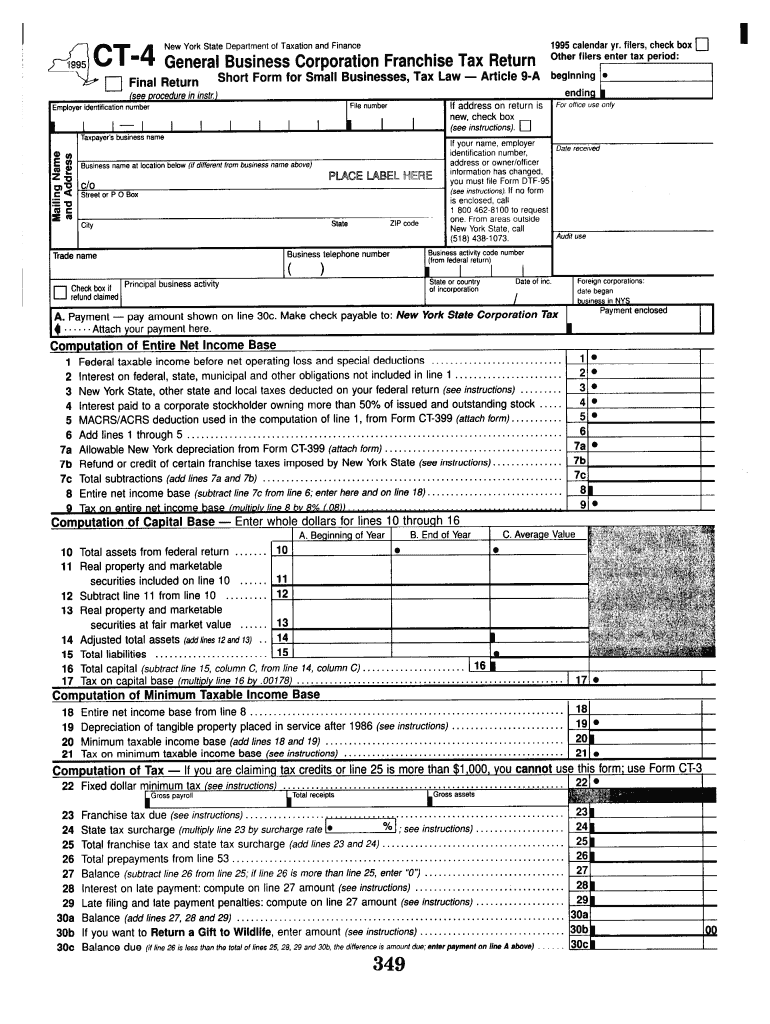

Ct4 Form 2014

What is the Ct4 Form

The Ct4 Form is a specific tax form used in the United States, primarily for reporting certain financial information to the Internal Revenue Service (IRS). This form is essential for individuals and businesses to ensure compliance with federal tax regulations. It serves various purposes, including income reporting and tax deductions, depending on the taxpayer's situation. Understanding the Ct4 Form's requirements is crucial for accurate and timely filing.

How to use the Ct4 Form

Using the Ct4 Form involves several steps to ensure that all necessary information is accurately reported. First, gather all relevant financial documents, including income statements and previous tax returns. Next, carefully fill out the form, ensuring that all sections are completed according to the instructions provided by the IRS. After completing the form, review it for accuracy and completeness before submission. Utilizing electronic tools, such as signNow, can streamline this process, allowing for easy eSigning and secure document management.

Steps to complete the Ct4 Form

Completing the Ct4 Form requires attention to detail and adherence to IRS guidelines. Follow these steps for successful completion:

- Gather necessary documents, such as W-2s, 1099s, and other income records.

- Download the Ct4 Form from the IRS website or access it through a reliable tax software.

- Fill in personal information, including your name, address, and Social Security number.

- Report your income and any applicable deductions or credits.

- Double-check all entries for accuracy and completeness.

- Sign and date the form, ensuring compliance with IRS regulations.

- Submit the form electronically or via mail, depending on your preference and the IRS guidelines.

Legal use of the Ct4 Form

The Ct4 Form must be used in compliance with federal tax laws to ensure its legal validity. This includes accurate reporting of income and adherence to deadlines set by the IRS. Failure to comply with these regulations can result in penalties or audits. Utilizing secure electronic platforms, like signNow, can help maintain the integrity of the form and provide a legally binding signature, ensuring that all submissions meet legal standards.

Filing Deadlines / Important Dates

Filing deadlines for the Ct4 Form are critical for compliance with IRS regulations. Typically, the form must be submitted by April 15 of the following tax year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is essential to stay informed about any changes to these deadlines, as they can vary based on specific circumstances or IRS announcements.

Required Documents

To complete the Ct4 Form accurately, certain documents are necessary. These include:

- W-2 forms from employers, detailing annual earnings.

- 1099 forms for other income sources, such as freelance work.

- Receipts for deductible expenses, if applicable.

- Previous year’s tax return for reference.

Having these documents ready will facilitate a smoother filing process and help ensure that all information reported is accurate.

Quick guide on how to complete 1995 ct4 form

Complete Ct4 Form seamlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly without any delays. Manage Ct4 Form on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to edit and eSign Ct4 Form effortlessly

- Find Ct4 Form and click on Get Form to start.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or obscure sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes only seconds and holds the same legal validity as a traditional ink signature.

- Review all the information and then click on the Done button to save your changes.

- Choose how you wish to share your form, whether by email, text (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs with just a few clicks from any device you prefer. Modify and eSign Ct4 Form and ensure smooth communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 1995 ct4 form

How to generate an eSignature for your PDF online

How to generate an eSignature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

The way to make an eSignature straight from your smartphone

The best way to create an electronic signature for a PDF on iOS

The way to make an eSignature for a PDF document on Android

People also ask

-

What is a Ct4 Form and how is it used?

The Ct4 Form is a key document for businesses to facilitate eSigning and electronic document management. With airSlate SignNow, users can easily create, send, and eSign Ct4 Forms online, ensuring seamless collaboration and compliance. This form is particularly beneficial for organizations looking to streamline their paperwork.

-

How does airSlate SignNow simplify the filling of a Ct4 Form?

airSlate SignNow simplifies the filling of a Ct4 Form by providing an intuitive interface for users to complete necessary fields quickly. With features like templates and pre-filled data, users can easily input information, saving time while reducing errors. This efficiency is vital for businesses dealing with multiple Ct4 Forms.

-

Is airSlate SignNow affordable for small businesses needing to use the Ct4 Form?

Yes, airSlate SignNow offers cost-effective pricing plans suitable for small businesses needing to use the Ct4 Form. With various tiered options, small businesses can select a plan that matches their needs without compromising on essential features. This makes it an ideal choice for budget-conscious enterprises.

-

What features does airSlate SignNow offer for managing the Ct4 Form?

airSlate SignNow provides a robust set of features for managing the Ct4 Form including eSigning, document tracking, and cloud storage. These features enhance efficiency by allowing users to manage their documents in one place and keep track of who has signed or filled out the Ct4 Form. This transparency helps businesses stay organized and compliant.

-

Can I integrate airSlate SignNow with other tools for handling the Ct4 Form?

Absolutely! airSlate SignNow offers integrations with various tools like Dropbox, Google Drive, and CRM systems to enhance the management of the Ct4 Form. This integration capability ensures that your business can connect workflows and streamline processes, making document handling more efficient.

-

What benefits do I gain from using airSlate SignNow for the Ct4 Form?

Using airSlate SignNow for the Ct4 Form provides signNow benefits including enhanced efficiency, faster turnaround times, and reduced paper usage. The platform allows for easy tracking and management, which ensures compliance and boosts overall productivity. This makes it an invaluable tool for modern businesses.

-

Is it secure to send and sign the Ct4 Form with airSlate SignNow?

Yes, airSlate SignNow prioritizes security when sending and signing the Ct4 Form. The platform utilizes advanced encryption protocols to protect sensitive information and ensures that all transactions are secure. This level of security provides peace of mind for businesses and their clients.

Get more for Ct4 Form

- Overtime request form 20992166

- Blank printable to do list form

- Partitioning a line segment worksheet with answers form

- Student enrollment form

- Kta application form

- Preschool teacher application form 429695761

- Hoa bylaw amendment template form

- Cas home health care application for website docx cashomehealth form

Find out other Ct4 Form

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself