IDHS Accessibility Illinois Department of Human Services 2020

IRS Guidelines

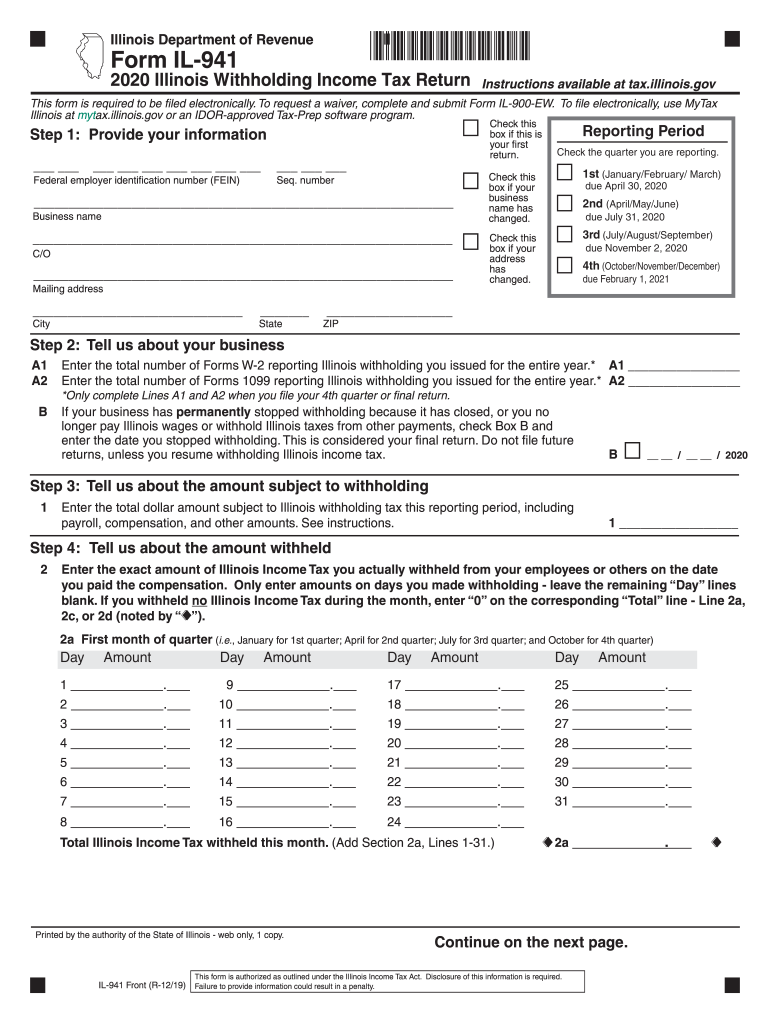

The Illinois 941 form is a crucial document for businesses operating within the state, as it is used to report income tax withheld from employees. It is essential to adhere to the IRS guidelines when completing this form to ensure compliance with federal tax regulations. The IRS requires accurate reporting of wages, tips, and other compensation paid to employees, along with the corresponding tax withheld. Failure to follow these guidelines may result in penalties or increased scrutiny from tax authorities.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Illinois 941 form is vital for businesses to avoid late penalties. The form is typically due on a quarterly basis, with specific deadlines falling on the last day of the month following the end of each quarter. For example, the due dates are often April 30 for the first quarter, July 31 for the second quarter, October 31 for the third quarter, and January 31 for the fourth quarter. Keeping track of these dates helps ensure timely submission and compliance with state regulations.

Required Documents

To complete the Illinois 941 form accurately, businesses must gather several key documents. These include payroll records that detail employee wages, tips, and other compensation, as well as documentation of the federal income tax withheld from each employee's paycheck. Additionally, businesses should have their Employer Identification Number (EIN) readily available, as it is necessary for proper identification on the form. Ensuring all required documents are in order streamlines the filing process and reduces the likelihood of errors.

Form Submission Methods (Online / Mail / In-Person)

Businesses have multiple options for submitting the Illinois 941 form. The form can be filed online through the Illinois Department of Revenue's e-filing system, which offers a convenient and efficient way to submit documents. Alternatively, businesses may choose to mail a paper version of the form to the appropriate address provided by the state. In-person submission is also an option at designated state offices, though this may be less common due to the convenience of online filing. Each method has its advantages, and businesses should select the one that best suits their needs.

Penalties for Non-Compliance

Failure to comply with the filing requirements for the Illinois 941 form can result in significant penalties. Late submissions may incur fines based on the amount of tax owed and the duration of the delay. Additionally, businesses may face interest charges on any unpaid taxes. It is crucial for employers to understand these potential penalties and take proactive measures to ensure timely and accurate filing to avoid unnecessary financial burdens.

Digital vs. Paper Version

When it comes to filing the Illinois 941 form, businesses can choose between a digital version and a traditional paper version. The digital form offers several advantages, including faster processing times and reduced risk of errors associated with manual entry. Additionally, e-filing provides instant confirmation of submission, which can be beneficial for record-keeping. On the other hand, some businesses may prefer the paper version for its tangible nature. Regardless of the choice, ensuring accuracy and compliance with filing requirements is essential.

Quick guide on how to complete idhs accessibility illinois department of human services

Effortlessly prepare IDHS Accessibility Illinois Department Of Human Services on any device

Digital document handling has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed paperwork, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, edit, and eSign your documents swiftly without delays. Manage IDHS Accessibility Illinois Department Of Human Services on any platform using airSlate SignNow apps for Android or iOS and simplify any document-related task today.

How to edit and eSign IDHS Accessibility Illinois Department Of Human Services with ease

- Find IDHS Accessibility Illinois Department Of Human Services and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes seconds and has the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Select your preferred delivery method for your form: via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misfiled documents, laborious form searching, or mistakes that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and eSign IDHS Accessibility Illinois Department Of Human Services and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct idhs accessibility illinois department of human services

Create this form in 5 minutes!

How to create an eSignature for the idhs accessibility illinois department of human services

How to create an eSignature for your PDF online

How to create an eSignature for your PDF in Google Chrome

The best way to generate an electronic signature for signing PDFs in Gmail

The best way to generate an eSignature right from your smartphone

How to generate an electronic signature for a PDF on iOS

The best way to generate an eSignature for a PDF on Android

People also ask

-

What is the Illinois 941 form, and why is it important?

The Illinois 941 form is a state income tax return form that employers in Illinois must file quarterly. It is essential for reporting state tax withholdings from employee wages. Understanding the complexities of the Illinois 941 is crucial for maintaining compliance and avoiding penalties.

-

How can airSlate SignNow help with filing the Illinois 941?

With airSlate SignNow, you can easily eSign and send documents like the Illinois 941 form, ensuring quick and efficient submission. Our platform provides an intuitive interface, allowing you to manage your forms seamlessly. This streamlines the filing process and reduces errors related to manual submissions.

-

What features does airSlate SignNow offer for handling the Illinois 941?

airSlate SignNow offers a range of features to simplify the handling of the Illinois 941, including eSignature capabilities, document templates, and secure storage. These features ensure that your forms are completed accurately and filed on time. Plus, our automated reminders help you stay on track with deadlines.

-

Is airSlate SignNow a cost-effective solution for managing the Illinois 941?

Yes, airSlate SignNow is designed to be a cost-effective solution for managing forms like the Illinois 941. Our pricing plans are flexible and cater to businesses of all sizes. By automating document processes, you can save time and reduce labor costs associated with manual form handling.

-

Can I integrate airSlate SignNow with other software for the Illinois 941?

Absolutely! airSlate SignNow easily integrates with various accounting and payroll software, which can assist in accurately generating the Illinois 941. This integration helps ensure that the data entered into the form is precise and up to date. Streamlining your workflows will save you time and resources.

-

What are the benefits of using airSlate SignNow for the Illinois 941?

Using airSlate SignNow for the Illinois 941 provides numerous benefits, including enhanced efficiency, reduced processing errors, and improved document security. Our platform enables quick eSigning and digital document tracking, ensuring that you can access your forms anytime. This leads to timely submissions and peace of mind.

-

How does airSlate SignNow ensure the security of the Illinois 941 form?

airSlate SignNow prioritizes the security of your sensitive documents, including the Illinois 941 form. Our platform employs advanced encryption and secure cloud storage, ensuring your data is protected. Additionally, we comply with industry regulations to keep your information safe and confidential.

Get more for IDHS Accessibility Illinois Department Of Human Services

Find out other IDHS Accessibility Illinois Department Of Human Services

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile