Cgr 2 Form

What is the CGR 2?

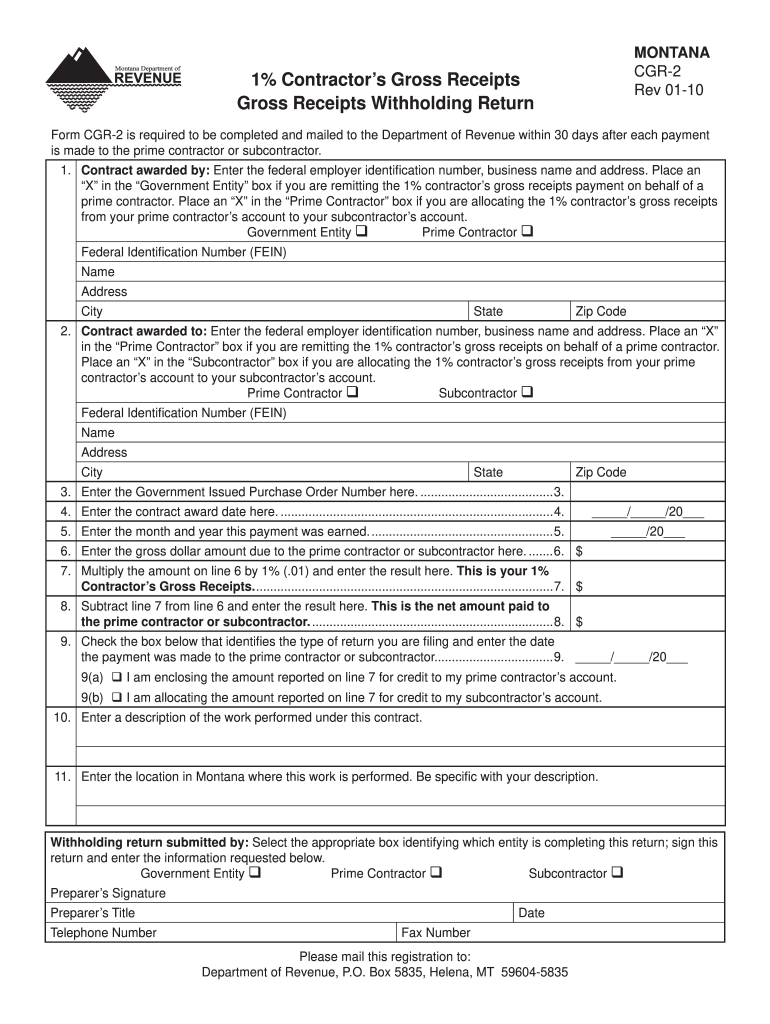

The Montana CGR 2 form, also known as the Montana Gross Receipts form, is a crucial document for businesses operating within the state of Montana. This form is primarily used to report gross receipts and calculate the associated tax obligations. It is essential for ensuring compliance with state tax laws and maintaining accurate financial records. By submitting the CGR 2, businesses provide the state with necessary information about their revenue, which aids in the assessment of taxes owed.

How to Use the CGR 2

Using the Montana CGR 2 form involves several steps that ensure accurate reporting of gross receipts. First, gather all necessary financial documents that detail your business income. Next, fill out the form with the required information, including total gross receipts and any deductions applicable. After completing the form, review it carefully to ensure all data is accurate. Finally, submit the form by the designated deadline to avoid penalties. Utilizing digital tools can streamline this process, making it easier to fill out and submit the form electronically.

Steps to Complete the CGR 2

Completing the Montana CGR 2 form requires careful attention to detail. Follow these steps for successful completion:

- Gather Documentation: Collect all financial records that reflect your gross receipts for the reporting period.

- Fill Out the Form: Enter your business information, total gross receipts, and any relevant deductions in the appropriate sections.

- Review for Accuracy: Double-check all entries to ensure they are correct and complete.

- Submit the Form: Choose your submission method—online, by mail, or in person—and ensure it is sent by the deadline.

Legal Use of the CGR 2

The legal use of the Montana CGR 2 form is governed by state tax regulations. It is essential for businesses to understand that submitting this form is not merely a procedural task; it is a legal obligation. Accurate completion and timely submission of the CGR 2 help ensure compliance with Montana's tax laws. Failure to file or inaccuracies can result in penalties, making it crucial to approach this form with diligence.

Filing Deadlines / Important Dates

Filing deadlines for the Montana CGR 2 form are critical for maintaining compliance. Typically, the form must be submitted annually, with specific dates determined by the Montana Department of Revenue. It is important for businesses to be aware of these deadlines to avoid late fees or penalties. Keeping a calendar of important tax dates can help ensure timely submissions and prevent any disruptions in business operations.

Form Submission Methods

The Montana CGR 2 form can be submitted through various methods, providing flexibility for businesses. Options include:

- Online Submission: Many businesses prefer to submit the form electronically for convenience and speed.

- Mail: The form can be printed and sent via postal service to the appropriate tax authority.

- In-Person Submission: Businesses may also choose to deliver the form directly to their local tax office.

Penalties for Non-Compliance

Non-compliance with the filing requirements of the Montana CGR 2 form can lead to significant penalties. These may include monetary fines, interest on unpaid taxes, and potential legal action. It is essential for businesses to adhere to filing deadlines and ensure the accuracy of their submissions to avoid these consequences. Understanding the implications of non-compliance can motivate timely and correct reporting of gross receipts.

Quick guide on how to complete cgr 2

Complete Cgr 2 effortlessly on any gadget

Web-based document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly replacement for conventional printed and signed paperwork, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents rapidly without delays. Manage Cgr 2 on any gadget using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to alter and eSign Cgr 2 without hassle

- Obtain Cgr 2 and then click Get Form to begin.

- Utilize the tools available to complete your form.

- Highlight pertinent sections of the documents or conceal sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your modifications.

- Select how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Alter and eSign Cgr 2 to ensure excellent communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the cgr 2

The way to make an eSignature for a PDF in the online mode

The way to make an eSignature for a PDF in Chrome

The way to create an eSignature for putting it on PDFs in Gmail

The way to make an eSignature straight from your smart phone

The way to make an eSignature for a PDF on iOS devices

The way to make an eSignature for a PDF document on Android OS

People also ask

-

What is the Montana CGR 2 form, and why is it important?

The Montana CGR 2 form is a crucial document required for certain business filings in Montana. It ensures compliance with state regulations and provides necessary information for processing applications. Understanding its importance helps businesses navigate legal requirements effectively.

-

How can airSlate SignNow help with the Montana CGR 2 form?

airSlate SignNow simplifies the process of completing and signing the Montana CGR 2 form. With an easy-to-use interface, users can quickly fill out and eSign the document, ensuring accuracy and compliance. This streamlines your workflow, allowing you to focus on your business.

-

Is there a cost associated with using airSlate SignNow for the Montana CGR 2 form?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. Our plans provide access to essential features for completing documents like the Montana CGR 2 form. You can choose a plan that aligns with your usage and budget.

-

What features does airSlate SignNow offer for the Montana CGR 2 form?

AirSlate SignNow provides features such as customizable templates, document sharing, and secure eSignature options for the Montana CGR 2 form. Additionally, users can track document status and receive notifications, enhancing their filing experience. These tools simplify completing legal forms.

-

Can I integrate airSlate SignNow with other applications for the Montana CGR 2 form?

Absolutely! airSlate SignNow supports integrations with a variety of applications, making it easier to manage the Montana CGR 2 form alongside your existing tools. This includes CRM systems, cloud storage, and other document management solutions, enhancing overall efficiency.

-

Are electronic signatures for the Montana CGR 2 form legally binding?

Yes, electronic signatures on the Montana CGR 2 form are legally binding under U.S. laws, including the ESIGN Act and UETA. Using airSlate SignNow ensures that your eSignatures are compliant and secure, providing peace of mind for your business transactions. This makes it a reliable choice for document management.

-

What benefits can I expect when using airSlate SignNow for the Montana CGR 2 form?

Using airSlate SignNow for the Montana CGR 2 form offers numerous benefits, including time savings, increased accuracy, and enhanced collaboration. The platform's intuitive design allows for seamless document completion and eSigning, which can signNowly expedite your business processes.

Get more for Cgr 2

Find out other Cgr 2

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer

- Electronic signature Missouri Legal Medical History Mobile

- Help Me With Electronic signature West Virginia Non-Profit Business Plan Template

- Electronic signature Nebraska Legal Living Will Simple

- Electronic signature Nevada Legal Contract Safe

- How Can I Electronic signature Nevada Legal Operating Agreement

- How Do I Electronic signature New Hampshire Legal LLC Operating Agreement

- How Can I Electronic signature New Mexico Legal Forbearance Agreement

- Electronic signature New Jersey Legal Residential Lease Agreement Fast

- How To Electronic signature New York Legal Lease Agreement