Nys 45 Form 2019-2026

What is the Nys 45 Form

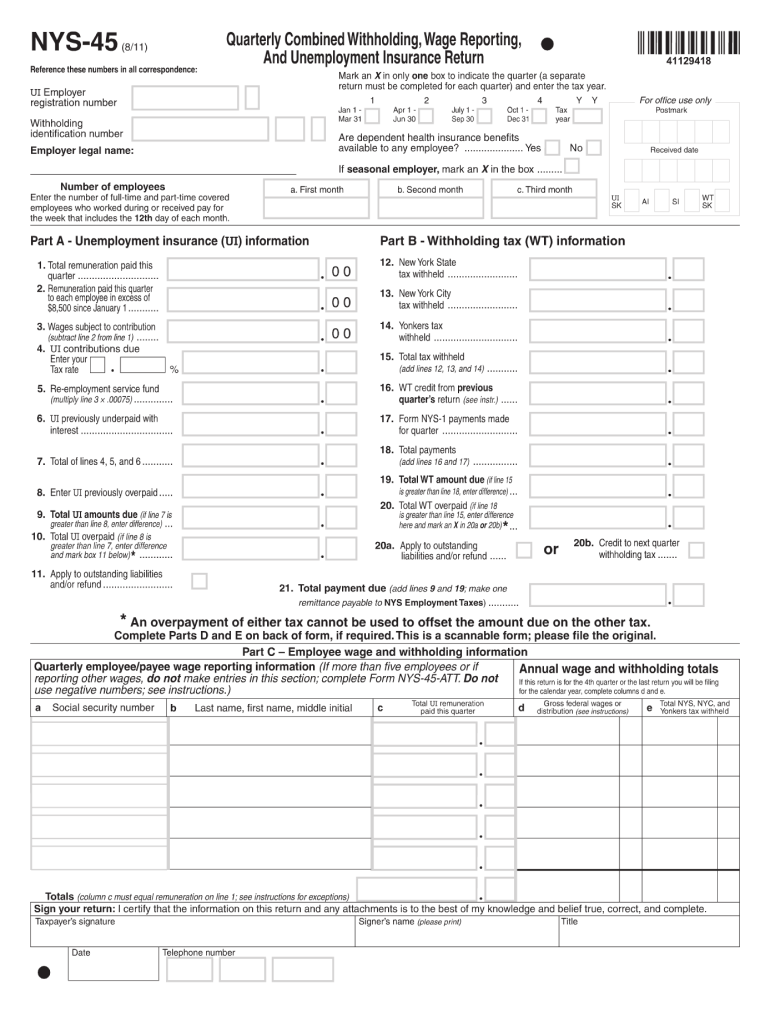

The Nys 45 form, officially known as the 2011 Nys 45, is a crucial document used for reporting employee wages and withholding tax information in New York State. This form is primarily utilized by employers to report quarterly wages paid to employees and the corresponding taxes withheld. It serves as a summary of the payroll information for a specific quarter and is essential for maintaining compliance with state tax regulations.

Steps to Complete the Nys 45 Form

Completing the Nys 45 form involves several key steps to ensure accuracy and compliance. First, gather all necessary payroll information for the reporting period, including total wages paid and taxes withheld. Next, accurately fill out the form, ensuring that all required fields are completed, such as the employer's identification details and employee wage information. After completing the form, review it thoroughly for any errors or omissions. Finally, submit the form by the designated deadline, either electronically or via mail, to ensure timely processing and compliance with state regulations.

How to Obtain the Nys 45 Form

The Nys 45 form can be easily obtained from the official New York State Department of Taxation and Finance website. Employers can download the form in PDF format, allowing for easy printing and completion. Additionally, the form may be available through tax preparation software that supports New York State tax filings. It is important to ensure that you are using the correct version of the form for the applicable tax year.

Legal Use of the Nys 45 Form

The Nys 45 form is legally binding when completed and submitted in accordance with state regulations. It is essential for employers to ensure that the information reported is accurate and reflects the actual wages paid and taxes withheld. Failure to comply with the legal requirements associated with the Nys 45 form can result in penalties and interest charges. Therefore, it is crucial for employers to understand their obligations and ensure proper filing to avoid potential legal issues.

Form Submission Methods (Online / Mail / In-Person)

Employers have multiple options for submitting the Nys 45 form. The form can be filed electronically through the New York State Department of Taxation and Finance's online services, which offers a streamlined and efficient process. Alternatively, employers may choose to mail a completed paper form to the appropriate address as specified in the filing instructions. In-person submissions are typically not required, but employers should verify local regulations if they have specific inquiries regarding submission methods.

Filing Deadlines / Important Dates

Filing deadlines for the Nys 45 form are critical for compliance. Employers must submit the form quarterly, with specific due dates typically falling on the last day of the month following the end of each quarter. For example, the deadline for the first quarter (January to March) is usually April 30. It is essential for employers to mark these dates on their calendars to avoid late filing penalties and ensure timely reporting of payroll information.

Quick guide on how to complete 2011 nys 45 form

Facilitate Nys 45 Form effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the necessary form and securely maintain it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents promptly without delays. Manage Nys 45 Form on any device using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and eSign Nys 45 Form with ease

- Locate Nys 45 Form and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Select your preferred method of sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from a device of your choosing. Edit and eSign Nys 45 Form and ensure outstanding communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2011 nys 45 form

Create this form in 5 minutes!

How to create an eSignature for the 2011 nys 45 form

The way to make an eSignature for a PDF file in the online mode

The way to make an eSignature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

The best way to make an electronic signature right from your smartphone

The way to make an eSignature for a PDF file on iOS devices

The best way to make an electronic signature for a PDF on Android

People also ask

-

What is the 2011 nys 45, and how does it relate to airSlate SignNow?

The 2011 nys 45 is a specific form required by New York State for certain tax purposes. airSlate SignNow allows businesses to easily create, send, and eSign this form digitally, streamlining the submission process and ensuring compliance with state regulations.

-

How can airSlate SignNow help me with the 2011 nys 45 form?

airSlate SignNow provides templates for the 2011 nys 45, making it simple for users to fill out the form accurately. With its intuitive interface, you can complete your forms quickly and ensure they are signed and sent to the appropriate authorities without delay.

-

Is there a cost associated with using airSlate SignNow for the 2011 nys 45?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. These plans provide access to features that simplify the process of managing forms like the 2011 nys 45, making it a cost-effective solution for businesses of all sizes.

-

What features does airSlate SignNow offer for handling the 2011 nys 45?

With airSlate SignNow, users can enjoy features such as document templates, electronic signatures, and secure cloud storage. These capabilities specifically enhance the efficiency of managing the 2011 nys 45 form and ensure that all documents are legally binding and stored securely.

-

Can I integrate airSlate SignNow with other tools for managing the 2011 nys 45?

Absolutely! airSlate SignNow integrates seamlessly with various third-party applications, allowing you to connect your workflow tools. This makes it easier to manage the 2011 nys 45 alongside your other business processes.

-

What are the benefits of using airSlate SignNow for the 2011 nys 45?

Using airSlate SignNow for the 2011 nys 45 offers numerous benefits, including time savings, enhanced accuracy, and better compliance. By streamlining the process of filling out and signing documents, you can focus more on running your business and less on paperwork.

-

How secure is airSlate SignNow when handling the 2011 nys 45?

airSlate SignNow prioritizes security and compliance, employing industry-standard encryption and secure access protocols. This ensures that your 2011 nys 45 forms and other sensitive documents remain protected from unauthorized access.

Get more for Nys 45 Form

Find out other Nys 45 Form

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure

- Sign Louisiana Car Dealer Resignation Letter Mobile

- Help Me With Sign Kansas Car Dealer POA

- How Do I Sign Massachusetts Car Dealer Warranty Deed

- How To Sign Nebraska Car Dealer Resignation Letter

- How Can I Sign New Jersey Car Dealer Arbitration Agreement

- How Can I Sign Ohio Car Dealer Cease And Desist Letter

- How To Sign Ohio Car Dealer Arbitration Agreement