Form IL 941 Illinois Withholding Income Tax Return Form IL 941 Illinois Withholding Income Tax Return 2022-2026

What is the Form IL 941?

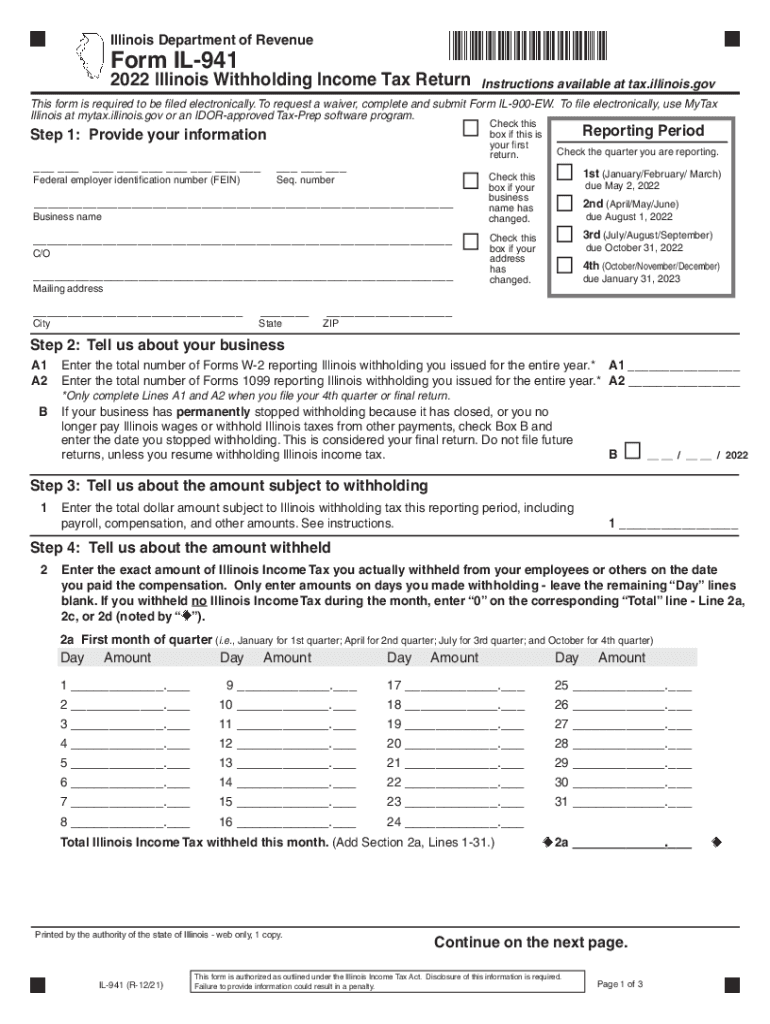

The IL 941 form, officially known as the Illinois Withholding Income Tax Return, is a crucial document for employers in Illinois. It is used to report and remit state income tax withheld from employees' wages. This form is essential for ensuring compliance with Illinois tax laws and helps maintain accurate records of tax obligations. Employers must file this form quarterly, detailing the amount of income tax withheld during the reporting period.

Steps to Complete the Form IL 941

Completing the IL 941 form involves several key steps to ensure accuracy and compliance. First, gather all necessary payroll records for the reporting period, including total wages paid and taxes withheld. Next, accurately fill out the form by entering the required information, such as your business name, address, and the total amount of tax withheld. After completing the form, review it for any errors before submitting it. Finally, ensure that you submit the form by the due date to avoid potential penalties.

Filing Deadlines / Important Dates

Employers must adhere to specific deadlines when filing the IL 941 form. The form is due on the last day of the month following the end of each quarter. For example, for the first quarter ending March 31, the form must be filed by April 30. It is essential to keep track of these dates to avoid late fees and penalties associated with non-compliance.

How to Obtain the Form IL 941

The IL 941 form can be obtained easily through the Illinois Department of Revenue's official website. Employers can download a printable version of the form or fill it out electronically. Additionally, many tax preparation software programs include the IL 941 form, allowing for a more streamlined filing process.

Legal Use of the Form IL 941

The IL 941 form serves as a legal document that verifies the withholding of state income tax from employee wages. Proper completion and timely submission of this form are crucial for compliance with Illinois tax regulations. Failing to file the form can result in penalties and interest on unpaid taxes, making it important for employers to understand their obligations under state law.

Key Elements of the Form IL 941

Several key elements must be included when completing the IL 941 form. These include the employer's identification number, total wages paid, and the amount of state income tax withheld. Additionally, the form requires the reporting of any adjustments or corrections to previously filed returns. Accurate reporting of these elements is vital for ensuring compliance and avoiding discrepancies with the Illinois Department of Revenue.

Quick guide on how to complete 2022 form il 941 illinois withholding income tax return 2022 form il 941 illinois withholding income tax return

Manage Form IL 941 Illinois Withholding Income Tax Return Form IL 941 Illinois Withholding Income Tax Return effortlessly on any device

Digital document management has gained signNow traction among businesses and individuals. It offers a superb eco-conscious alternative to traditional printed and signed paperwork, enabling you to access the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without any hold-ups. Handle Form IL 941 Illinois Withholding Income Tax Return Form IL 941 Illinois Withholding Income Tax Return on any platform with airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

How to alter and electronically sign Form IL 941 Illinois Withholding Income Tax Return Form IL 941 Illinois Withholding Income Tax Return with ease

- Obtain Form IL 941 Illinois Withholding Income Tax Return Form IL 941 Illinois Withholding Income Tax Return and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of the documents or obscure sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature with the Sign tool, which takes just seconds and carries the same legal validity as a conventional ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method for delivering your form, whether by email, SMS, invitation link, or download it to your computer.

No more concerns about lost or misplaced documents, tedious form searches, or errors that necessitate reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign Form IL 941 Illinois Withholding Income Tax Return Form IL 941 Illinois Withholding Income Tax Return and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2022 form il 941 illinois withholding income tax return 2022 form il 941 illinois withholding income tax return

Create this form in 5 minutes!

People also ask

-

What is the IL 941 form 2020 and why is it important?

The IL 941 form 2020 is a state tax form used in Illinois for reporting employee income and withholding taxes. It is crucial for businesses to accurately complete and submit this form to comply with state regulations and avoid penalties. Utilizing services like airSlate SignNow can streamline this process, ensuring you manage your documentation efficiently.

-

How can airSlate SignNow help with the IL 941 form 2020?

airSlate SignNow simplifies the process of completing the IL 941 form 2020 by allowing users to fill out, sign, and send the form electronically. This not only saves time but also enhances accuracy by reducing manual errors. Additionally, our platform provides templates to ensure compliance with state requirements.

-

Is there a cost associated with using airSlate SignNow for the IL 941 form 2020?

Yes, airSlate SignNow offers various pricing plans tailored to fit different business needs. Each plan provides access to features that facilitate the completion and filing of the IL 941 form 2020 efficiently. We recommend visiting our pricing page to find the plan that best suits your requirements.

-

What are the key features of airSlate SignNow related to the IL 941 form 2020?

Key features of airSlate SignNow include customizable templates, electronic signatures, real-time collaboration, and secure cloud storage. These tools make it easier for businesses to manage the IL 941 form 2020 effectively and ensure that all stakeholders can access the necessary documentation seamlessly.

-

Can I integrate airSlate SignNow with other software for the IL 941 form 2020?

Absolutely! airSlate SignNow offers integrations with popular accounting and payroll software, providing a smooth workflow when managing the IL 941 form 2020. This allows businesses to consolidate their operations and improve overall efficiency while handling tax forms.

-

What are the benefits of using airSlate SignNow for the IL 941 form 2020?

Using airSlate SignNow for the IL 941 form 2020 offers numerous benefits including increased accuracy, reduced processing time, and enhanced security. By leveraging our platform, businesses can ensure compliance with state tax regulations while freeing up resources to focus on core operations.

-

Is airSlate SignNow user-friendly for submitting the IL 941 form 2020?

Yes, airSlate SignNow is designed with user experience in mind, making it easy for anyone to navigate and utilize its features for the IL 941 form 2020. With an intuitive interface, users can quickly learn how to fill out forms, sign documents, and manage their submissions without any technical expertise.

Get more for Form IL 941 Illinois Withholding Income Tax Return Form IL 941 Illinois Withholding Income Tax Return

- Corporate records maintenance package for existing corporations new jersey form

- Nj limited form

- Nj llc form

- Nj company 497319080 form

- Nj interest form

- Construction lien claim mechanic liens individual new jersey form

- Nj husband wife 497319084 form

- Warranty deed from individual to husband and wife new jersey form

Find out other Form IL 941 Illinois Withholding Income Tax Return Form IL 941 Illinois Withholding Income Tax Return

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online

- How To Sign Rhode Island Real Estate LLC Operating Agreement

- How Do I Sign Arizona Police Resignation Letter

- Sign Texas Orthodontists Business Plan Template Later

- How Do I Sign Tennessee Real Estate Warranty Deed

- Sign Tennessee Real Estate Last Will And Testament Free

- Sign Colorado Police Memorandum Of Understanding Online

- How To Sign Connecticut Police Arbitration Agreement

- Sign Utah Real Estate Quitclaim Deed Safe

- Sign Utah Real Estate Notice To Quit Now

- Sign Hawaii Police LLC Operating Agreement Online

- How Do I Sign Hawaii Police LLC Operating Agreement