W 9 Idaho 2020

What is the W-9 Idaho

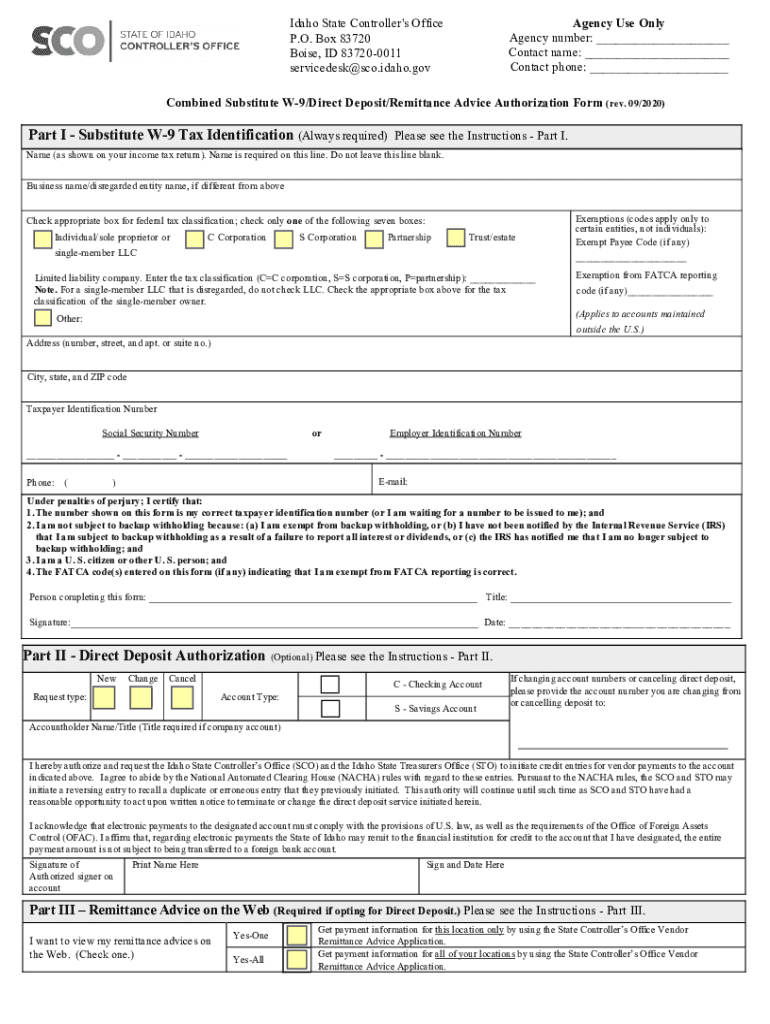

The W-9 Idaho form is a tax document used by individuals and businesses in the state of Idaho to provide their taxpayer identification information to entities that will report income paid to them. This form is essential for freelancers, contractors, and other self-employed individuals who need to report their income accurately to the Internal Revenue Service (IRS). By completing the W-9 Idaho, the requester can ensure that they have the correct information for tax reporting purposes, including the name, address, and taxpayer identification number (TIN) of the payee.

Steps to complete the W-9 Idaho

Completing the W-9 Idaho form involves a few straightforward steps:

- Download the form: Obtain the W-9 Idaho form from a reliable source or the IRS website.

- Fill in your information: Provide your name, business name (if applicable), and address. Include your TIN, which can be your Social Security number or Employer Identification Number.

- Select your tax classification: Indicate whether you are an individual, corporation, partnership, or another entity type.

- Sign and date the form: Your signature certifies that the information provided is accurate and complete.

- Submit the form: Send the completed W-9 Idaho to the requester, not to the IRS.

Legal use of the W-9 Idaho

The W-9 Idaho form is legally binding when filled out correctly. It serves as a declaration of your taxpayer information and is used by businesses to report payments to the IRS. The form must be completed accurately to avoid potential penalties for incorrect reporting. Additionally, eSigning the W-9 Idaho ensures that the signature is legally recognized, provided that the eSignature complies with federal regulations such as the ESIGN Act and UETA. Using a trusted electronic signature platform can help maintain the integrity and security of the document.

Key elements of the W-9 Idaho

Several key elements make up the W-9 Idaho form:

- Name: The full legal name of the individual or business.

- Business name: If applicable, the name under which the business operates.

- Address: The physical address where the taxpayer can be reached.

- Taxpayer Identification Number (TIN): This can be a Social Security number or Employer Identification Number.

- Tax classification: Indication of whether the entity is an individual, corporation, partnership, etc.

- Signature and date: The individual must sign and date the form to certify its accuracy.

Examples of using the W-9 Idaho

The W-9 Idaho form is commonly used in various scenarios, such as:

- A freelancer providing services to a business that needs to report payments made to the freelancer.

- A contractor working on a project who must submit their taxpayer information to the hiring company.

- A landlord requiring tenant information for reporting rental income.

In each case, the W-9 Idaho ensures that the entity requesting the information has the correct details for tax reporting, helping to maintain compliance with IRS regulations.

Form Submission Methods (Online / Mail / In-Person)

The W-9 Idaho form can be submitted in several ways, depending on the requester's preferences:

- Email: The completed form can be scanned and emailed directly to the requester.

- Mail: A physical copy of the form can be printed and mailed to the entity requesting it.

- In-person: The form can be handed over directly if the requester is local.

It is important to keep a copy of the submitted form for your records, regardless of the submission method chosen.

Quick guide on how to complete w 9 idaho

Effortlessly Prepare W 9 Idaho on Any Device

Online document management has gained signNow traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to easily locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly and without delays. Manage W 9 Idaho on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

How to Edit and eSign W 9 Idaho with Ease

- Locate W 9 Idaho and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of the documents or redact sensitive information with the tools that airSlate SignNow provides specifically for that function.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, and errors that require printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you choose. Edit and eSign W 9 Idaho to ensure excellent communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct w 9 idaho

Create this form in 5 minutes!

How to create an eSignature for the w 9 idaho

The way to generate an eSignature for your PDF document in the online mode

The way to generate an eSignature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

The way to generate an electronic signature right from your mobile device

The way to create an electronic signature for a PDF document on iOS devices

The way to generate an electronic signature for a PDF on Android devices

People also ask

-

What is an Idaho W9 form and why is it important for businesses?

The Idaho W9 form is used by businesses to collect taxpayer information from independent contractors and freelancers in Idaho. It’s crucial for ensuring accurate tax reporting and compliance. By having a completed Idaho W9, businesses can properly report the payments made to individuals during the tax year, helping avoid potential fines from the IRS.

-

How does airSlate SignNow facilitate the completion of the Idaho W9 form?

airSlate SignNow allows users to easily fill out and eSign the Idaho W9 form online. With its user-friendly interface, businesses can streamline the completion process, ensuring that all necessary information is captured accurately. This saves time and reduces errors, making it easier to collect vital information from contractors.

-

What are the pricing plans for using airSlate SignNow for Idaho W9 forms?

airSlate SignNow offers various pricing plans that cater to different business needs, including options for individuals and teams. Each plan provides access to essential features necessary for handling Idaho W9 forms efficiently. Visit our pricing page for detailed information about our affordable plans and to find the one that best fits your requirements.

-

Can I integrate airSlate SignNow with other applications to manage Idaho W9 forms?

Yes, airSlate SignNow can integrate with a variety of applications, allowing seamless management of Idaho W9 forms. This integration enhances workflow by connecting with popular tools such as Google Drive, Dropbox, and more. These integrations help streamline document management and improve overall efficiency.

-

What features does airSlate SignNow offer to enhance the eSigning of Idaho W9 forms?

airSlate SignNow provides robust eSigning features that ensure the security and legality of your Idaho W9 forms. With advanced encryption and compliance with electronic signature laws, your documents are safe and valid. Additionally, users can track the signing process in real time, making it easy to manage important paperwork.

-

How can airSlate SignNow improve the efficiency of collecting Idaho W9 forms from contractors?

Using airSlate SignNow simplifies the process of collecting Idaho W9 forms, allowing businesses to send documents directly to contractors via email. Additionally, reminders can be automated to ensure timely responses. This signNowly reduces the time spent chasing down missing information and enhances overall operational efficiency.

-

Is there customer support available if I have questions about my Idaho W9 forms?

Absolutely! airSlate SignNow offers dedicated customer support to assist you with any questions related to your Idaho W9 forms. Whether you need help navigating the platform or have inquiries about specific features, our support team is readily available to provide the assistance you need.

Get more for W 9 Idaho

Find out other W 9 Idaho

- Electronic signature Delaware Joint Venture Agreement Template Free

- Electronic signature Hawaii Joint Venture Agreement Template Simple

- Electronic signature Idaho Web Hosting Agreement Easy

- Electronic signature Illinois Web Hosting Agreement Secure

- Electronic signature Texas Joint Venture Agreement Template Easy

- How To Electronic signature Maryland Web Hosting Agreement

- Can I Electronic signature Maryland Web Hosting Agreement

- Electronic signature Michigan Web Hosting Agreement Simple

- Electronic signature Missouri Web Hosting Agreement Simple

- Can I eSignature New York Bulk Sale Agreement

- How Do I Electronic signature Tennessee Web Hosting Agreement

- Help Me With Electronic signature Hawaii Debt Settlement Agreement Template

- Electronic signature Oregon Stock Purchase Agreement Template Later

- Electronic signature Mississippi Debt Settlement Agreement Template Later

- Electronic signature Vermont Stock Purchase Agreement Template Safe

- Electronic signature California Stock Transfer Form Template Mobile

- How To Electronic signature Colorado Stock Transfer Form Template

- Electronic signature Georgia Stock Transfer Form Template Fast

- Electronic signature Michigan Stock Transfer Form Template Myself

- Electronic signature Montana Stock Transfer Form Template Computer