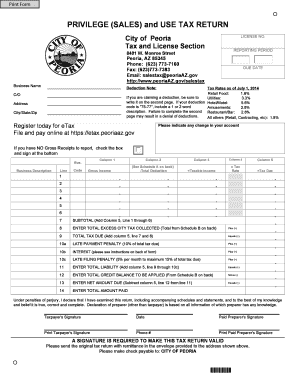

Peoria Sales Tax Form

What is the Peoria Sales Tax

The Peoria sales tax is a local tax imposed on the sale of tangible personal property and certain services within the city of Peoria, Arizona. This tax is a crucial source of revenue for local governments, funding essential services such as public safety, infrastructure, and community programs. The current rate may vary depending on specific goods or services, and it is important for both residents and businesses to understand how this tax applies to their transactions.

How to use the Peoria Sales Tax

Using the Peoria sales tax involves understanding when and how to apply it during transactions. Businesses must collect the appropriate sales tax from customers at the point of sale. This is typically calculated as a percentage of the sale price of taxable items. For individuals, it is important to know that sales tax applies to most purchases made within the city limits, and this tax is usually included in the total price displayed at checkout.

Steps to complete the Peoria Sales Tax

Completing the Peoria sales tax involves several key steps for businesses and individuals. Businesses must first register for a transaction privilege tax (TPT) license with the Arizona Department of Revenue. Once registered, they should:

- Collect the appropriate sales tax from customers.

- Keep accurate records of all sales and taxes collected.

- File regular tax returns, reporting the sales tax collected.

- Remit the collected sales tax to the state by the designated deadlines.

Legal use of the Peoria Sales Tax

The legal use of the Peoria sales tax is governed by Arizona state law and local ordinances. Businesses must comply with these regulations to ensure they are collecting and remitting the correct amounts. Failure to do so can result in penalties or fines. It is essential for businesses to stay informed about any changes in tax rates or regulations to maintain compliance.

Required Documents

When dealing with the Peoria sales tax, several documents are necessary for both businesses and individuals. Businesses need to maintain records of sales transactions, tax collected, and TPT license documentation. Individuals may need receipts to verify purchases for tax purposes or when filing tax returns. Keeping organized records can help streamline the process during audits or inquiries from tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the Peoria sales tax are crucial for businesses to avoid penalties. Generally, businesses must file their tax returns on a monthly or quarterly basis, depending on their sales volume. Important dates include the last day of the month for monthly filers and specific quarterly deadlines for those who file less frequently. Staying aware of these deadlines ensures timely compliance and helps maintain good standing with tax authorities.

Penalties for Non-Compliance

Non-compliance with Peoria sales tax regulations can lead to significant penalties for businesses. Common consequences include fines, interest on unpaid taxes, and potential legal action. It is vital for businesses to adhere to tax laws and deadlines to avoid these repercussions. Regular training and updates on tax regulations can help ensure compliance and mitigate risks associated with non-compliance.

Quick guide on how to complete peoria sales tax

Effortlessly Prepare Peoria Sales Tax on Any Device

The management of online documents has gained traction among organizations and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely keep it online. airSlate SignNow provides all the tools necessary for you to create, modify, and electronically sign your documents quickly without delays. Manage Peoria Sales Tax on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

Effortlessly Modify and Electronically Sign Peoria Sales Tax

- Find Peoria Sales Tax and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important parts of your documents or obscure sensitive information with the tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature using the Sign feature, which takes just a few seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management requirements in just a few clicks from any chosen device. Modify and electronically sign Peoria Sales Tax to ensure seamless communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the peoria sales tax

How to create an eSignature for your PDF file in the online mode

How to create an eSignature for your PDF file in Chrome

The best way to make an eSignature for putting it on PDFs in Gmail

How to generate an eSignature from your smartphone

How to generate an electronic signature for a PDF file on iOS devices

How to generate an eSignature for a PDF file on Android

People also ask

-

What is airSlate SignNow's approach to az taxation?

airSlate SignNow provides businesses with a streamlined process for handling documents related to az taxation. It ensures that all electronic signatures comply with state regulations, making tax submissions easier and more efficient. With SignNow, users can manage their documentation securely, addressing the specific needs associated with az taxation.

-

How does airSlate SignNow help with document compliance for az taxation?

With airSlate SignNow, businesses can ensure that all documents related to az taxation meet legal standards. Our platform offers features like audit trails and secure storage, which are crucial for maintaining compliance. This not only simplifies the preparation process but also protects your business during audits.

-

What pricing plans does airSlate SignNow offer for az taxation needs?

airSlate SignNow offers flexible pricing plans designed to fit various business needs, including those related to az taxation. Our plans provide essential features for electronic signing and document management at competitive rates. By investing in our solution, businesses can save on costs associated with manual processes.

-

Can airSlate SignNow integrate with other tools for az taxation?

Yes, airSlate SignNow offers seamless integrations with multiple platforms to streamline your workflow surrounding az taxation. Whether it’s accounting software or CRM systems, our integrations help consolidate your processes. This ensures that all your tax-related documents are easily accessible and manageable.

-

What are the key features of airSlate SignNow for managing az taxation documents?

Key features of airSlate SignNow for managing az taxation documents include eSigning, document routing, and real-time collaboration. These tools enhance productivity by allowing users to expedite the signing process, reducing delays commonly associated with paper-based methods. Additionally, our user-friendly interface makes navigating tax documents simple.

-

What benefits does airSlate SignNow provide for small businesses dealing with az taxation?

For small businesses, airSlate SignNow offers a cost-effective and efficient way to manage az taxation documentation. By reducing the time spent on paperwork and increasing accuracy with electronic signatures, businesses can focus more on growth. This not only optimizes productivity but also provides peace of mind during tax season.

-

Is training available for new users to understand az taxation features in airSlate SignNow?

Absolutely! airSlate SignNow provides comprehensive training and support resources for new users to fully understand how to utilize its features for az taxation. Our help center offers tutorials, FAQs, and live support to ensure a smooth onboarding experience. This empowers users to leverage our platform effectively right from the start.

Get more for Peoria Sales Tax

Find out other Peoria Sales Tax

- eSignature California Franchise Contract Secure

- How To eSignature Colorado Sponsorship Proposal Template

- eSignature Alabama Distributor Agreement Template Secure

- eSignature California Distributor Agreement Template Later

- eSignature Vermont General Power of Attorney Template Easy

- eSignature Michigan Startup Cost Estimate Simple

- eSignature New Hampshire Invoice for Services (Standard Format) Computer

- eSignature Arkansas Non-Compete Agreement Later

- Can I eSignature Arizona Non-Compete Agreement

- How Do I eSignature New Jersey Non-Compete Agreement

- eSignature Tennessee Non-Compete Agreement Myself

- How To eSignature Colorado LLC Operating Agreement

- Help Me With eSignature North Carolina LLC Operating Agreement

- eSignature Oregon LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Computer

- eSignature Wyoming LLC Operating Agreement Later

- eSignature Wyoming LLC Operating Agreement Free

- How To eSignature Wyoming LLC Operating Agreement

- eSignature California Commercial Lease Agreement Template Myself