Nys Sales Tax St 330 Form 2018-2026

What is the NYS Sales Tax ST-330 Form

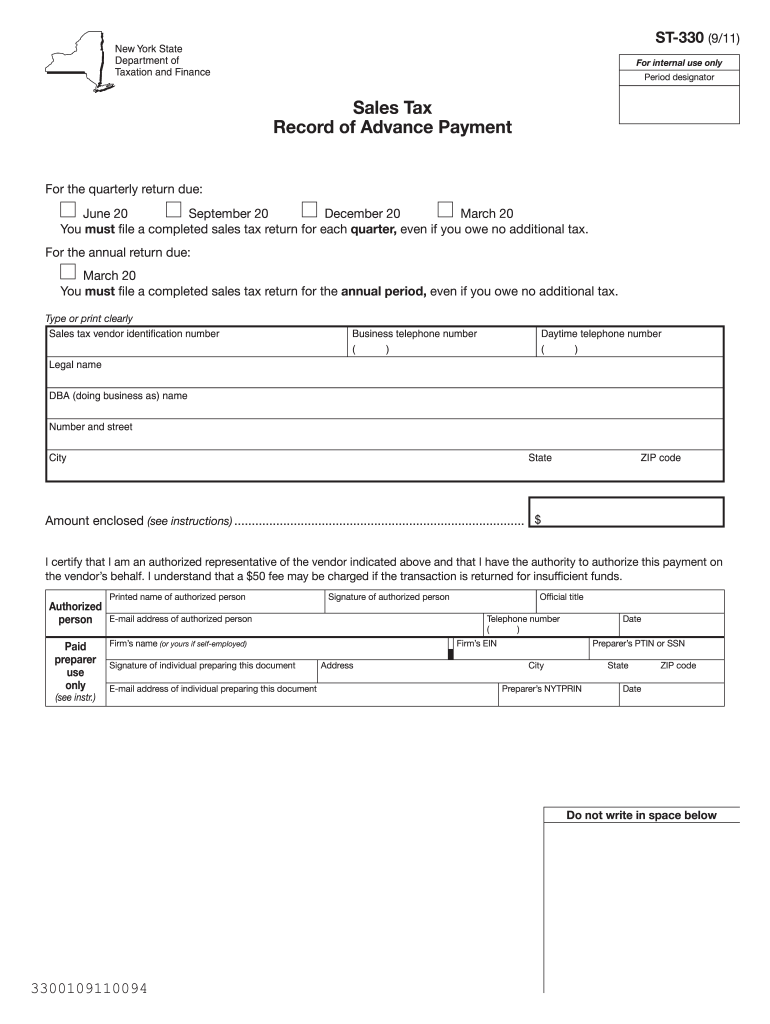

The NYS Sales Tax ST-330 Form is a document used by businesses in New York State to report and remit sales tax. This form is essential for ensuring compliance with state tax regulations. It is specifically designed for businesses that collect sales tax from customers on taxable sales. The form captures critical information regarding total sales, taxable sales, and the amount of sales tax collected during a specified period. Accurate completion of this form is vital for businesses to avoid penalties and ensure proper tax reporting.

Steps to Complete the NYS Sales Tax ST-330 Form

Completing the NYS Sales Tax ST-330 Form involves several key steps to ensure accuracy and compliance. Here’s a straightforward guide:

- Gather necessary information: Collect sales records, including total sales and taxable sales figures.

- Fill in business details: Enter your business name, address, and sales tax identification number at the top of the form.

- Report sales figures: Input the total sales and the amount of taxable sales in the designated fields.

- Calculate sales tax: Determine the sales tax collected based on the applicable rate and enter it in the appropriate section.

- Review the form: Double-check all entries for accuracy, ensuring that all figures are correct and complete.

- Sign and date: Ensure that an authorized person signs and dates the form before submission.

Legal Use of the NYS Sales Tax ST-330 Form

The NYS Sales Tax ST-330 Form holds legal significance as it is required by the New York State Department of Taxation and Finance. Properly completed forms serve as official records of sales tax collected and remitted by businesses. Filing this form accurately and on time helps businesses maintain compliance with state tax laws, thereby avoiding potential legal issues or penalties associated with non-compliance. It is crucial for businesses to understand the legal implications of this form and ensure that all information reported is truthful and accurate.

Form Submission Methods

Businesses can submit the NYS Sales Tax ST-330 Form through various methods, depending on their preferences and requirements:

- Online Submission: Many businesses opt for electronic filing through the New York State Department of Taxation and Finance website, which allows for quick processing.

- Mail Submission: The completed form can also be printed and mailed to the appropriate tax office. Ensure that it is sent to the correct address as indicated on the form.

- In-Person Submission: Some businesses may choose to deliver the form in person at a local tax office, which can provide immediate confirmation of receipt.

Filing Deadlines / Important Dates

Timely filing of the NYS Sales Tax ST-330 Form is crucial for compliance. The deadlines for filing typically align with the sales tax reporting periods, which can be monthly, quarterly, or annually, depending on the volume of sales. Businesses should be aware of their specific filing frequency and ensure that the form is submitted by the due date to avoid late fees and penalties. It is advisable to check the New York State Department of Taxation and Finance for any updates or changes to filing deadlines.

Penalties for Non-Compliance

Failure to file the NYS Sales Tax ST-330 Form on time or inaccuracies in reporting can lead to significant penalties for businesses. These penalties may include fines, interest on unpaid taxes, and potential legal action. Additionally, non-compliance can adversely affect a business's reputation and relationship with tax authorities. It is essential for businesses to prioritize timely and accurate filing to mitigate these risks and maintain good standing with the state.

Quick guide on how to complete nys sales tax st 330 2011 form

Prepare Nys Sales Tax St 330 Form effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without lag. Manage Nys Sales Tax St 330 Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process instantly.

The easiest way to alter and eSign Nys Sales Tax St 330 Form without effort

- Locate Nys Sales Tax St 330 Form and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Mark essential parts of your documents or obscure confidential information using tools specifically designed by airSlate SignNow.

- Generate your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to deliver your form, whether via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors requiring new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your preferred device. Edit and eSign Nys Sales Tax St 330 Form and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct nys sales tax st 330 2011 form

Create this form in 5 minutes!

How to create an eSignature for the nys sales tax st 330 2011 form

The way to create an eSignature for your PDF document in the online mode

The way to create an eSignature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

The best way to create an eSignature from your mobile device

The best way to generate an electronic signature for a PDF document on iOS devices

The best way to create an eSignature for a PDF file on Android devices

People also ask

-

What is a taxation audit, and why is it important for businesses?

A taxation audit is a thorough examination of a company's financial records to ensure compliance with tax laws. It is crucial for businesses to understand their tax obligations and maintain accountability, as an effective taxation audit can help to identify discrepancies and avoid potential penalties.

-

How can airSlate SignNow support businesses during a taxation audit?

airSlate SignNow provides a secure platform for businesses to manage and eSign essential documents related to taxation audits. By streamlining document flow and ensuring easy access, it simplifies compliance and may reduce the stress and time involved in the audit process.

-

What features does airSlate SignNow offer to assist with documentation for taxation audits?

With features like customizable templates, automated workflow management, and secure cloud storage, airSlate SignNow enables businesses to organize and manage their tax-related documents efficiently. These features are designed to streamline the process and ensure that all necessary documents are readily available during a taxation audit.

-

Is airSlate SignNow compliant with legal standards for taxation audits?

Yes, airSlate SignNow complies with industry standards and legal regulations to ensure your documents are handled securely and appropriately for tax purposes. This compliance helps businesses feel confident that they are ready for a taxation audit at any time.

-

What pricing options does airSlate SignNow offer for managing taxation audit documents?

airSlate SignNow offers flexible pricing plans tailored for businesses of all sizes. These plans provide access to essential features that streamline the document management process, making it a cost-effective solution for businesses preparing for a taxation audit.

-

Can airSlate SignNow integrate with other software for managing taxation audits?

Absolutely! airSlate SignNow integrates easily with various accounting and document management software, facilitating seamless data transfer and collaboration. This integration enhances the auditing process and ensures your business is well-prepared for any taxation audit.

-

What are the benefits of using airSlate SignNow for a taxation audit?

The primary benefits of using airSlate SignNow for a taxation audit include improved efficiency, reduced errors, and enhanced security. By centralizing document management, businesses can signNowly simplify their preparation for a taxation audit and minimize the risk of compliance issues.

Get more for Nys Sales Tax St 330 Form

Find out other Nys Sales Tax St 330 Form

- eSign Hawaii Promotion Announcement Secure

- eSign Alaska Worksheet Strengths and Weaknesses Myself

- How To eSign Rhode Island Overtime Authorization Form

- eSign Florida Payroll Deduction Authorization Safe

- eSign Delaware Termination of Employment Worksheet Safe

- Can I eSign New Jersey Job Description Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter

- eSign Rhode Island Deed of Indemnity Template Secure

- eSign Illinois Car Lease Agreement Template Fast

- eSign Delaware Retainer Agreement Template Later

- eSign Arkansas Attorney Approval Simple

- eSign Maine Car Lease Agreement Template Later

- eSign Oregon Limited Power of Attorney Secure

- How Can I eSign Arizona Assignment of Shares

- How To eSign Hawaii Unlimited Power of Attorney

- How To eSign Louisiana Unlimited Power of Attorney

- eSign Oklahoma Unlimited Power of Attorney Now

- How To eSign Oregon Unlimited Power of Attorney

- eSign Hawaii Retainer for Attorney Easy