encryption protocols to protect your data during transmission and storage. Additionally, we provide compliance with key regulations, ensuring that your information remains secure and confidential.

-

How does airSlate SignNow improve efficiency when completing the Form W 4 Employee's Withholding Allowance Certificate?

By using airSlate SignNow, you can signNowly reduce the time spent on the Form W 4 Employee's Withholding Allowance Certificate. Our user-friendly interface allows for quick completion and electronic signing of documents, minimizing delays associated with traditional paper methods. Employees can get their withholding allowances sorted out faster, promoting better financial planning.

Get more for Form W 4 Employee's Withholding Allowance Certificate

Find out other Form W 4 Employee's Withholding Allowance Certificate

- Sign Alaska Plumbing Moving Checklist Later

- Sign Arkansas Plumbing Business Plan Template Secure

- Sign Arizona Plumbing RFP Mobile

- Sign Arizona Plumbing Rental Application Secure

- Sign Colorado Plumbing Emergency Contact Form Now

- Sign Colorado Plumbing Emergency Contact Form Free

- How Can I Sign Connecticut Plumbing LLC Operating Agreement

- Sign Illinois Plumbing Business Plan Template Fast

- Sign Plumbing PPT Idaho Free

- How Do I Sign Wyoming Life Sciences Confidentiality Agreement

- Sign Iowa Plumbing Contract Safe

- Sign Iowa Plumbing Quitclaim Deed Computer

- Sign Maine Plumbing LLC Operating Agreement Secure

- How To Sign Maine Plumbing POA

- Sign Maryland Plumbing Letter Of Intent Myself

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free