Tuscaloosa County Use Tax Forms

What is the Tuscaloosa County Use Tax Forms

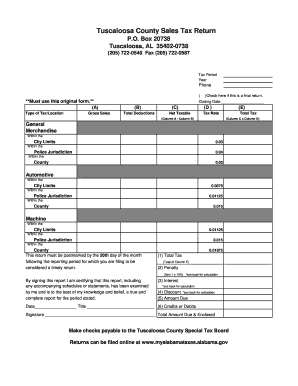

The Tuscaloosa County Use Tax Forms are essential documents required for reporting and paying use tax on goods purchased for use within the county. This tax applies to items acquired from out-of-state vendors or online purchases where sales tax was not collected at the time of purchase. Understanding these forms is crucial for residents and businesses in Tuscaloosa County to ensure compliance with local tax regulations.

How to use the Tuscaloosa County Use Tax Forms

Using the Tuscaloosa County Use Tax Forms involves several steps. First, gather all relevant purchase receipts and documentation. Next, accurately fill out the form by providing details such as the item description, purchase date, and amount paid. After completing the form, it can be submitted to the appropriate county tax authority. Ensuring that all information is correct is vital to avoid potential penalties.

Steps to complete the Tuscaloosa County Use Tax Forms

Completing the Tuscaloosa County Use Tax Forms requires careful attention to detail. Follow these steps:

- Collect all purchase receipts and relevant information.

- Download or obtain the Tuscaloosa County Use Tax Form.

- Fill in your personal information, including name and address.

- List each item purchased, specifying the purchase price and date.

- Calculate the total use tax owed based on the applicable tax rate.

- Review the form for accuracy and completeness.

- Submit the completed form to the county tax office.

Legal use of the Tuscaloosa County Use Tax Forms

The legal use of the Tuscaloosa County Use Tax Forms is governed by state and local tax laws. These forms must be filled out accurately to ensure compliance with tax obligations. Failing to report use tax can lead to penalties and interest on unpaid amounts. It is important to keep copies of submitted forms and receipts for your records, as they may be required for future audits or inquiries.

Filing Deadlines / Important Dates

Filing deadlines for the Tuscaloosa County Use Tax Forms are critical for compliance. Typically, these forms are due annually, with specific dates set by the county tax authority. It is advisable to check the local tax office's website or contact them directly for the most current deadlines. Missing these deadlines can result in penalties and interest on the amount owed.

Required Documents

To complete the Tuscaloosa County Use Tax Forms, certain documents are required. These include:

- Receipts for all taxable purchases.

- Previous tax returns, if applicable.

- Identification information, such as a driver's license or Social Security number.

- Any correspondence from the county tax authority regarding prior use tax assessments.

Form Submission Methods (Online / Mail / In-Person)

The Tuscaloosa County Use Tax Forms can be submitted through various methods. Residents may choose to file online via the county's tax portal, mail the completed forms to the tax office, or deliver them in person. Each method has its own processing times, so selecting the most convenient option is important for timely compliance.

Quick guide on how to complete tuscaloosa county use tax forms

Finalize Tuscaloosa County Use Tax Forms seamlessly on any device

Digital document management has become increasingly favored by organizations and individuals alike. It offers a perfect eco-friendly substitute to conventional printed and signed documents, as you can obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to create, adjust, and electronically sign your documents promptly without delays. Manage Tuscaloosa County Use Tax Forms on any device with airSlate SignNow’s Android or iOS applications and simplify any document-based activity today.

How to modify and electronically sign Tuscaloosa County Use Tax Forms effortlessly

- Retrieve Tuscaloosa County Use Tax Forms and click on Get Form to begin.

- Employ the tools we provide to complete your form.

- Select pertinent sections of your documents or redact sensitive information using the tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature with the Sign tool, which takes only seconds and carries the same legal validity as a conventional handwritten signature.

- Review all information and click on the Done button to save your changes.

- Decide how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device of your choice. Modify and electronically sign Tuscaloosa County Use Tax Forms and ensure outstanding communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tuscaloosa county use tax forms

How to create an eSignature for your PDF in the online mode

How to create an eSignature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

How to generate an eSignature right from your smart phone

How to generate an electronic signature for a PDF on iOS devices

How to generate an eSignature for a PDF on Android OS

People also ask

-

What are the pricing options for airSlate SignNow in Tuscaloosa County?

airSlate SignNow offers a variety of pricing plans tailored to the needs of businesses in Tuscaloosa County. Whether you are a small business or a larger enterprise, there is a plan to fit your budget. All plans provide access to core features, ensuring an efficient eSigning process for all your document needs.

-

What features does airSlate SignNow offer to users in Tuscaloosa County?

Users in Tuscaloosa County can benefit from a comprehensive set of features with airSlate SignNow. These include document templates, real-time tracking, and customizable workflows, which make eSigning documents easy and efficient. The platform is designed to enhance productivity and streamline the signing process.

-

How does airSlate SignNow enhance document security for Tuscaloosa County users?

Document security is a top priority for airSlate SignNow users in Tuscaloosa County. The platform employs advanced encryption methods and authentication processes to protect sensitive information. This ensures that all documents signed through airSlate SignNow remain confidential and secure.

-

What are the benefits of using airSlate SignNow for businesses in Tuscaloosa County?

Businesses in Tuscaloosa County can enjoy numerous benefits by using airSlate SignNow, including signNow time savings and reduced paper usage. The ability to quickly send and eSign documents enhances workflow efficiency and supports better collaboration among teams. Additionally, the platform's user-friendly interface makes it accessible for all employees.

-

Can airSlate SignNow integrate with other tools for Tuscaloosa County users?

Yes, airSlate SignNow offers various integrations with popular tools and applications used by businesses in Tuscaloosa County. This includes compatibility with CRMs, document management systems, and cloud storage services, allowing users to manage their documents more effectively. Integration enhances the overall functionality of the platform.

-

Is there customer support available for airSlate SignNow users in Tuscaloosa County?

Absolutely! airSlate SignNow provides dedicated customer support for users in Tuscaloosa County. Whether you have queries about pricing, features, or technical issues, the support team is readily available to assist you through multiple channels, ensuring a seamless experience.

-

How easy is it to set up airSlate SignNow in Tuscaloosa County?

Setting up airSlate SignNow is quick and straightforward for users in Tuscaloosa County. Users can create an account within minutes and start utilizing the platform immediately. The intuitive design eliminates the learning curve, enabling businesses to get started with eSigning right away.

Get more for Tuscaloosa County Use Tax Forms

Find out other Tuscaloosa County Use Tax Forms

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation