CERTIFICATE I Certify that the Full Consideration Paid for the Property Described in This Form

What is the Certificate I Certify That The Full Consideration Paid For The Property Described In This

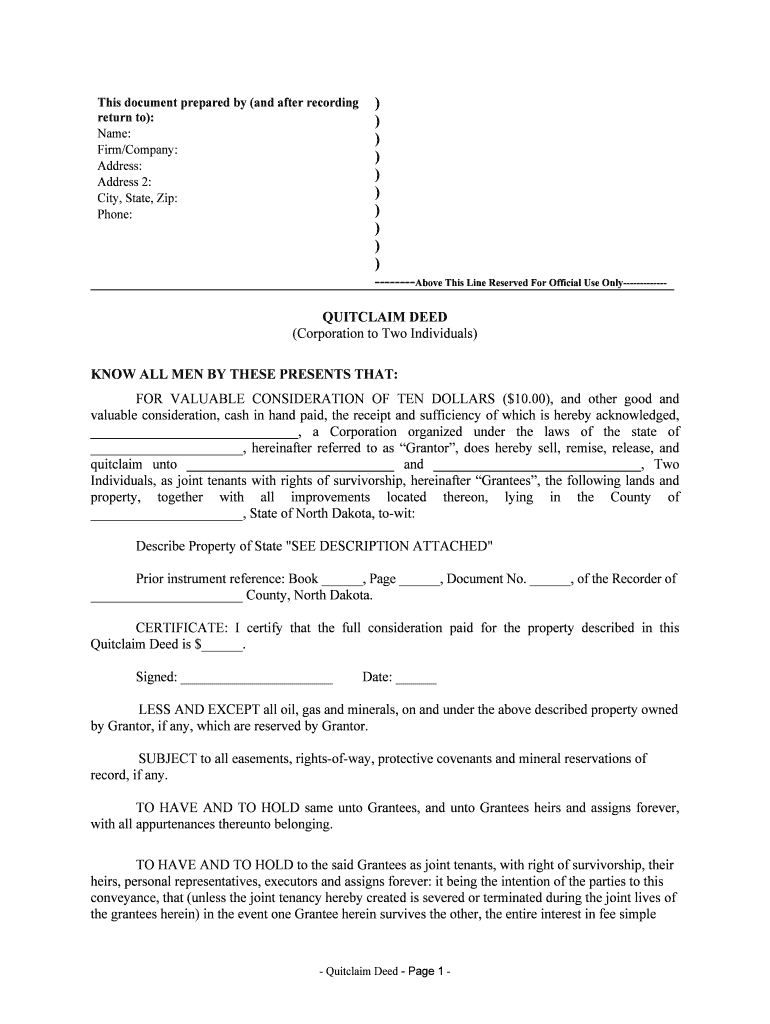

The Certificate I Certify That The Full Consideration Paid For The Property Described In This is a legal document used in real estate transactions. It serves as a declaration by the seller or transferor that the full payment for the property has been received. This certificate is essential for ensuring transparency in property transactions and helps prevent disputes regarding payment. It is often required by state authorities or financial institutions during the closing process of a property sale.

Steps to Complete the Certificate I Certify That The Full Consideration Paid For The Property Described In This

Completing the Certificate I Certify That The Full Consideration Paid For The Property Described In This involves several key steps:

- Gather necessary information about the property, including its legal description and the full consideration amount.

- Fill out the certificate form accurately, ensuring that all required fields are completed.

- Sign the document in the presence of a notary public, if required by state law.

- Submit the completed certificate to the relevant authority, such as the county recorder’s office, as part of the property transaction process.

Legal Use of the Certificate I Certify That The Full Consideration Paid For The Property Described In This

This certificate is legally binding and must comply with state laws governing property transactions. It serves as proof that the seller has received the full payment, which can be crucial in resolving any future disputes about the transaction. The legal validity of the certificate is reinforced when it is executed properly, including notarization where necessary. It is advisable to consult with a legal professional to ensure compliance with all applicable laws.

Key Elements of the Certificate I Certify That The Full Consideration Paid For The Property Described In This

Several critical elements must be included in the certificate for it to be valid:

- The full legal description of the property being sold.

- The total consideration amount paid for the property.

- The names and signatures of the parties involved in the transaction.

- The date of the transaction.

- Notarization, if required by state law.

Examples of Using the Certificate I Certify That The Full Consideration Paid For The Property Described In This

This certificate is commonly used in various real estate scenarios, such as:

- Residential property sales, where the seller needs to confirm receipt of the purchase price.

- Commercial property transactions that require formal documentation of payment.

- Transfers of property between family members, where legal documentation is still necessary for clarity.

State-Specific Rules for the Certificate I Certify That The Full Consideration Paid For The Property Described In This

Each state may have specific requirements regarding the use and format of this certificate. It is essential to check local regulations to ensure compliance. Some states may require additional information or specific wording to be included in the certificate. Consulting with a local real estate attorney or a title company can provide guidance on state-specific rules and help ensure that the certificate meets all legal standards.

Quick guide on how to complete certificate i certify that the full consideration paid for the property described in this

Effortlessly Prepare CERTIFICATE I Certify That The Full Consideration Paid For The Property Described In This on Any Device

Digital document management has gained traction among organizations and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to locate the appropriate template and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without any delays. Handle CERTIFICATE I Certify That The Full Consideration Paid For The Property Described In This seamlessly across any platform with the airSlate SignNow Android or iOS applications and simplify your document operations today.

The Easiest Way to Edit and eSign CERTIFICATE I Certify That The Full Consideration Paid For The Property Described In This

- Locate CERTIFICATE I Certify That The Full Consideration Paid For The Property Described In This and click Get Form to commence.

- Use the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure sensitive information using tools provided specifically for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details, then click on the Done button to save your modifications.

- Choose your preferred method to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious document searches, or errors that necessitate printing new copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you choose. Modify and eSign CERTIFICATE I Certify That The Full Consideration Paid For The Property Described In This, ensuring excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the purpose of the CERTIFICATE I signNow That The Full Consideration Paid For The Property Described In This?

The CERTIFICATE I signNow That The Full Consideration Paid For The Property Described In This serves as a legal acknowledgment that the total payment for a specific property has been completed. This document is crucial for ensuring clear ownership transfer and for maintaining accurate property records.

-

How can airSlate SignNow help in creating a CERTIFICATE I signNow That The Full Consideration Paid For The Property Described In This?

airSlate SignNow allows you to create, customize, and eSign documents, including the CERTIFICATE I signNow That The Full Consideration Paid For The Property Described In This, quickly and efficiently. Our platform simplifies the paperwork process, making it easy to generate this important certificate within minutes.

-

Is there a specific pricing structure for obtaining the CERTIFICATE I signNow That The Full Consideration Paid For The Property Described In This through airSlate SignNow?

Yes, airSlate SignNow offers flexible pricing plans that cater to different business needs. While the cost of specific documents like the CERTIFICATE I signNow That The Full Consideration Paid For The Property Described In This may vary, the overall solution remains cost-effective, providing great value for eSigning and document management.

-

What features are included when using airSlate SignNow for the CERTIFICATE I signNow That The Full Consideration Paid For The Property Described In This?

When using airSlate SignNow for the CERTIFICATE I signNow That The Full Consideration Paid For The Property Described In This, you gain access to features such as customizable templates, secure eSigning, real-time tracking, and integrations with popular applications. These features enhance the overall efficiency of your document workflow.

-

Can I integrate airSlate SignNow with other software for managing the CERTIFICATE I signNow That The Full Consideration Paid For The Property Described In This?

Absolutely! airSlate SignNow offers integrations with various software platforms, allowing you to manage the CERTIFICATE I signNow That The Full Consideration Paid For The Property Described In This alongside your existing tools. This ensures a seamless workflow between document signing and other business processes.

-

What are the benefits of using airSlate SignNow for the CERTIFICATE I signNow That The Full Consideration Paid For The Property Described In This?

Using airSlate SignNow for the CERTIFICATE I signNow That The Full Consideration Paid For The Property Described In This enhances efficiency, reduces processing time, and minimizes paperwork errors. The user-friendly platform ensures that your signing experience is smooth and straightforward.

-

How secure is the process of obtaining a CERTIFICATE I signNow That The Full Consideration Paid For The Property Described In This through airSlate SignNow?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your data. The process of obtaining a CERTIFICATE I signNow That The Full Consideration Paid For The Property Described In This is secure, ensuring that your sensitive information remains confidential.

Get more for CERTIFICATE I Certify That The Full Consideration Paid For The Property Described In This

Find out other CERTIFICATE I Certify That The Full Consideration Paid For The Property Described In This

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe