Illinois Tax Form 2020

What is the Illinois Tax Form

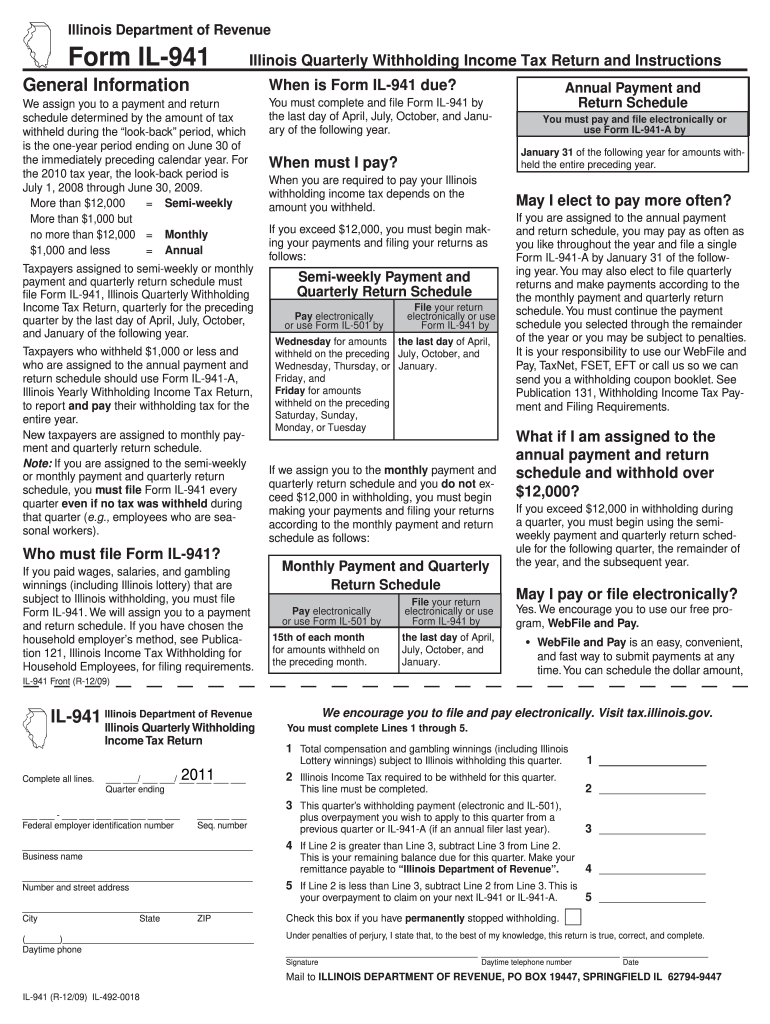

The Illinois Tax Form is a crucial document used by residents of Illinois to report their income and calculate their state tax obligations. This form is essential for individuals, businesses, and other entities operating within the state. It serves as a means for taxpayers to disclose their earnings, claim deductions, and determine their tax liabilities. The Illinois Department of Revenue issues these forms annually, and they must be completed accurately to ensure compliance with state tax laws.

How to use the Illinois Tax Form

Using the Illinois Tax Form involves several steps to ensure proper completion and submission. Taxpayers should first gather all necessary financial documents, including W-2s, 1099s, and any relevant receipts for deductions. Once the form is obtained, individuals can fill it out by providing personal information, income details, and applicable deductions. It is important to review the form for accuracy before submission. Taxpayers can file the form electronically or through traditional mail, depending on their preference.

Steps to complete the Illinois Tax Form

Completing the Illinois Tax Form requires careful attention to detail. Here are the steps to follow:

- Gather all necessary documents, including income statements and deduction receipts.

- Obtain the correct version of the Illinois Tax Form from the Illinois Department of Revenue.

- Fill in your personal information, including name, address, and Social Security number.

- Report your total income from all sources accurately.

- Claim any eligible deductions and credits to reduce your taxable income.

- Calculate your total tax liability based on the provided tax rates.

- Review the completed form for any errors or omissions.

- Submit the form electronically or by mail, ensuring it is sent by the deadline.

Legal use of the Illinois Tax Form

The Illinois Tax Form is legally binding when completed and submitted according to state regulations. To ensure its legal standing, taxpayers must provide accurate information and sign the form as required. Electronic signatures are acceptable, provided they comply with the Electronic Signatures in Global and National Commerce Act (ESIGN) and the Uniform Electronic Transactions Act (UETA). Misrepresentation or failure to file can lead to penalties, making it crucial to adhere to legal guidelines when using the form.

Filing Deadlines / Important Dates

Filing deadlines for the Illinois Tax Form are critical for compliance. Typically, individual tax returns are due by April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of any extensions that may apply, as well as deadlines for estimated tax payments. Keeping track of these dates helps avoid penalties and ensures timely compliance with state tax laws.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting the Illinois Tax Form. These methods include:

- Online Submission: Many taxpayers prefer to file electronically using approved e-filing software, which can streamline the process and reduce errors.

- Mail: Taxpayers can print the completed form and send it via postal service to the designated address provided by the Illinois Department of Revenue.

- In-Person: Some individuals may choose to deliver their forms directly to local tax offices, ensuring immediate receipt.

Required Documents

To complete the Illinois Tax Form, several documents are necessary. These typically include:

- W-2 forms from employers that report annual wages.

- 1099 forms for any freelance or contract work.

- Receipts and documentation for any deductions claimed, such as medical expenses or charitable contributions.

- Previous year’s tax return for reference, if applicable.

Quick guide on how to complete 2009 illinois tax form

Effortlessly Prepare Illinois Tax Form on Any Device

Managing documents online has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to discover the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents promptly without any delays. Handle Illinois Tax Form on any device using the airSlate SignNow Android or iOS applications and enhance any document-focused procedure today.

The Easiest Way to Edit and eSign Illinois Tax Form with Minimal Effort

- Retrieve Illinois Tax Form and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of your documents or conceal sensitive information with tools specifically offered by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose your preferred method to deliver your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Illinois Tax Form and guarantee excellent communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2009 illinois tax form

Create this form in 5 minutes!

How to create an eSignature for the 2009 illinois tax form

How to create an eSignature for your PDF document in the online mode

How to create an eSignature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

The best way to generate an eSignature from your mobile device

How to generate an electronic signature for a PDF document on iOS devices

The best way to generate an eSignature for a PDF file on Android devices

People also ask

-

What is the Illinois Tax Form and why do I need it?

The Illinois Tax Form is a required document for filing taxes in the state of Illinois. Understanding how to complete it correctly is crucial for compliance and avoiding penalties. Utilizing airSlate SignNow can streamline the signing process, ensuring all necessary signatures are obtained promptly.

-

How does airSlate SignNow simplify the process of signing the Illinois Tax Form?

airSlate SignNow simplifies the signing process for the Illinois Tax Form by allowing users to electronically sign documents from any device. With its user-friendly interface, you can ensure that all parties can effortlessly sign and send the form without any delays.

-

Is airSlate SignNow cost-effective for handling Illinois Tax Forms?

Yes, airSlate SignNow offers a cost-effective solution for handling Illinois Tax Forms. With competitive pricing plans, businesses can manage document workflows and eSignatures at a fraction of the cost of traditional methods, saving both time and money.

-

Can I integrate airSlate SignNow with other software for my Illinois Tax Form submissions?

Absolutely! airSlate SignNow seamlessly integrates with various platforms, ensuring that your Illinois Tax Form submissions are efficient. Whether you use CRMs, cloud storage, or accounting software, you can easily connect and manage your documents through our integrations.

-

What features does airSlate SignNow offer for managing the Illinois Tax Form?

airSlate SignNow offers several features for managing the Illinois Tax Form, including templates, secure storage, and audit trails. These features help ensure that your forms are filled out correctly and track who signed them, providing peace of mind throughout the process.

-

How secure is my information while using airSlate SignNow for Illinois Tax Forms?

Security is a top priority at airSlate SignNow. When using our platform for Illinois Tax Forms, your data is protected with encryption and complies with industry standards, ensuring that sensitive tax information remains safe and confidential.

-

Can I access my Illinois Tax Form from anywhere using airSlate SignNow?

Yes, with airSlate SignNow, you can access your Illinois Tax Form from anywhere, anytime. Our cloud-based solution allows users to manage their documents on any device, making it convenient for busy professionals on the go.

Get more for Illinois Tax Form

Find out other Illinois Tax Form

- Help Me With eSignature Georgia Non-Profit NDA

- How Can I eSignature Idaho Non-Profit Business Plan Template

- eSignature Mississippi Life Sciences Lease Agreement Myself

- How Can I eSignature Mississippi Life Sciences Last Will And Testament

- How To eSignature Illinois Non-Profit Contract

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later