Mi 1040es 2013

What is the MI 1040ES?

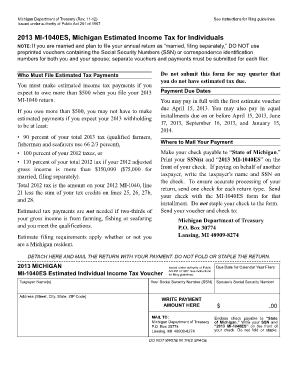

The MI 1040ES is the estimated income tax form used by Michigan residents to report and pay estimated taxes throughout the year. This form is essential for individuals who expect to owe tax of $500 or more when they file their annual income tax return. It helps taxpayers manage their tax obligations in a structured manner, ensuring they meet their financial responsibilities to the state.

Steps to Complete the MI 1040ES

Completing the MI 1040ES involves several key steps:

- Gather necessary financial information, including income sources and deductions.

- Calculate your estimated tax liability for the year using your previous year's tax return as a reference.

- Fill out the MI 1040ES form, ensuring all calculations are accurate.

- Submit the form along with your estimated tax payments by the specified deadlines.

Legal Use of the MI 1040ES

The MI 1040ES serves as a legally binding document when completed and submitted according to Michigan tax laws. It is important to ensure that all information provided is truthful and accurate, as any discrepancies may lead to penalties or audits by the state. Compliance with the legal requirements surrounding this form is essential for maintaining good standing with the Michigan Department of Treasury.

Filing Deadlines / Important Dates

Taxpayers must be aware of the filing deadlines associated with the MI 1040ES to avoid penalties. The estimated tax payments are typically due on:

- April 15 for the first quarter

- June 15 for the second quarter

- September 15 for the third quarter

- January 15 of the following year for the fourth quarter

Staying informed about these dates helps ensure timely payments and compliance with state tax regulations.

Required Documents

To accurately complete the MI 1040ES, taxpayers should gather relevant documents, including:

- Previous year’s tax return for reference

- W-2 forms from employers

- 1099 forms for other income sources

- Records of any deductions or credits applicable

Having these documents on hand will facilitate a smoother and more accurate completion of the form.

Form Submission Methods

The MI 1040ES can be submitted through various methods, including:

- Online filing through the Michigan Department of Treasury website

- Mailing a paper form to the appropriate address

- In-person submission at local tax offices

Choosing the right submission method can enhance convenience and ensure that your estimated tax payments are processed promptly.

Quick guide on how to complete mi 1040es

Complete Mi 1040es effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents quickly without any delays. Handle Mi 1040es on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to alter and electronically sign Mi 1040es with ease

- Find Mi 1040es and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize key sections of your documents or redact sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature with the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review all details and click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate reprinting new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your preferred device. Modify and electronically sign Mi 1040es and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct mi 1040es

Create this form in 5 minutes!

How to create an eSignature for the mi 1040es

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Michigan fillable 1040 form?

The Michigan fillable 1040 form is a state income tax return that allows residents to report their income and claim deductions electronically. This form simplifies the filing process, making it easier to complete and submit your taxes on time. Using a fillable format ensures that calculations are accurate and helps prevent errors.

-

How can I use airSlate SignNow to complete my Michigan fillable 1040?

With airSlate SignNow, you can easily upload your Michigan fillable 1040 form and use our intuitive editing tools to complete it online. The platform allows you to sign, eSign, and share your completed tax form securely. This online solution can save you time and streamline the filing process.

-

Is there a cost associated with using airSlate SignNow for Michigan fillable 1040 forms?

Yes, there is a cost associated with using airSlate SignNow, but the pricing is competitive and designed to be cost-effective for businesses and individuals alike. You can choose from various subscription plans based on your needs. This investment in a reliable solution can enhance your document management process.

-

What features does airSlate SignNow offer for Michigan fillable 1040 forms?

airSlate SignNow offers several features for completing Michigan fillable 1040 forms, including customizable templates, eSigning capabilities, and secure document storage. Additionally, it allows for easy collaboration, which is beneficial for tax professionals working with clients. The user-friendly interface enhances your overall experience.

-

Can I integrate airSlate SignNow with other applications for managing my Michigan fillable 1040 forms?

Yes, airSlate SignNow seamlessly integrates with various third-party applications, allowing you to manage your Michigan fillable 1040 forms alongside your other business tools. This integration capability streamlines workflow and enhances productivity in your tax preparation process. You can connect it with popular accounting and document management software.

-

What are the benefits of using airSlate SignNow for my Michigan fillable 1040 filing?

Using airSlate SignNow for your Michigan fillable 1040 filing offers numerous benefits, including enhanced accuracy, reduced filing time, and improved security. The platform’s easy-to-use tools help you fill out your forms correctly and efficiently. Furthermore, the ability to eSign documents facilitates a quicker submission process.

-

Is my data secure when using airSlate SignNow for Michigan fillable 1040 forms?

Absolutely, airSlate SignNow prioritizes the security of your data, employing advanced encryption protocols to protect your information. When you use our platform for Michigan fillable 1040 forms, you can trust that your personal and financial data is safe. We follow strict compliance standards to ensure the security and privacy of our users.

Get more for Mi 1040es

- Tcu drug screen ii form

- University transcript sample doc form

- Lesson 5 skills practice more two step equations answer key form

- Distribution direct deposit authorization form

- Get your quotathletic packetquot omni middle school form

- Burn permitfire seasonanderson valley fire department form

- Southern california boston terrier rescue form

- Septic tank pumping inspection report county of ventura form

Find out other Mi 1040es

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement