Tax Conveyance Form 2019

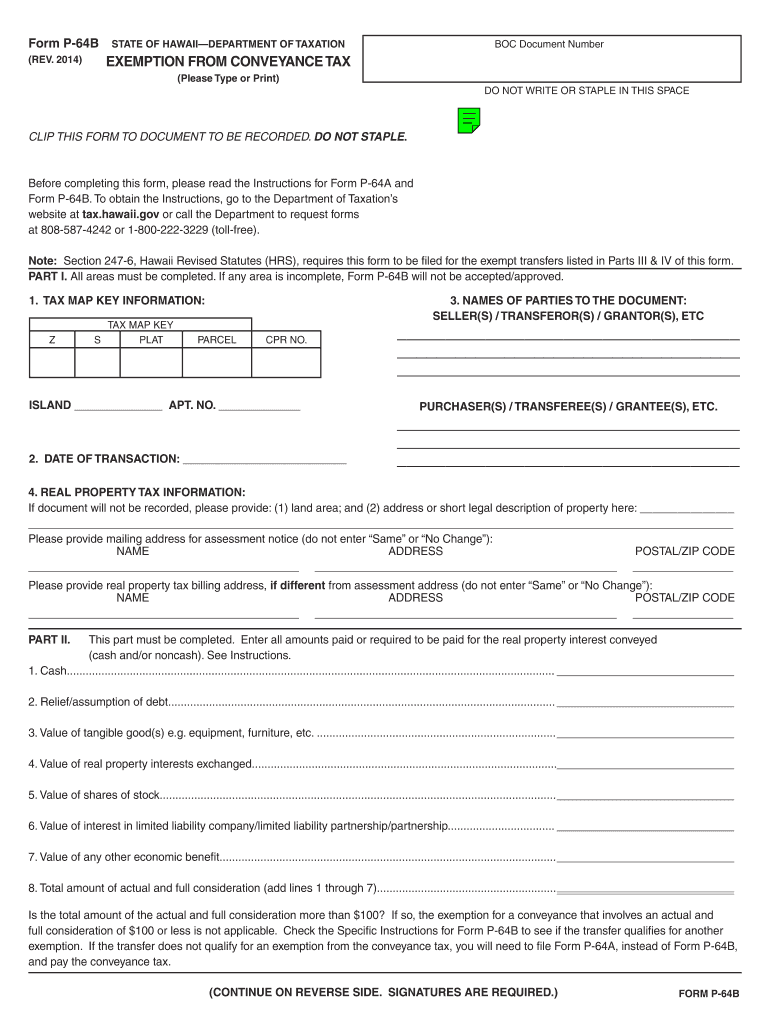

What is the P64B Form?

The P64B form is a specific document used primarily in tax-related processes. It serves as a declaration for certain financial transactions and is essential for ensuring compliance with tax regulations. This form is crucial for both individuals and businesses, as it helps in accurately reporting income and expenses to the Internal Revenue Service (IRS). Understanding the purpose of the P64B form is vital for maintaining proper tax records and fulfilling legal obligations.

How to Use the P64B Form

Using the P64B form involves several key steps to ensure that all necessary information is accurately captured. First, gather all relevant financial documents that pertain to the transactions being reported. Next, carefully fill out the form, ensuring that each section is completed with precise details. It is important to review the form for accuracy before submission. Once completed, the form can be submitted electronically or via traditional mail, depending on the specific requirements set forth by the IRS.

Steps to Complete the P64B Form

Completing the P64B form requires attention to detail and adherence to specific guidelines. Here are the steps to follow:

- Begin by downloading the latest version of the P64B form from the appropriate source.

- Fill in your personal information, including your name, address, and taxpayer identification number.

- Provide detailed descriptions of the financial transactions relevant to the form.

- Ensure that all amounts are accurate and reflect the actual figures from your records.

- Review the completed form for any errors or omissions.

- Submit the form according to the guidelines provided by the IRS.

Legal Use of the P64B Form

The P64B form is legally binding when filled out correctly and submitted in compliance with IRS regulations. It is essential to ensure that all information provided is truthful and accurate, as any discrepancies can lead to legal repercussions. The form must be signed and dated, confirming that the information is complete to the best of the signer's knowledge. Understanding the legal implications of using this form helps in maintaining compliance and avoiding potential penalties.

Required Documents for the P64B Form

When preparing to complete the P64B form, certain documents are typically required to support the information being reported. These may include:

- Previous tax returns to reference income and deductions.

- Receipts and invoices related to the transactions being reported.

- Bank statements that provide evidence of financial activity.

- Any relevant correspondence from the IRS or tax professionals.

Gathering these documents beforehand can facilitate a smoother completion process and ensure that the form is accurate and comprehensive.

Filing Deadlines for the P64B Form

Timely submission of the P64B form is critical to avoid penalties and ensure compliance with tax regulations. The filing deadlines may vary based on the specific circumstances of the taxpayer, such as whether they are an individual or a business entity. Generally, the P64B form should be submitted by the standard tax filing deadline, which is typically April fifteenth for individuals. Businesses may have different deadlines depending on their fiscal year-end. It is advisable to check the IRS guidelines for any updates or changes to these deadlines.

Quick guide on how to complete tax conveyance 2014 form

Effortlessly Prepare Tax Conveyance Form on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed paperwork since you can obtain the necessary forms and securely save them online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents swiftly without any delays. Handle Tax Conveyance Form on any device using airSlate SignNow’s Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign Tax Conveyance Form without hassle

- Find Tax Conveyance Form and click on Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive details with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes just seconds and has the same legal validity as a conventional wet ink signature.

- Review all information carefully and select the Done button to save your changes.

- Decide how you want to send your form, whether by email, text message (SMS), an invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tiresome form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Modify and eSign Tax Conveyance Form and ensure excellent communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax conveyance 2014 form

Create this form in 5 minutes!

How to create an eSignature for the tax conveyance 2014 form

The way to make an electronic signature for your PDF in the online mode

The way to make an electronic signature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

How to make an eSignature right from your smart phone

The way to generate an electronic signature for a PDF on iOS devices

How to make an eSignature for a PDF on Android OS

People also ask

-

What is p64b in relation to airSlate SignNow?

The term p64b refers to a specific pricing model for airSlate SignNow that offers unique benefits for businesses looking to streamline their document management. This model is designed to accommodate various team sizes and needs, ensuring that all users can access essential features without overwhelming costs.

-

How can p64b enhance my document signing experience?

p64b enhances the document signing experience by providing a user-friendly interface that simplifies the entire eSigning process. With the p64b model, users can effortlessly create, manage, and track documents, making it easier to gain approvals in a timely manner.

-

What features are included in the p64b pricing plan?

The p64b pricing plan includes a comprehensive suite of features such as customizable templates, audit trails, and advanced security measures to protect your sensitive documents. Users also benefit from mobile access and integration options with popular applications, further improving workflow efficiency.

-

Is p64b a cost-effective solution for businesses?

Yes, p64b is considered a cost-effective solution for businesses of all sizes. Its pricing is structured to provide value for money while offering robust features that promote productivity, enabling teams to save both time and resources.

-

Can I integrate p64b with other applications?

Absolutely! p64b supports integration with numerous applications including CRM software and cloud storage solutions. This allows users to seamlessly incorporate airSlate SignNow into their existing workflows, enhancing overall efficiency.

-

What are the benefits of choosing p64b for my eSigning needs?

Choosing p64b for your eSigning needs brings multiple benefits such as increased turnaround times, improved compliance with legal standards, and reduced paper usage. Additionally, the platform’s intuitive design makes it accessible for users of all skill levels.

-

Is customer support available for users on the p64b plan?

Yes, users on the p64b plan receive access to dedicated customer support to address any inquiries or issues. This ensures that you have the assistance you need to utilize the platform effectively and maximize its potential.

Get more for Tax Conveyance Form

Find out other Tax Conveyance Form

- eSignature Illinois House rental agreement Free

- How To eSignature Indiana House rental agreement

- Can I eSignature Minnesota House rental lease agreement

- eSignature Missouri Landlord lease agreement Fast

- eSignature Utah Landlord lease agreement Simple

- eSignature West Virginia Landlord lease agreement Easy

- How Do I eSignature Idaho Landlord tenant lease agreement

- eSignature Washington Landlord tenant lease agreement Free

- eSignature Wisconsin Landlord tenant lease agreement Online

- eSignature Wyoming Landlord tenant lease agreement Online

- How Can I eSignature Oregon lease agreement

- eSignature Washington Lease agreement form Easy

- eSignature Alaska Lease agreement template Online

- eSignature Alaska Lease agreement template Later

- eSignature Massachusetts Lease agreement template Myself

- Can I eSignature Arizona Loan agreement

- eSignature Florida Loan agreement Online

- eSignature Florida Month to month lease agreement Later

- Can I eSignature Nevada Non-disclosure agreement PDF

- eSignature New Mexico Non-disclosure agreement PDF Online