Ft 943 Form 2020

What is the Ft 943 Form

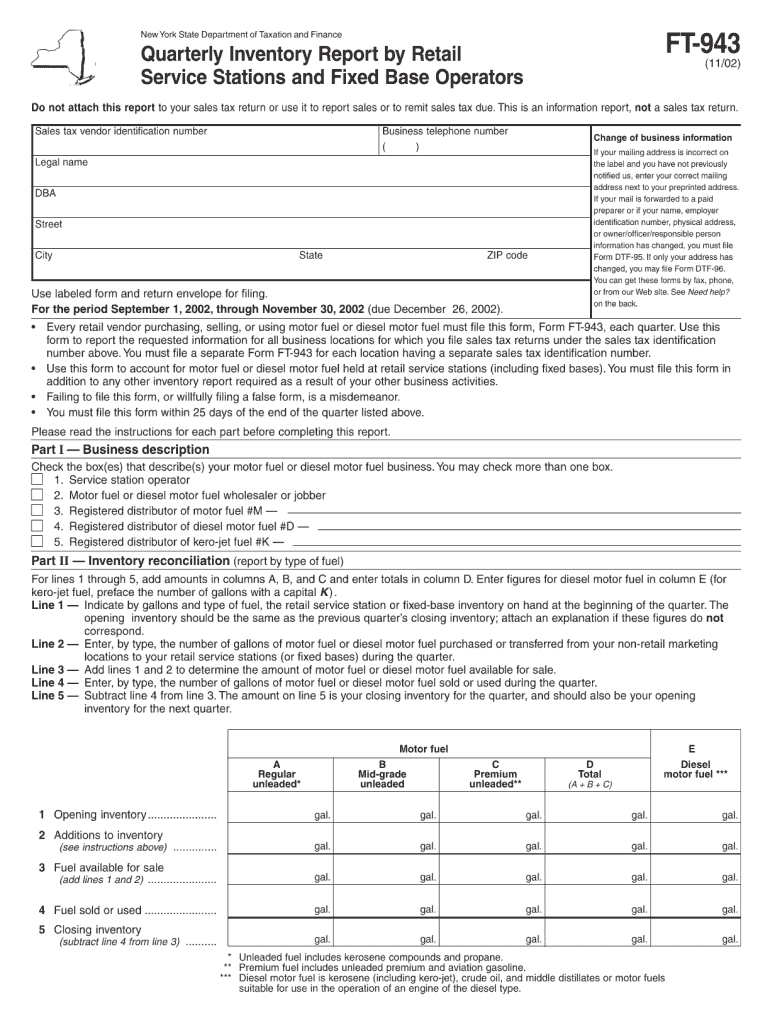

The Ft 943 Form is a specific tax form used in the United States, primarily for reporting certain tax-related information. This form is essential for individuals and businesses to ensure compliance with IRS regulations. It is typically associated with specific tax obligations and helps the IRS track income, deductions, and tax credits claimed by taxpayers. Understanding the purpose and requirements of the Ft 943 Form is crucial for accurate tax reporting and avoiding potential penalties.

How to use the Ft 943 Form

Using the Ft 943 Form involves several key steps to ensure that all required information is accurately reported. First, gather all necessary financial documents, including income statements and previous tax returns. Next, fill out the form with accurate and complete information, ensuring that all fields are addressed. It is important to review the form for any errors before submission. Once completed, the form can be submitted electronically or via mail, depending on the IRS guidelines for that tax year.

Steps to complete the Ft 943 Form

Completing the Ft 943 Form requires careful attention to detail. Follow these steps for a successful submission:

- Gather necessary documents, such as W-2s, 1099s, and any relevant receipts.

- Begin filling out the form, starting with personal identification information.

- Report all income accurately, ensuring that all sources are included.

- Complete the deductions and credits sections, providing necessary documentation.

- Review the entire form for accuracy and completeness.

- Sign and date the form before submission.

Legal use of the Ft 943 Form

The Ft 943 Form is legally binding when completed and submitted according to IRS regulations. It is important to ensure that all information provided is truthful and accurate, as any discrepancies may lead to audits or penalties. The form must be signed by the taxpayer or an authorized representative, affirming that the information is correct to the best of their knowledge. Compliance with all applicable laws and regulations is essential to maintain the legal validity of the form.

Filing Deadlines / Important Dates

Filing deadlines for the Ft 943 Form vary depending on the tax year and the taxpayer's specific circumstances. Generally, the form must be submitted by the tax filing deadline, which is typically April 15 for individual taxpayers. It is advisable to check the IRS website or consult a tax professional for any updates on deadlines or extensions that may apply to your situation. Missing the deadline can result in penalties and interest on unpaid taxes.

Who Issues the Form

The Ft 943 Form is issued by the Internal Revenue Service (IRS), the federal agency responsible for tax collection and enforcement in the United States. The IRS provides guidelines and instructions for completing the form, ensuring that taxpayers have the necessary resources to comply with federal tax laws. It is important to refer to the official IRS documentation when obtaining the Ft 943 Form to ensure it is the most current version.

Quick guide on how to complete ft 943 2002 form

Complete Ft 943 Form effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly substitute to traditional printed and signed documents, as you can easily find the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents swiftly without delays. Manage Ft 943 Form on any platform with airSlate SignNow Android or iOS applications and enhance any document-centric workflow today.

The easiest way to modify and eSign Ft 943 Form without strain

- Obtain Ft 943 Form and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you prefer to share your form, via email, SMS, or invite link, or download it to your computer.

Put an end to lost or misfiled documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Edit and eSign Ft 943 Form and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ft 943 2002 form

Create this form in 5 minutes!

How to create an eSignature for the ft 943 2002 form

How to make an eSignature for a PDF online

How to make an eSignature for a PDF in Google Chrome

The way to create an eSignature for signing PDFs in Gmail

How to create an eSignature straight from your smartphone

The best way to make an eSignature for a PDF on iOS

How to create an eSignature for a PDF document on Android

People also ask

-

What is the Ft 943 Form?

The Ft 943 Form is a tax document used by employers to report income tax withheld from employee earnings. It is crucial for businesses to understand how to complete the Ft 943 Form accurately to avoid penalties. Utilizing airSlate SignNow can streamline this process with easy eSigning capabilities.

-

How can airSlate SignNow assist with the Ft 943 Form?

airSlate SignNow simplifies the process of signing and sending the Ft 943 Form by offering a user-friendly platform for electronic signatures. This efficient solution allows businesses to collect signatures quickly and securely. With airSlate SignNow, you can ensure compliance while saving time.

-

Is there a cost to use airSlate SignNow for the Ft 943 Form?

Yes, airSlate SignNow offers various pricing plans tailored to meet different business needs. You can choose a plan that fits your budget and ensures you can efficiently manage documents like the Ft 943 Form. Check our website for detailed pricing information and features.

-

What features does airSlate SignNow offer for managing the Ft 943 Form?

airSlate SignNow includes features such as customizable templates, bulk sending, and secure eSignatures, making it ideal for handling the Ft 943 Form. These features enhance workflow efficiency and ensure that your documents are processed swiftly. Additionally, tracking tools allow you to monitor the status of your forms.

-

Can I integrate airSlate SignNow with other software for the Ft 943 Form?

Absolutely! airSlate SignNow offers integrations with a variety of applications, including HR and accounting software. This ensures that you can incorporate the eSigning of the Ft 943 Form seamlessly into your existing processes. Check our integration options to find the tools that best meet your needs.

-

How does using airSlate SignNow benefit my business when submitting the Ft 943 Form?

Using airSlate SignNow to submit the Ft 943 Form can signNowly improve efficiency and reduce paper usage. The platform ensures that your eSigned documents are stored securely and accessible anytime. This not only saves time but also minimizes the chances of errors typically associated with manual submissions.

-

Is airSlate SignNow compliant with regulations regarding the Ft 943 Form?

Yes, airSlate SignNow is designed to be compliant with electronic signature laws and regulations governing forms like the Ft 943 Form. Our platform adheres to industry standards to ensure that your documents are legally binding. You can focus on your business while we take care of compliance.

Get more for Ft 943 Form

- Second parent adoption florida forms

- Trailer inspection sheet pdf form

- Ofs 4av ofs 18c form

- Notice of termination of notice of commencement pdf form

- Dg checklist pdf form

- Faa pilots bill of rights pdf 8610 2 form

- Submittal template fill out and sign printable pdf form

- Non prisoner complaint for violation of civil rights form

Find out other Ft 943 Form

- eSignature Hawaii Sports Living Will Safe

- eSignature Hawaii Sports LLC Operating Agreement Myself

- eSignature Maryland Real Estate Quitclaim Deed Secure

- eSignature Idaho Sports Rental Application Secure

- Help Me With eSignature Massachusetts Real Estate Quitclaim Deed

- eSignature Police Document Florida Easy

- eSignature Police Document Florida Safe

- How Can I eSignature Delaware Police Living Will

- eSignature Michigan Real Estate LLC Operating Agreement Mobile

- eSignature Georgia Police Last Will And Testament Simple

- How To eSignature Hawaii Police RFP

- Can I eSignature Minnesota Real Estate Warranty Deed

- How Do I eSignature Indiana Police Lease Agreement Form

- eSignature Police PPT Kansas Free

- How Can I eSignature Mississippi Real Estate Rental Lease Agreement

- How Do I eSignature Kentucky Police LLC Operating Agreement

- eSignature Kentucky Police Lease Termination Letter Now

- eSignature Montana Real Estate Quitclaim Deed Mobile

- eSignature Montana Real Estate Quitclaim Deed Fast

- eSignature Montana Real Estate Cease And Desist Letter Easy