Nyc Doe Tax Exempt Form 2011

What is the NYC DOE Tax Exempt Form

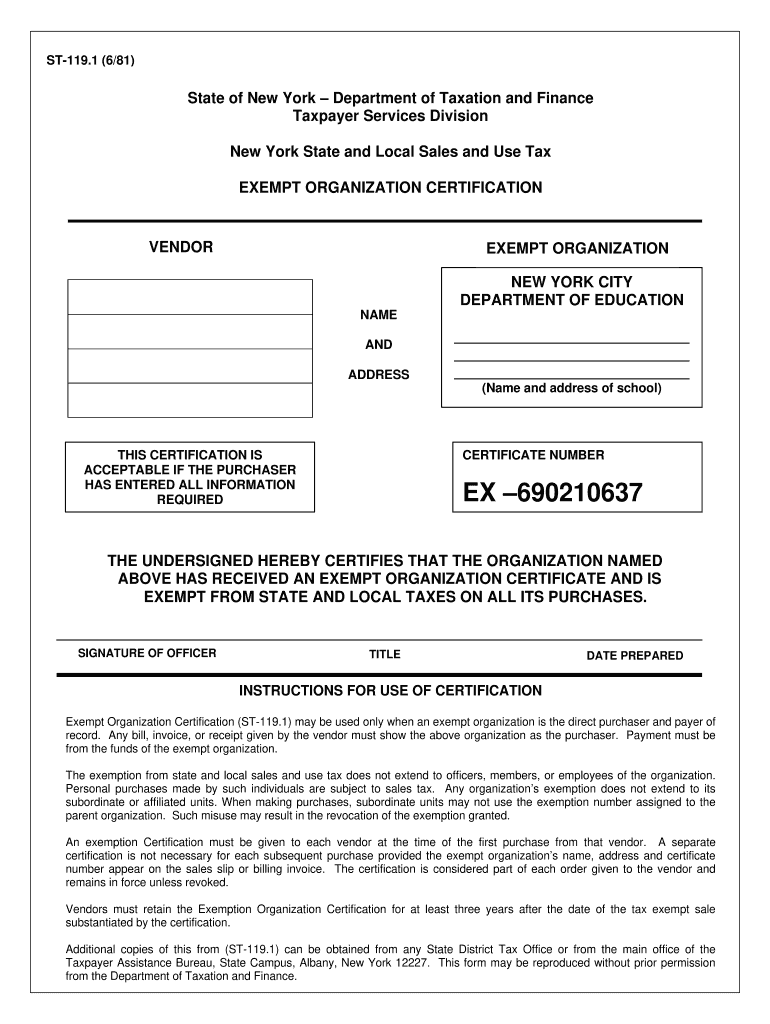

The NYC DOE tax exempt form is a crucial document that allows eligible organizations to claim exemption from certain taxes within New York City. This form is primarily utilized by educational institutions, non-profit organizations, and other entities that meet specific criteria set by the New York City Department of Education (DOE). By completing this form, organizations can avoid paying sales tax on qualifying purchases, which can result in significant savings over time. Understanding the purpose and function of this form is essential for any organization seeking to maximize its financial resources.

How to Obtain the NYC DOE Tax Exempt Form

Organizations looking to obtain the NYC DOE tax exempt form can typically find it on the official New York City Department of Education website or through direct request to the DOE. The form may also be available at various educational institutions and non-profit organizations that frequently deal with tax-exempt transactions. It is important to ensure that you are accessing the most current version of the form to avoid any compliance issues.

Steps to Complete the NYC DOE Tax Exempt Form

Completing the NYC DOE tax exempt form involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including the organization’s legal name, address, and tax identification number. Next, fill out the form with precise details, ensuring that all required fields are completed. After filling out the form, review it thoroughly for any errors or omissions. Finally, submit the form according to the specified guidelines, which may include online submission, mailing, or in-person delivery to the appropriate DOE office.

Legal Use of the NYC DOE Tax Exempt Form

The legal use of the NYC DOE tax exempt form is governed by specific regulations that outline eligibility criteria and acceptable uses. Organizations must ensure they meet the qualifications for tax exemption, which typically include being a non-profit or educational entity. Misuse of the form, such as submitting it for ineligible purchases, can result in penalties and loss of tax-exempt status. Therefore, it is vital to understand the legal implications and requirements associated with this form to maintain compliance.

Key Elements of the NYC DOE Tax Exempt Form

Several key elements must be included in the NYC DOE tax exempt form for it to be valid. These elements typically include the organization’s name, address, tax identification number, and a detailed description of the intended use of the tax exemption. Additionally, the form may require the signature of an authorized representative, along with any supporting documentation that verifies the organization’s tax-exempt status. Ensuring that all key elements are accurately completed is essential for the acceptance of the form.

Eligibility Criteria for the NYC DOE Tax Exempt Form

To qualify for the NYC DOE tax exempt form, organizations must meet specific eligibility criteria established by the New York City Department of Education. Generally, this includes being a recognized non-profit organization, educational institution, or government entity. Organizations may also need to provide proof of their tax-exempt status, such as a determination letter from the IRS. Understanding these criteria is crucial for any organization seeking to apply for tax exemption to avoid unnecessary complications.

Quick guide on how to complete nyc doe tax exempt form

Prepare Nyc Doe Tax Exempt Form effortlessly on any device

Online document management has become increasingly popular among businesses and individuals alike. It offers a perfect eco-friendly substitute to conventional printed and signed documents, allowing you to find the correct form and securely save it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents quickly without delays. Manage Nyc Doe Tax Exempt Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign Nyc Doe Tax Exempt Form without hassle

- Obtain Nyc Doe Tax Exempt Form and click on Get Form to begin.

- Use the tools available to fill in your document.

- Emphasize important sections of the documents or obscure sensitive details with features that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your alterations.

- Select how you wish to send your form, via email, SMS, or a sharing link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or errors that necessitate printing new copies of documents. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign Nyc Doe Tax Exempt Form and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct nyc doe tax exempt form

Create this form in 5 minutes!

How to create an eSignature for the nyc doe tax exempt form

The best way to create an electronic signature for a PDF in the online mode

The best way to create an electronic signature for a PDF in Chrome

How to create an eSignature for putting it on PDFs in Gmail

How to generate an eSignature right from your smart phone

The way to create an eSignature for a PDF on iOS devices

How to generate an eSignature for a PDF on Android OS

People also ask

-

What is the NYC DOE tax exempt form and who needs it?

The NYC DOE tax exempt form is a document that allows qualifying entities to exempt certain purchases from sales tax. It is primarily used by educational institutions, non-profits, and other tax-exempt organizations in New York City. If you are part of a qualifying organization, this form will help you save money on eligible purchases.

-

How can I obtain the NYC DOE tax exempt form?

You can obtain the NYC DOE tax exempt form directly from the NYC Department of Education's website or through your organization's financial office. Once you have the form, you can fill it out and use it for tax-exempt purchases. It's important to ensure you meet all the eligibility criteria before applying.

-

What features does airSlate SignNow offer for handling the NYC DOE tax exempt form?

airSlate SignNow provides features like secure eSigning, document storage, and templates specifically for the NYC DOE tax exempt form. Our platform allows users to easily manage and track the entire signing process, which streamlines the administrative workflow for tax-exempt documentation. Additionally, you can collaborate in real-time with team members.

-

Is there a cost associated with using airSlate SignNow for the NYC DOE tax exempt form?

Yes, while airSlate SignNow offers various pricing plans, using the platform for the NYC DOE tax exempt form can be very cost-effective compared to traditional signing methods. Our pricing is transparent, with no hidden fees, and you can choose a plan that suits your organization's needs. Many users find that the savings from tax exemptions offset the costs.

-

Can I integrate airSlate SignNow with other applications for managing the NYC DOE tax exempt form?

Absolutely! airSlate SignNow seamlessly integrates with various applications such as Google Drive, Dropbox, and Microsoft Office. This means you can easily manage, share, and store your NYC DOE tax exempt form alongside your other essential documents, enhancing workflow efficiency across platforms.

-

What are the benefits of using airSlate SignNow for the NYC DOE tax exempt form?

Using airSlate SignNow for the NYC DOE tax exempt form provides numerous benefits, including improved efficiency and reduced processing time. Our platform ensures that documents are securely signed, stored, and easily accessible, which aligns with the fast-paced nature of educational institutions. Additionally, the user-friendly interface makes it easy for users of all technical levels to navigate.

-

How secure is my information when using airSlate SignNow for the NYC DOE tax exempt form?

airSlate SignNow prioritizes security, employing advanced encryption methods to protect your information related to the NYC DOE tax exempt form. Our platform is compliant with industry standards, ensuring that your documents and personal data remain confidential and secure throughout the signing process. You can trust that your sensitive information is in safe hands.

Get more for Nyc Doe Tax Exempt Form

- Form 482 65830700

- Credit investigation form 26496274

- Daycare payment agreement form

- Medication administration record form

- 30 day eviction notice california pdf form

- Risk assessment for trips and outings template form

- Chestnut health systems gain short screener gain ss asap vt form

- Unemployment insurance appeals handbook form

Find out other Nyc Doe Tax Exempt Form

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF