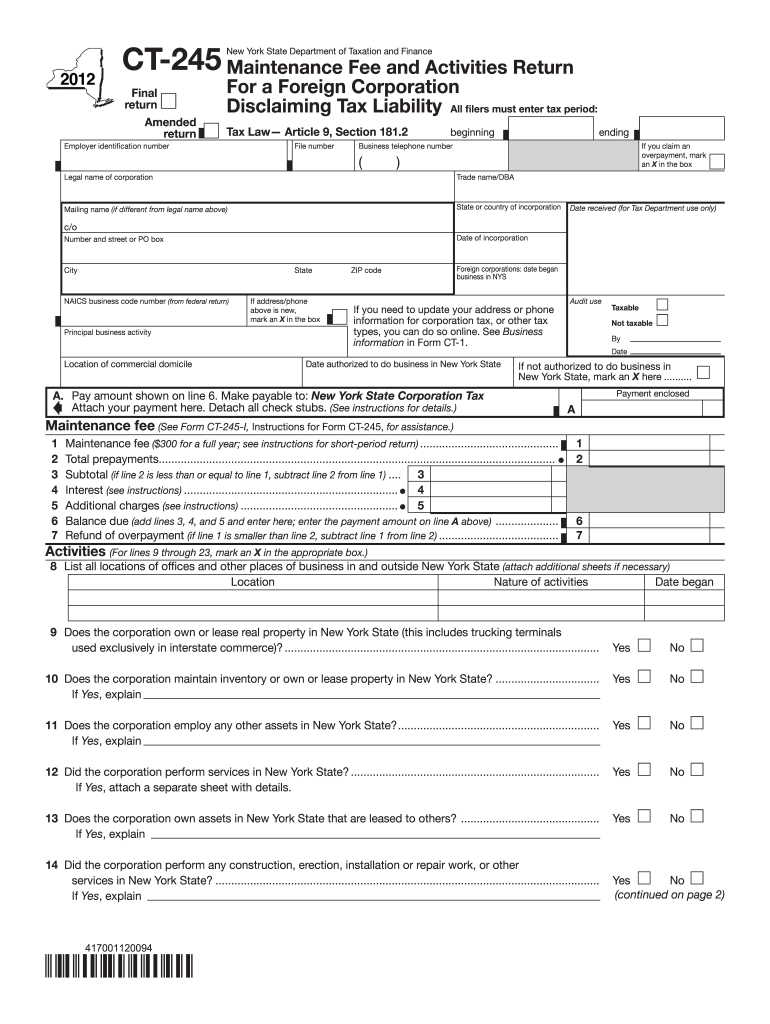

Ct 245 Form 2004

What is the Ct 245 Form

The Ct 245 Form is a legal document used primarily in the state of Connecticut. It is typically associated with specific legal proceedings, such as family law matters, including custody and visitation issues. Understanding the purpose and function of this form is crucial for individuals navigating the legal system in Connecticut.

How to use the Ct 245 Form

Using the Ct 245 Form involves several steps to ensure that it is completed accurately and submitted correctly. First, individuals must gather all necessary information related to their case, including personal details and any relevant legal documentation. Next, the form should be filled out carefully, ensuring that all sections are completed as required. Once completed, the form can be submitted to the appropriate court or legal authority as specified in the accompanying instructions.

Steps to complete the Ct 245 Form

Completing the Ct 245 Form requires attention to detail. Here are the steps to follow:

- Review the form thoroughly to understand the required sections.

- Gather necessary information, such as names, addresses, and case numbers.

- Fill out the form, ensuring all information is accurate and complete.

- Sign and date the form where indicated.

- Make copies for your records before submission.

Legal use of the Ct 245 Form

The Ct 245 Form is legally binding once it is completed and submitted according to the court's requirements. It is essential to ensure that the form is filled out correctly to avoid delays or complications in legal proceedings. Courts rely on the accuracy of the information provided in this form to make informed decisions regarding the case.

Key elements of the Ct 245 Form

Several key elements are critical to the Ct 245 Form's effectiveness. These include:

- Identifying Information: This section requires the names and contact details of all parties involved.

- Case Information: Details about the legal case, including case numbers and relevant dates.

- Signature Section: A place for all parties to sign, indicating their agreement and understanding of the contents.

Who Issues the Form

The Ct 245 Form is issued by the Connecticut Judicial Branch. It is important to obtain the most current version of the form to ensure compliance with any updates or changes in legal requirements. Individuals can typically find the form on the official Connecticut Judicial Branch website or at local courthouses.

Quick guide on how to complete 2012 ct 245 form

Complete Ct 245 Form effortlessly on any device

Digital document management has become widespread among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can easily find the appropriate form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage Ct 245 Form on any device using airSlate SignNow's Android or iOS applications and streamline any document-related processes today.

The easiest way to modify and eSign Ct 245 Form without hassle

- Find Ct 245 Form and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device of your choice. Modify and eSign Ct 245 Form to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2012 ct 245 form

Create this form in 5 minutes!

How to create an eSignature for the 2012 ct 245 form

The way to create an electronic signature for your PDF document online

The way to create an electronic signature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

How to make an electronic signature right from your smart phone

The best way to create an electronic signature for a PDF document on iOS

How to make an electronic signature for a PDF on Android OS

People also ask

-

What is the Ct 245 Form?

The Ct 245 Form is a document used for specific administrative purposes, often related to tax matters or legal documentation in Connecticut. Understanding its requirements is crucial for ensuring compliance. With airSlate SignNow, filling and signing the Ct 245 Form becomes quick and effortless.

-

How does airSlate SignNow help with the Ct 245 Form?

airSlate SignNow streamlines the process of signing and sending the Ct 245 Form electronically. Our platform allows users to easily fill out, send, and receive signatures in real time. This enhances productivity and reduces the time spent on paperwork.

-

What are the pricing options for using airSlate SignNow with the Ct 245 Form?

airSlate SignNow offers flexible pricing plans that cater to various business sizes and needs. You can start with a free trial to explore the features supporting documents like the Ct 245 Form. Once you're ready, choose a plan that fits your workflow and budget.

-

Can I integrate airSlate SignNow with other applications for the Ct 245 Form?

Yes, airSlate SignNow seamlessly integrates with various applications, enhancing your workflow when handling the Ct 245 Form. Popular integrations include Google Drive, Dropbox, and Salesforce, making it easy to manage documents across platforms effortlessly.

-

What are the benefits of using airSlate SignNow for the Ct 245 Form?

Using airSlate SignNow for the Ct 245 Form provides numerous benefits, such as reduced turnaround time and enhanced document security. You can track the signing process in real time and store documents securely in the cloud, ensuring all necessary files are easily accessible.

-

Is my data secure when signing the Ct 245 Form with airSlate SignNow?

Absolutely! airSlate SignNow prioritizes the security of your data, especially when handling the Ct 245 Form. We use advanced encryption and secure servers to protect your personal and financial information during the signing process.

-

How can I get assistance when using airSlate SignNow for the Ct 245 Form?

Our customer support team is readily available to assist you with any questions regarding the Ct 245 Form and its processing on airSlate SignNow. You can signNow out via chat, email, or phone for prompt assistance whenever you need help.

Get more for Ct 245 Form

- Oklahoma title transfer form

- Lead paint disclosure washington state form

- Global cash card direct deposit form

- Superannuation standard choice form 51757980

- Letter recognition assessmentindividual record form

- Application jimmy johns print form

- Blank missouri marriage license form

- Small scale embedded generation sseg application form

Find out other Ct 245 Form

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement