Illinois Form Exemption 2019

What is the Illinois Form Exemption

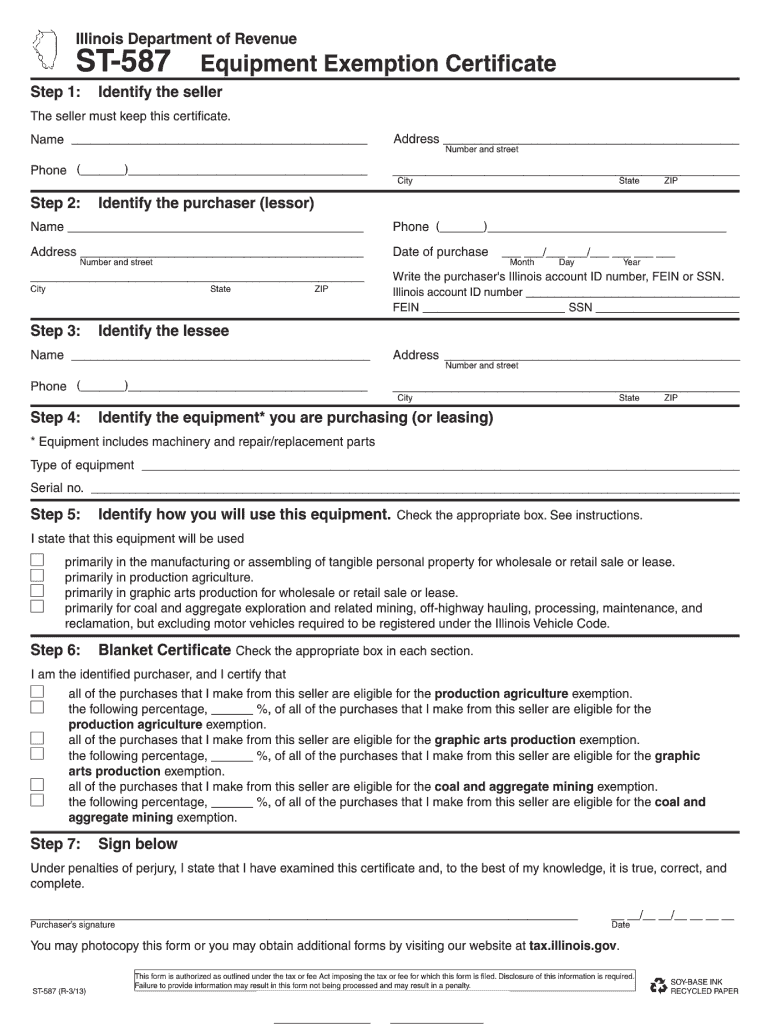

The Illinois Form Exemption is a specific document that allows individuals or businesses to claim an exemption from certain taxes or regulatory requirements within the state of Illinois. This form is essential for those who qualify under specific criteria, enabling them to avoid unnecessary financial burdens. Understanding the purpose and implications of this form is crucial for compliance and effective financial planning.

How to use the Illinois Form Exemption

Using the Illinois Form Exemption involves several steps to ensure that it is filled out correctly and submitted in a timely manner. First, determine your eligibility by reviewing the criteria set forth by the state. Next, gather all necessary documentation that supports your claim for exemption. Once you have the required information, complete the form accurately, ensuring all details are correct. Finally, submit the form through the appropriate channels, whether online, by mail, or in person, depending on the guidelines provided by the state.

Steps to complete the Illinois Form Exemption

Completing the Illinois Form Exemption requires careful attention to detail. Follow these steps:

- Review eligibility criteria to confirm you qualify for the exemption.

- Collect supporting documents, such as tax returns or proof of income.

- Fill out the form, ensuring all fields are completed accurately.

- Double-check your entries for any errors or omissions.

- Submit the form according to the specified submission methods.

Legal use of the Illinois Form Exemption

The legal use of the Illinois Form Exemption is governed by state tax laws and regulations. It is vital to ensure that the form is used appropriately to avoid penalties or legal issues. The form must be completed honestly and submitted by the deadline to maintain compliance with state requirements. Understanding the legal implications of the exemption can help individuals and businesses navigate their tax obligations effectively.

Eligibility Criteria

Eligibility for the Illinois Form Exemption varies based on specific conditions set by the state. Generally, individuals or entities must demonstrate that they meet certain financial thresholds or operational requirements. Common eligibility criteria may include income levels, business type, or specific exemptions related to certain industries. It is essential to review the latest guidelines from the Illinois Department of Revenue to ensure compliance.

Required Documents

When applying for the Illinois Form Exemption, several documents may be required to support your claim. These can include:

- Proof of income or financial statements.

- Tax returns from previous years.

- Business registration documents, if applicable.

- Any additional documentation that substantiates your eligibility for the exemption.

Form Submission Methods

The Illinois Form Exemption can be submitted through various methods, each catering to different preferences and circumstances. Common submission methods include:

- Online submission through the Illinois Department of Revenue website.

- Mailing the completed form to the designated address.

- In-person submission at local tax offices or designated locations.

Quick guide on how to complete illinois form exemption 2013

Effortlessly Prepare Illinois Form Exemption on Any Device

Managing documents online has become increasingly common for organizations and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed materials, allowing you to obtain the appropriate document and securely save it in the cloud. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents swiftly without interruptions. Handle Illinois Form Exemption on any device using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

The Easiest Way to Modify and eSign Illinois Form Exemption Effortlessly

- Locate Illinois Form Exemption and click Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize important sections of your documents or obscure sensitive information using tools that airSlate SignNow specifically provides for this purpose.

- Create your signature with the Sign tool, which takes seconds and has the same legal validity as a conventional wet ink signature.

- Review all information and click the Done button to finalize your changes.

- Select how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and eSign Illinois Form Exemption to ensure outstanding communication at any step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct illinois form exemption 2013

Create this form in 5 minutes!

How to create an eSignature for the illinois form exemption 2013

How to make an electronic signature for a PDF in the online mode

How to make an electronic signature for a PDF in Chrome

The best way to create an eSignature for putting it on PDFs in Gmail

The best way to make an electronic signature from your smart phone

The best way to generate an eSignature for a PDF on iOS devices

The best way to make an electronic signature for a PDF file on Android OS

People also ask

-

What is the Illinois Form Exemption?

The Illinois Form Exemption is a legal provision that allows certain forms to be excluded from specific regulatory requirements. Understanding this exemption is essential for businesses operating in Illinois to ensure compliance. Using airSlate SignNow can simplify the process of applying for and managing these exemptions efficiently.

-

How can airSlate SignNow help with the Illinois Form Exemption process?

airSlate SignNow streamlines the documentation process related to the Illinois Form Exemption by enabling users to easily fill out, sign, and send forms digitally. This reduces the complexity involved in navigating exemptions and enhances the overall workflow. With our solution, you can stay organized and compliant with Illinois regulations.

-

Is airSlate SignNow cost-effective for managing the Illinois Form Exemption?

Yes, airSlate SignNow offers competitive pricing that makes it a cost-effective solution for businesses needing to manage the Illinois Form Exemption. With a variety of pricing plans tailored to different needs, you can choose the option that best fits your budget while ensuring you have the tools necessary for compliance.

-

What features does airSlate SignNow offer for the Illinois Form Exemption?

airSlate SignNow provides a range of features tailored to simplify the handling of the Illinois Form Exemption, including electronic signatures, customizable templates, and workflow automation. These features ensure that you can efficiently manage documentation and meet regulatory standards without unnecessary delays.

-

Can I integrate airSlate SignNow with other tools for managing the Illinois Form Exemption?

Absolutely! airSlate SignNow integrates seamlessly with various applications to enhance your workflow when managing the Illinois Form Exemption. Whether you need to connect with CRM systems or document management software, our integrations ensure a smooth experience.

-

What are the benefits of using airSlate SignNow for Illinois Form Exemption documentation?

Using airSlate SignNow for Illinois Form Exemption documentation provides numerous benefits, including increased efficiency, reduced processing times, and improved document accuracy. Additionally, the ease of electronic signatures enhances collaboration among team members while ensuring compliance with state regulations.

-

Is airSlate SignNow compliant with Illinois regulations related to the Form Exemption?

Yes, airSlate SignNow is designed to comply with Illinois regulations relevant to the Form Exemption, ensuring that your documents meet legal standards. We prioritize security and compliance, so you can trust that your documentation is handled appropriately while maintaining the integrity of sensitive information.

Get more for Illinois Form Exemption

- Bayo data form

- Annexure oc letter of indemnity form

- Locus scoring sheet form

- Contractors material and test certificate for underground piping form

- Active listening checklist form

- P53z tax form online

- Taxpayer relief requeststatement of income and expenses and assetsand liabilities for individuals form

- Discretionary housing payment application form benefits

Find out other Illinois Form Exemption

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Do I eSign Hawaii Construction Form

- How Can I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Document

- Can I eSign Hawaii Construction Document

- How Do I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Form

- How Do I eSign Hawaii Construction Form

- How To eSign Florida Doctors Form

- Help Me With eSign Hawaii Doctors Word

- How Can I eSign Hawaii Doctors Word

- Help Me With eSign New York Doctors PPT

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document