Dr 430 Form

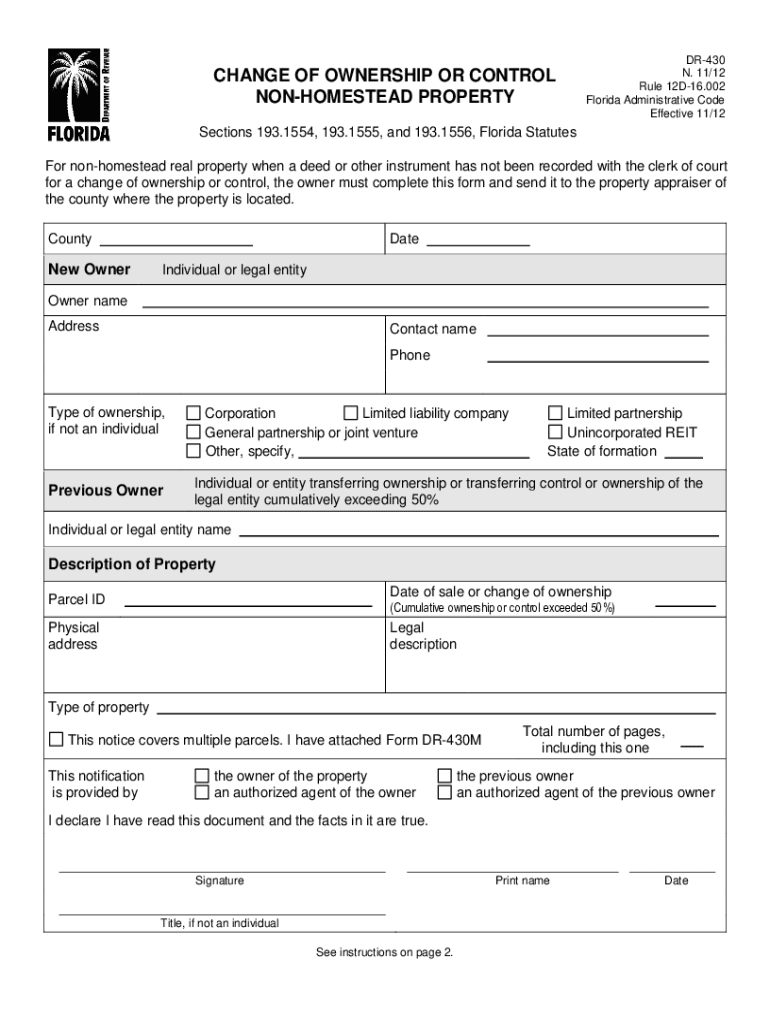

What is the DR-430?

The DR-430 is a form used in Florida to declare non-homestead property status. This designation is crucial for property owners who wish to apply for specific tax exemptions or changes in property classification. By filing the DR-430, property owners can ensure that their non-homestead property is accurately reflected in the state's tax records, which can affect property tax rates and eligibility for certain benefits.

How to Use the DR-430

Using the DR-430 involves several straightforward steps. First, property owners need to gather relevant information about their property, including its current classification and any changes they wish to make. Next, the form must be filled out accurately, providing details such as the property's address, owner information, and the reason for the non-homestead designation. Once completed, the form can be submitted to the local property appraiser's office for processing.

Steps to Complete the DR-430

Completing the DR-430 requires careful attention to detail. Follow these steps:

- Obtain the DR-430 form from the local property appraiser's office or the official Florida Department of Revenue website.

- Fill in the property owner's name and address, ensuring all information is accurate.

- Indicate the property's current classification and specify the desired non-homestead status.

- Provide any additional information required, such as documentation supporting the request.

- Review the form for completeness and accuracy before submission.

Legal Use of the DR-430

The legal use of the DR-430 is governed by Florida state law, which outlines the requirements for property classification and tax exemptions. Submitting this form correctly ensures compliance with state regulations and helps avoid penalties. It is essential for property owners to understand their rights and responsibilities regarding non-homestead properties, as failure to comply may result in incorrect tax assessments or loss of eligibility for exemptions.

Required Documents

When filing the DR-430, certain documents may be required to support the application. These may include:

- Proof of ownership, such as a deed or title.

- Documentation that verifies the property's current use and classification.

- Any previous tax exemption applications related to the property.

Having these documents ready can streamline the process and ensure a successful application.

Form Submission Methods

The DR-430 can typically be submitted through various methods, including:

- Online submission via the local property appraiser's website, if available.

- Mailing the completed form to the appropriate county office.

- In-person delivery to the local property appraiser's office.

Choosing the right submission method can depend on personal preference and the urgency of the request.

Quick guide on how to complete dr 430

Complete Dr 430 seamlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute to conventional printed and signed documentation, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides you with all the resources needed to create, modify, and eSign your documents quickly without delays. Manage Dr 430 on any platform with airSlate SignNow’s Android or iOS apps and simplify any document-related task today.

How to update and eSign Dr 430 effortlessly

- Obtain Dr 430 and click Get Form to initiate.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes moments and holds the same legal validity as a traditional handwritten signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device of your choice. Modify and eSign Dr 430 and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the dr 430

The way to generate an eSignature for your PDF online

The way to generate an eSignature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

The way to generate an eSignature straight from your smartphone

The way to create an electronic signature for a PDF on iOS

The way to generate an eSignature for a PDF document on Android

People also ask

-

What is a non homestead property?

A non homestead property refers to any real estate that is not classified as a primary residence. Unlike homestead properties, non homestead properties may not benefit from tax exemptions. Understanding this classification is crucial, especially when using airSlate SignNow for signing documents related to property transactions.

-

How can airSlate SignNow help with non homestead property transactions?

airSlate SignNow enables businesses to manage non homestead property transactions efficiently by allowing users to send and eSign necessary documents quickly. This electronic signature solution streamlines the close of deals, reducing paperwork and enhancing productivity. With its user-friendly interface, navigating through non homestead property agreements becomes hassle-free.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans that cater to different business needs, including options for those dealing with non homestead transactions. You can choose from various tiers based on features and number of users. Each plan is designed to provide a cost-effective solution for signing documents digitally.

-

Are there specific features for managing non homestead documents?

Yes! airSlate SignNow includes features specifically designed for efficient document management of non homestead properties. Users can create templates, set signing orders, and track document status in real-time, which makes handling non homestead documents straightforward and organized.

-

What are the benefits of using airSlate SignNow for non homestead agreements?

Using airSlate SignNow for non homestead agreements offers numerous benefits, including faster transaction times and reduced paperwork. The electronic signature capability ensures that all parties can sign documents securely from anywhere. Additionally, it provides a comprehensive audit trail for each document, adding an extra layer of security.

-

Does airSlate SignNow integrate with other software for managing non homestead properties?

Absolutely! airSlate SignNow integrates seamlessly with various CRM and property management software, making it easier to manage non homestead properties. This integration allows for a smoother workflow, ensuring that all necessary documents related to non homestead transactions are accessible and easily signed.

-

Is airSlate SignNow secure for signing non homestead documents?

Yes, airSlate SignNow prioritizes security, ensuring that all non homestead documents signed through the platform are safeguarded. The platform employs encryption and complies with industry standards to protect sensitive information. You can trust that your non homestead transactions will remain confidential and secure.

Get more for Dr 430

Find out other Dr 430

- How Do I Sign Oregon Financial Affidavit

- Sign Maine Revocation of Power of Attorney Online

- Sign Louisiana Mechanic's Lien Online

- How To Sign New Mexico Revocation of Power of Attorney

- How Can I Sign Ohio Revocation of Power of Attorney

- Sign Michigan Mechanic's Lien Easy

- How To Sign Texas Revocation of Power of Attorney

- Sign Virginia Revocation of Power of Attorney Easy

- Can I Sign North Carolina Mechanic's Lien

- Sign Maine Payment Guaranty Myself

- Help Me With Sign Oklahoma Mechanic's Lien

- Sign Oregon Mechanic's Lien Simple

- How To Sign Utah Mechanic's Lien

- How To Sign Washington Mechanic's Lien

- Help Me With Sign Washington Mechanic's Lien

- Sign Arizona Notice of Rescission Safe

- Sign Hawaii Notice of Rescission Later

- Sign Missouri Demand Note Online

- How To Sign New York Notice to Stop Credit Charge

- How Do I Sign North Dakota Notice to Stop Credit Charge