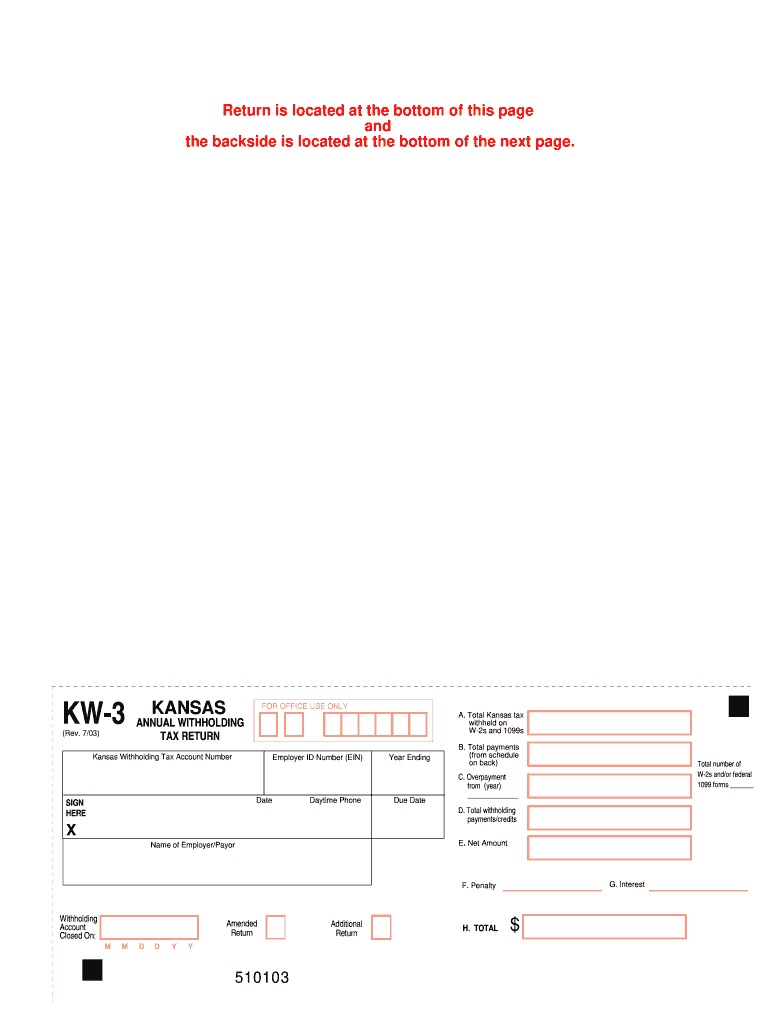

Kw 3 Form 2018

What is the Kw 3 Form

The Kw 3 Form is a tax document used in the United States, primarily for reporting income and withholding for certain types of payments. It is often utilized by employers or businesses to report wages paid to employees, as well as to provide essential information to the Internal Revenue Service (IRS). This form plays a critical role in ensuring that the appropriate taxes are withheld and reported accurately, contributing to compliance with federal tax regulations.

How to use the Kw 3 Form

Using the Kw 3 Form involves several steps to ensure accurate reporting and compliance. First, gather all necessary information, including the employee's name, Social Security number, and the amount of wages paid. Next, complete the form by filling in the required fields, ensuring that all information is accurate and matches the records of both the employer and employee. After the form is completed, it should be submitted to the IRS and a copy provided to the employee for their records. This process helps maintain transparency and accountability in tax reporting.

Steps to complete the Kw 3 Form

Completing the Kw 3 Form requires careful attention to detail. Follow these steps:

- Collect necessary information, including the employee's full name, Social Security number, and total wages paid.

- Fill out the form accurately, ensuring that all fields are completed correctly.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the IRS by the designated deadline.

- Provide a copy of the form to the employee for their records.

Legal use of the Kw 3 Form

The Kw 3 Form is legally binding when filled out correctly and submitted in compliance with IRS regulations. It serves as an official record of income and withholding, which can be referenced in case of audits or disputes. Proper use of this form ensures that both employers and employees meet their tax obligations, thereby avoiding potential legal issues related to tax compliance.

Filing Deadlines / Important Dates

Filing deadlines for the Kw 3 Form are crucial for compliance. Typically, employers must submit this form to the IRS by January thirty-first of the year following the tax year being reported. Additionally, providing copies to employees should also be completed by this date. Being aware of these deadlines helps prevent penalties and ensures timely reporting of income and withholding.

Form Submission Methods (Online / Mail / In-Person)

The Kw 3 Form can be submitted through various methods to accommodate different preferences. Employers may choose to file online using the IRS e-file system, which offers a secure and efficient way to submit tax forms. Alternatively, the form can be mailed directly to the appropriate IRS address or submitted in person at designated IRS offices. Each method has its own advantages, such as speed and convenience, allowing employers to select the best option for their needs.

Quick guide on how to complete kw 3 form 2003

Manage Kw 3 Form effortlessly on any device

Digital document management has become increasingly prevalent among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the resources needed to create, modify, and electronically sign your documents quickly and without delays. Handle Kw 3 Form on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to modify and electronically sign Kw 3 Form without hassle

- Find Kw 3 Form and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your electronic signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Carefully review the details and then click the Done button to save your modifications.

- Select how you would like to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your preferred device. Alter and electronically sign Kw 3 Form and guarantee effective communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct kw 3 form 2003

Create this form in 5 minutes!

How to create an eSignature for the kw 3 form 2003

How to make an eSignature for your PDF document in the online mode

How to make an eSignature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

The way to create an electronic signature straight from your mobile device

The best way to make an electronic signature for a PDF document on iOS devices

The way to create an electronic signature for a PDF document on Android devices

People also ask

-

What is the Kw 3 Form and how can it benefit my business?

The Kw 3 Form is a digital document designed to streamline the signing process for businesses. By utilizing the airSlate SignNow platform, you can easily create, send, and eSign the Kw 3 Form, improving efficiency and reducing the turnaround time for important documents.

-

How much does it cost to use the Kw 3 Form through airSlate SignNow?

Pricing for using the Kw 3 Form with airSlate SignNow varies based on the selected plan. Our plans are cost-effective, ensuring that you get value for your investment while accessing powerful features to enhance your document workflow.

-

Can I customize the Kw 3 Form for my specific needs?

Absolutely! The Kw 3 Form can be fully customized within the airSlate SignNow platform. You can add fields, change formatting, and include your branding to ensure that the form fits your business's requirements.

-

What features does airSlate SignNow offer for the Kw 3 Form?

airSlate SignNow provides a wide range of features for the Kw 3 Form, including secure eSign capabilities, automated workflows, and real-time tracking of document status. These features are designed to enhance user experience and improve document management.

-

Is it easy to integrate the Kw 3 Form with other applications?

Yes, integrating the Kw 3 Form with other applications is seamless with airSlate SignNow. We offer numerous integrations with popular tools such as CRM systems, document storage solutions, and email platforms to ensure your workflow remains uninterrupted.

-

What security measures are in place for the Kw 3 Form?

Security is a top priority for airSlate SignNow. The Kw 3 Form is protected with advanced encryption protocols and complies with industry standards to ensure that your data remains safe and secure during the signing process.

-

Can I track the status of my Kw 3 Form after sending it?

Yes, airSlate SignNow allows you to track the status of your Kw 3 Form in real time. You will receive notifications when the document is viewed, signed, or completed, providing you with full visibility throughout the process.

Get more for Kw 3 Form

- Assam gramin vikash bank internet banking pdf form

- First 12 chords for the guitar bphilwestfallbbcomb form

- Does springfield college have nsfas form

- 7887684174 form

- How to print m g withdrawal form for executors

- Wells fargo teacher grants form

- Request for consent to assign a manufactured home site tenancy bb form

- Omb control number 0702xxxx omb expiration date form

Find out other Kw 3 Form

- eSign California Sublease Agreement Template Safe

- How To eSign Colorado Sublease Agreement Template

- How Do I eSign Colorado Sublease Agreement Template

- eSign Florida Sublease Agreement Template Free

- How Do I eSign Hawaii Lodger Agreement Template

- eSign Arkansas Storage Rental Agreement Now

- How Can I eSign Texas Sublease Agreement Template

- eSign Texas Lodger Agreement Template Free

- eSign Utah Lodger Agreement Template Online

- eSign Hawaii Rent to Own Agreement Mobile

- How To eSignature Colorado Postnuptial Agreement Template

- How Do I eSignature Colorado Postnuptial Agreement Template

- Help Me With eSignature Colorado Postnuptial Agreement Template

- eSignature Illinois Postnuptial Agreement Template Easy

- eSignature Kentucky Postnuptial Agreement Template Computer

- How To eSign California Home Loan Application

- How To eSign Florida Home Loan Application

- eSign Hawaii Home Loan Application Free

- How To eSign Hawaii Home Loan Application

- How To eSign New York Home Loan Application