Form P 64b 2024-2026

What is the Form P 64b

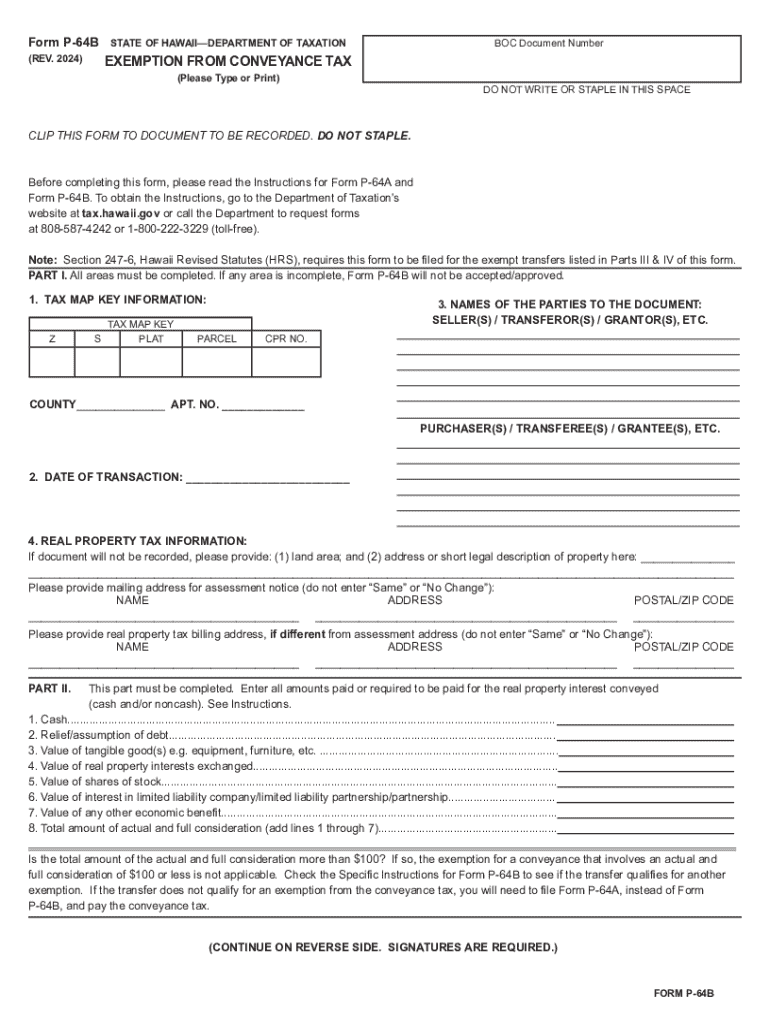

The Form P 64b is a specific tax exemption form used in Hawaii, primarily for conveyance tax purposes. This form allows property owners to claim exemptions from the conveyance tax when transferring real estate. Understanding the purpose of this form is essential for individuals and businesses involved in real estate transactions in Hawaii, as it helps reduce tax liabilities associated with property transfers.

How to use the Form P 64b

To effectively use the Form P 64b, individuals must first determine if they qualify for the exemption. The form must be completed accurately, providing all necessary information about the property and the transaction. Once filled out, it should be submitted to the appropriate state agency, along with any required documentation that supports the claim for exemption. Proper use of this form can lead to significant savings in conveyance taxes.

Steps to complete the Form P 64b

Completing the Form P 64b involves several key steps:

- Gather necessary information about the property, including its address, tax map key, and the nature of the transaction.

- Fill out the form with accurate details, ensuring all sections are completed as required.

- Attach supporting documents that verify eligibility for the exemption, such as proof of ownership or prior exemption claims.

- Review the completed form for accuracy before submission.

Legal use of the Form P 64b

The legal use of the Form P 64b is governed by Hawaii state tax laws. Property owners must ensure they meet the eligibility criteria outlined in the state regulations to avoid penalties. Misuse of the form or incorrect claims can lead to legal repercussions, including fines or additional tax liabilities. Therefore, understanding the legal framework surrounding this form is crucial for compliance.

Required Documents

When submitting the Form P 64b, certain documents may be required to substantiate the exemption claim. These documents can include:

- Proof of ownership, such as a deed or title.

- Previous tax exemption forms, if applicable.

- Any additional documentation that supports the claim for exemption.

Having these documents ready can streamline the submission process and enhance the likelihood of approval.

Form Submission Methods

The Form P 64b can be submitted through various methods, including:

- Online submission via the state’s tax portal, if available.

- Mailing the completed form to the appropriate state tax office.

- In-person submission at designated state tax offices.

Choosing the right submission method can depend on individual preferences and the urgency of the transaction.

Create this form in 5 minutes or less

Find and fill out the correct form p 64b

Create this form in 5 minutes!

How to create an eSignature for the form p 64b

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form hawaii exemption and how does it work?

The form hawaii exemption is a specific document that allows businesses to claim certain tax exemptions in Hawaii. By using airSlate SignNow, you can easily fill out and eSign this form, ensuring compliance with state regulations. Our platform simplifies the process, making it quick and efficient for users.

-

How can airSlate SignNow help with the form hawaii exemption?

airSlate SignNow provides a user-friendly interface to complete the form hawaii exemption. With our eSigning capabilities, you can securely sign and send the document electronically, saving time and reducing paperwork. This streamlines the process for businesses looking to manage their exemptions effectively.

-

Is there a cost associated with using airSlate SignNow for the form hawaii exemption?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Our plans are designed to be cost-effective, especially for those frequently handling documents like the form hawaii exemption. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for managing the form hawaii exemption?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, all of which are beneficial for managing the form hawaii exemption. These tools enhance efficiency and ensure that your documents are processed smoothly. Additionally, you can collaborate with team members in real-time.

-

Can I integrate airSlate SignNow with other applications for the form hawaii exemption?

Absolutely! airSlate SignNow offers integrations with various applications, allowing you to streamline your workflow when handling the form hawaii exemption. Whether you use CRM systems or cloud storage solutions, our platform can connect seamlessly to enhance your document management process.

-

What are the benefits of using airSlate SignNow for the form hawaii exemption?

Using airSlate SignNow for the form hawaii exemption provides numerous benefits, including increased efficiency, reduced turnaround time, and enhanced security. Our platform ensures that your documents are signed and stored securely, giving you peace of mind. Additionally, the ease of use allows anyone in your organization to manage the process effortlessly.

-

How secure is airSlate SignNow when handling the form hawaii exemption?

Security is a top priority at airSlate SignNow. When handling the form hawaii exemption, we utilize advanced encryption and secure cloud storage to protect your sensitive information. Our compliance with industry standards ensures that your documents are safe from unauthorized access.

Get more for Form P 64b

- Bir form 1601 eq editable

- Reinforcement activity 2 part a answer key form

- Medical fitness certificate for joining new job form

- Cracker barrel wage statements form

- Unmarried certificate format for kanyashree pdf

- Pma entrance exam reviewer pdf form

- Jammin jensen vendors form

- Participation affidavit form

Find out other Form P 64b

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online

- How To Sign Rhode Island Real Estate LLC Operating Agreement

- How Do I Sign Arizona Police Resignation Letter

- Sign Texas Orthodontists Business Plan Template Later

- How Do I Sign Tennessee Real Estate Warranty Deed