Forida Form Rts 2

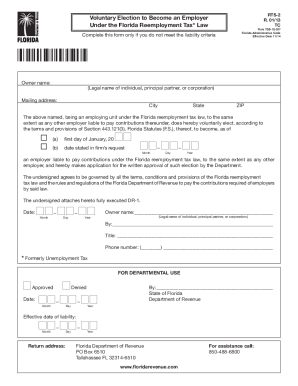

What is the Florida Form RTS 2?

The Florida Form RTS 2 is a tax form used for reporting voluntary employer taxes in the state of Florida. This form is essential for employers who wish to comply with state tax regulations while managing their tax obligations effectively. The RTS 2 form is specifically designed to facilitate the reporting of certain taxes that employers are responsible for, ensuring that they meet their legal requirements.

Steps to Complete the Florida Form RTS 2

Completing the Florida Form RTS 2 involves several key steps to ensure accuracy and compliance. Here is a simplified process:

- Gather necessary information, including employer identification details and tax-related data.

- Access the form through a reliable source or download it from an official site.

- Fill out the required fields, ensuring that all information is accurate and complete.

- Review the form for any errors or omissions before submission.

- Submit the completed form via the chosen method, whether online, by mail, or in person.

Legal Use of the Florida Form RTS 2

The Florida Form RTS 2 is legally binding when completed and submitted according to state regulations. Employers must ensure that they adhere to the relevant tax laws and guidelines to avoid potential penalties. The form must be signed by an authorized representative of the business, confirming the accuracy of the information provided. Compliance with the legal requirements surrounding the RTS 2 form is crucial for maintaining good standing with state tax authorities.

Required Documents for the Florida Form RTS 2

When preparing to complete the Florida Form RTS 2, certain documents are typically required. These may include:

- Employer Identification Number (EIN)

- Previous tax returns or records related to employer taxes

- Payroll records that detail employee earnings and tax withholdings

- Any correspondence from the Florida Department of Revenue regarding tax obligations

Form Submission Methods

The Florida Form RTS 2 can be submitted through various methods, providing flexibility for employers. The available submission methods include:

- Online submission through the Florida Department of Revenue’s website

- Mailing the completed form to the appropriate tax office

- In-person delivery at designated tax offices

Filing Deadlines for the Florida Form RTS 2

Filing deadlines for the Florida Form RTS 2 are critical to ensure compliance with state tax regulations. Employers should be aware of the following important dates:

- The due date for submitting the RTS 2 form typically aligns with the employer's tax reporting schedule.

- Employers should check for specific deadlines that may vary based on their tax filing frequency (monthly, quarterly, or annually).

Quick guide on how to complete forida form rts 2

Manage Forida Form Rts 2 easily on any device

Digital document management has gained signNow traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents quickly and efficiently. Handle Forida Form Rts 2 on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and electronically sign Forida Form Rts 2 effortlessly

- Locate Forida Form Rts 2 and click Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically designed by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, time-consuming form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Alter and electronically sign Forida Form Rts 2 to ensure effective communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the forida form rts 2

The way to generate an eSignature for a PDF document in the online mode

The way to generate an eSignature for a PDF document in Chrome

How to generate an eSignature for putting it on PDFs in Gmail

The way to generate an eSignature from your mobile device

The way to create an eSignature for a PDF document on iOS devices

The way to generate an eSignature for a PDF file on Android devices

People also ask

-

What is rts2 in airSlate SignNow and how can it benefit my business?

The rts2 feature in airSlate SignNow allows businesses to streamline their document signing process. By utilizing rts2, you can enhance efficiency, reduce errors, and save time in managing contracts and agreements. This powerful tool is designed to make electronic signing seamless and secure.

-

How much does airSlate SignNow with rts2 cost?

Pricing for airSlate SignNow with rts2 is competitive and tailored to meet diverse business needs. It offers flexible plans starting from affordable monthly subscriptions, ensuring that businesses of any size can benefit from this powerful tool. Contact our sales team for detailed pricing that matches your requirements.

-

What features are included in the rts2 functionality of airSlate SignNow?

The rts2 functionality includes a variety of features such as customizable templates, automated workflows, and real-time tracking of document status. With rts2, you can easily manage your document signing processes and improve overall productivity within your organization. Expect an intuitive user interface that makes signing documents a breeze.

-

How does airSlate SignNow with rts2 integrate with other software?

airSlate SignNow with rts2 offers seamless integration with major CRM, ERP, and productivity tools like Salesforce, HubSpot, and Google Workspace. This means you can enhance your workflow by connecting your existing applications with minimal effort. Integration with rts2 ensures that your document signing process fits smoothly into your daily operations.

-

Is airSlate SignNow with rts2 compliant with legal standards?

Yes, airSlate SignNow with rts2 complies with international eSignature laws such as ESIGN and UETA in the USA. This ensures that your electronically signed documents are legally binding and secure. Using rts2 helps businesses meet regulatory requirements and provides peace of mind for document transactions.

-

What types of documents can I sign using rts2 in airSlate SignNow?

With rts2 in airSlate SignNow, you can sign a variety of document types, including contracts, agreements, and consent forms. The platform supports multiple file formats, allowing for flexibility in your document management. Utilizing rts2 simplifies the signing of essential business documents without the hassle of printing and scanning.

-

Can I customize my document templates using the rts2 feature?

Absolutely! airSlate SignNow's rts2 feature allows you to create and customize document templates tailored to your business needs. This not only saves time but also ensures consistency across all your documents. Custom templates enable a more professional approach to document management.

Get more for Forida Form Rts 2

Find out other Forida Form Rts 2

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online

- How To Sign Rhode Island Real Estate LLC Operating Agreement

- How Do I Sign Arizona Police Resignation Letter

- Sign Texas Orthodontists Business Plan Template Later

- How Do I Sign Tennessee Real Estate Warranty Deed

- Sign Tennessee Real Estate Last Will And Testament Free

- Sign Colorado Police Memorandum Of Understanding Online

- How To Sign Connecticut Police Arbitration Agreement

- Sign Utah Real Estate Quitclaim Deed Safe

- Sign Utah Real Estate Notice To Quit Now

- Sign Hawaii Police LLC Operating Agreement Online

- How Do I Sign Hawaii Police LLC Operating Agreement

- Sign Hawaii Police Purchase Order Template Computer

- Sign West Virginia Real Estate Living Will Online

- How Can I Sign West Virginia Real Estate Confidentiality Agreement