Property Tax Appraisal Appeals Form Warwick Ri

What is the Property Tax Appraisal Appeals Form Warwick RI

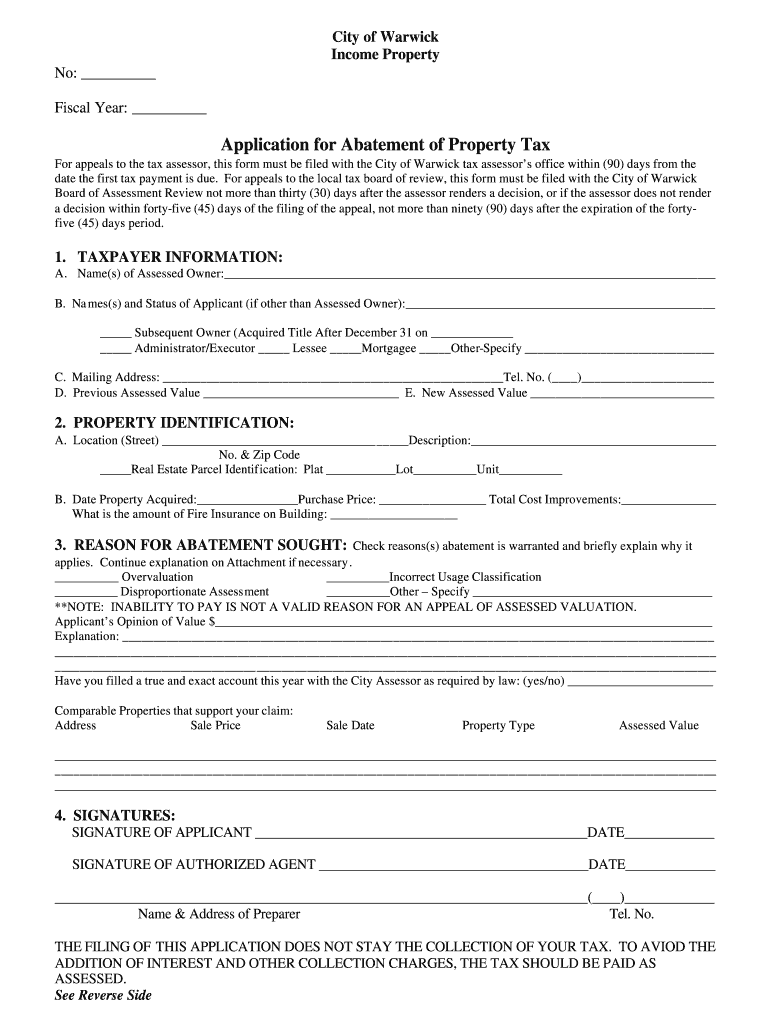

The Property Tax Appraisal Appeals Form Warwick RI is a legal document that allows property owners to contest the assessed value of their property as determined by the Warwick tax assessor. This form is crucial for individuals who believe their property has been overvalued, leading to higher tax liabilities than warranted. By filing this form, taxpayers can initiate a formal appeal process to seek a reassessment of their property’s value, which can ultimately result in lower property taxes.

How to use the Property Tax Appraisal Appeals Form Warwick RI

Using the Property Tax Appraisal Appeals Form Warwick RI involves several steps. First, property owners should gather relevant documentation, including the current property assessment and any evidence supporting their claim of overvaluation. Next, complete the form accurately, ensuring all required fields are filled out. Once completed, the form must be submitted to the Warwick tax assessor's office by the specified deadline. It is important to retain copies of all submitted documents for personal records.

Steps to complete the Property Tax Appraisal Appeals Form Warwick RI

Completing the Property Tax Appraisal Appeals Form Warwick RI requires careful attention to detail. Follow these steps:

- Obtain the form from the Warwick tax assessor's office or their official website.

- Fill in your personal information, including name, address, and property details.

- Provide a clear explanation of why you believe the assessment is incorrect.

- Attach supporting documents, such as recent appraisals or comparable property assessments.

- Sign and date the form to certify its accuracy.

Legal use of the Property Tax Appraisal Appeals Form Warwick RI

The legal use of the Property Tax Appraisal Appeals Form Warwick RI ensures that property owners can formally challenge their tax assessments. This form must be completed and submitted in accordance with local laws and regulations. Adhering to these legal guidelines is essential to ensure that the appeal is considered valid by the Warwick tax assessor's office. Additionally, understanding the legal framework surrounding property tax appeals can help taxpayers navigate the process more effectively.

Required Documents

When filing the Property Tax Appraisal Appeals Form Warwick RI, certain documents are necessary to support your appeal. These may include:

- A copy of the current property tax assessment.

- Evidence of property value, such as recent appraisals or sales data of comparable properties.

- Any correspondence with the Warwick tax assessor's office related to the assessment.

Form Submission Methods

The Property Tax Appraisal Appeals Form Warwick RI can be submitted through various methods to accommodate different preferences. Property owners may choose to:

- Submit the form in person at the Warwick tax assessor's office.

- Mail the completed form to the office address.

- Utilize any available online submission options, if applicable.

Quick guide on how to complete property tax appraisal appeals form warwick ri

Prepare Property Tax Appraisal Appeals Form Warwick Ri effortlessly on any device

Online document management has become increasingly favored by companies and individuals. It serves as an excellent environmentally friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely save it online. airSlate SignNow equips you with all the resources essential for creating, modifying, and electronically signing your documents swiftly without holdups. Handle Property Tax Appraisal Appeals Form Warwick Ri on any platform with airSlate SignNow Android or iOS applications and enhance any document-focused procedure today.

How to modify and eSign Property Tax Appraisal Appeals Form Warwick Ri with ease

- Find Property Tax Appraisal Appeals Form Warwick Ri and click Get Form to begin.

- Use the tools we offer to complete your document.

- Highlight important sections of your files or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your electronic signature with the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your modifications.

- Choose how you wish to submit your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device of your choosing. Modify and eSign Property Tax Appraisal Appeals Form Warwick Ri and guarantee excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

I need to pay an $800 annual LLC tax for my LLC that formed a month ago, so I am looking to apply for an extension. It's a solely owned LLC, so I need to fill out a Form 7004. How do I fill this form out?

ExpressExtension is an IRS-authorized e-file provider for all types of business entities, including C-Corps (Form 1120), S-Corps (Form 1120S), Multi-Member LLC, Partnerships (Form 1065). Trusts, and Estates.File Tax Extension Form 7004 InstructionsStep 1- Begin by creating your free account with ExpressExtensionStep 2- Enter the basic business details including: Business name, EIN, Address, and Primary Contact.Step 3- Select the business entity type and choose the form you would like to file an extension for.Step 4- Select the tax year and select the option if your organization is a Holding CompanyStep 5- Enter and make a payment on the total estimated tax owed to the IRSStep 6- Carefully review your form for errorsStep 7- Pay and transmit your form to the IRSClick here to e-file before the deadline

-

How can I deduct on my Federal income taxes massage therapy for my chronic migraines? Is there some form to fill out to the IRS for permission?

As long as your doctor prescribed this, it is tax deductible under the category for medical expenses. There is no IRS form for permission.

-

The company I work for is taking taxes out of my paycheck but has not asked me to complete any paperwork or fill out any forms since day one. How are they paying taxes without my SSN?

WHOA! You may have a BIG problem. When you started, are you certain you did not fill in a W-4 form? Are you certain that your employer doesn’t have your SS#? If that’s the case, I would be alarmed. Do you have paycheck stubs showing how they calculated your withholding? ( BTW you are entitled to those under the law, and if you are not receiving them, I would demand them….)If your employer is just giving you random checks with no calculation of your wages and withholdings, you have a rogue employer. They probably aren’t payin in what they purport to withhold from you.

-

Which forms do I fill out for taxes in California? I have a DBA/sole proprietorship company with less than $1000 in profit. How many forms do I fill out? This is really overwhelming. Do I need to fill the Form 1040-ES? Did the deadline pass?

You need to file two tax returns- one Federal Tax Form and another California State income law.My answer to your questions are for Tax Year 2018The limitation date for tax year 15.04.2018Federal Tax return for Individual is Form 1040 . Since you are carrying on proprietorship business, you will need to fill the Schedule C in Form 1040Form 1040 -ES , as the name suggests is for paying estimated tax for the current year. This is not the actual tax return form. Please note that while Form 1040, which is the return form for individuals, relates to the previous year, the estimated tax form (Form 1040-EZ ) calculates taxes for the current year.As far as , the tax return under tax laws of Californa State is concerned, the Schedule CA (540) Form is to be used for filing state income tax return . You use your federal information (forms 1040) to fill out your 540 FormPrashanthttp://irstaxapp.com

Create this form in 5 minutes!

How to create an eSignature for the property tax appraisal appeals form warwick ri

How to make an electronic signature for your Property Tax Appraisal Appeals Form Warwick Ri online

How to generate an electronic signature for the Property Tax Appraisal Appeals Form Warwick Ri in Chrome

How to create an eSignature for signing the Property Tax Appraisal Appeals Form Warwick Ri in Gmail

How to make an electronic signature for the Property Tax Appraisal Appeals Form Warwick Ri from your smartphone

How to generate an electronic signature for the Property Tax Appraisal Appeals Form Warwick Ri on iOS devices

How to make an eSignature for the Property Tax Appraisal Appeals Form Warwick Ri on Android

People also ask

-

What does the Warwick tax assessor do?

The Warwick tax assessor is responsible for evaluating property values within Warwick to determine tax assessments. This includes ensuring that property assessments are fair and accurate, which is crucial for property owners and taxpayers alike. Understanding the role of the Warwick tax assessor can help you better navigate your property taxes.

-

How can I appeal my property tax assessment in Warwick?

To appeal your property tax assessment in Warwick, you must file a formal appeal with the Warwick tax assessor’s office. This process typically involves providing evidence that supports your claim for a reduced assessment. It's important to prepare all relevant documentation to strengthen your case during this review.

-

What are the benefits of using airSlate SignNow for eSigning property assessments?

Using airSlate SignNow for eSigning property assessments can signNowly streamline document workflows. The platform allows you to quickly send, sign, and manage important documents related to your property and the Warwick tax assessor. This ease of use can save you time and reduce the stress associated with tax assessments.

-

Is airSlate SignNow integrated with tax assessment software?

Yes, airSlate SignNow offers integrations with various tax assessment software that can enhance your document management process. Integrating with systems used by the Warwick tax assessor ensures a seamless flow of information. This can improve efficiency and accuracy in managing property assessments and related documents.

-

How much does airSlate SignNow cost for eSigning tax documents?

AirSlate SignNow offers flexible pricing plans that cater to different needs, including individual and business options for eSigning tax documents. The cost-effectiveness of airSlate SignNow makes it an appealing choice for those dealing with properties assessed by the Warwick tax assessor. Be sure to check their website for the most current pricing and promotions.

-

What features does airSlate SignNow provide for document security?

AirSlate SignNow prioritizes document security with features such as encrypted signatures and secure cloud storage. This ensures that your documents related to the Warwick tax assessor are protected from unauthorized access. Trusting SignNow with your documents gives you peace of mind while managing your property assessments.

-

How can airSlate SignNow improve my communication with the Warwick tax assessor?

AirSlate SignNow enhances communication by allowing you to send and sign documents in real-time, thus speeding up the response times with the Warwick tax assessor’s office. Quick document exchanges can help resolve issues faster, ensuring that your property assessments are handled promptly. Improved communication can lead to better collaboration and transparency.

Get more for Property Tax Appraisal Appeals Form Warwick Ri

Find out other Property Tax Appraisal Appeals Form Warwick Ri

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself