Drink Excise Form

What is the Drink Excise Form

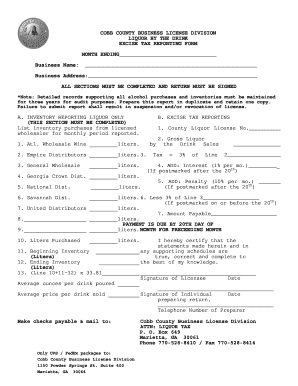

The liquor drink excise form is a regulatory document used by businesses involved in the production, distribution, or sale of alcoholic beverages. This form is essential for reporting and remitting excise taxes imposed on liquor sales. Each state may have its own version of this form, tailored to local laws and tax rates. Understanding this form is crucial for compliance and to avoid potential penalties associated with incorrect filings.

How to Use the Drink Excise Form

Using the liquor drink excise form involves several steps to ensure accurate reporting. First, gather all necessary information regarding your business operations, including sales figures and inventory. Next, fill out the form with precise details, ensuring that all calculations are correct. After completing the form, it must be submitted to the appropriate state tax authority, either online or via mail, depending on state requirements. Keeping copies for your records is also advisable for future reference.

Steps to Complete the Drink Excise Form

Completing the liquor drink excise form requires careful attention to detail. Follow these steps:

- Collect all relevant sales data for the reporting period.

- Access the appropriate version of the form for your state.

- Fill in your business information, including name, address, and tax identification number.

- Report total sales of alcoholic beverages and calculate the excise tax owed based on state rates.

- Review the form for accuracy before submission.

Legal Use of the Drink Excise Form

The liquor drink excise form must be used in accordance with state and federal regulations. Legal use includes accurate reporting of sales and timely payment of taxes. Failure to comply with these regulations can result in fines or other penalties. It is important to stay informed about any changes in tax laws that may affect the completion of this form.

Filing Deadlines / Important Dates

Each state has specific deadlines for filing the liquor drink excise form, often aligned with quarterly or annual reporting periods. Missing these deadlines can lead to penalties, including late fees. It is essential to mark these dates on your calendar and prepare your documentation in advance to ensure timely submission.

Required Documents

To complete the liquor drink excise form, certain documents may be required. These typically include:

- Sales records for the reporting period.

- Inventory records to support sales data.

- Previous excise tax returns, if applicable.

Having these documents readily available will facilitate a smoother filing process.

Penalties for Non-Compliance

Failure to properly complete and submit the liquor drink excise form can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. Understanding the importance of compliance is critical for any business involved in the sale of alcoholic beverages. Regular audits and reviews of your reporting practices can help mitigate the risk of non-compliance.

Quick guide on how to complete drink excise form

Effortlessly Prepare Drink Excise Form on Any Device

Managing documents online has gained popularity among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed papers, as you can easily find the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents quickly and without delays. Handle Drink Excise Form on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to Adjust and Electronically Sign Drink Excise Form with Ease

- Obtain Drink Excise Form and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of the documents or redact sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Create your electronic signature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Select your preferred method of sharing your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and electronically sign Drink Excise Form to ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the drink excise form

How to generate an eSignature for a PDF in the online mode

How to generate an eSignature for a PDF in Chrome

How to create an eSignature for putting it on PDFs in Gmail

How to make an eSignature right from your smart phone

The best way to create an eSignature for a PDF on iOS devices

How to make an eSignature for a PDF on Android OS

People also ask

-

What is a liquor drink excise tax?

A liquor drink excise tax is a specific tax applied to the sale and distribution of alcoholic beverages. This tax is generally imposed at the federal or state level and is intended to regulate the sale of liquor as well as generate revenue for public services. Understanding the liquor drink excise is crucial for businesses in the alcohol industry to ensure compliance and accurate financial reporting.

-

How does airSlate SignNow help with liquor drink excise documentation?

airSlate SignNow streamlines the process of sending and signing documents related to liquor drink excise taxes. Our easy-to-use platform allows businesses to create, distribute, and store essential tax-related documents securely. This helps ensure that all necessary documentation is completed accurately and efficiently, minimizing the risk of errors and compliance issues.

-

What features does airSlate SignNow offer for managing liquor drink excise tax forms?

airSlate SignNow provides several features tailored for managing liquor drink excise tax forms, including customizable templates, e-signature capabilities, and real-time tracking. These tools enable users to fill out, sign, and file their excise tax forms with ease. Additionally, our integration options allow seamless connections to accounting and tax software, enhancing overall efficiency.

-

Is airSlate SignNow cost-effective for small businesses handling liquor drink excise?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes, including small enterprises managing liquor drink excise tax processes. With flexible pricing plans and the ability to automate document workflows, small businesses can save time and reduce costs associated with manual paperwork. This ensures they can focus more on their operations rather than administrative tasks.

-

Can airSlate SignNow integrate with accounting software for liquor drink excise management?

Absolutely! airSlate SignNow offers integration capabilities with various accounting software, allowing businesses to synchronize their liquor drink excise records seamlessly. This integration streamlines the process of managing financial records and tax obligations, ensuring that all information is up-to-date and accurate. It simplifies compliance checks and generates necessary reports effortlessly.

-

What are the benefits of using airSlate SignNow for liquor drink excise deliveries?

Using airSlate SignNow for liquor drink excise documentation delivers numerous benefits, including enhanced security, faster processing times, and improved compliance management. The platform ensures all electronic signatures are legally binding and secure, reducing the risk of fraud. Additionally, the speed of document processing means that businesses can address excise tax obligations on time, avoiding penalties.

-

How secure is airSlate SignNow when handling liquor drink excise documents?

Security is a top priority at airSlate SignNow, especially when dealing with sensitive liquor drink excise documents. We employ advanced encryption and security protocols to protect all your electronic documents and signatures. Our platform is compliant with the highest security standards to ensure that your data remains safe and confidential throughout the transaction process.

Get more for Drink Excise Form

Find out other Drink Excise Form

- Sign Delaware Real Estate Quitclaim Deed Secure

- Sign Georgia Real Estate Business Plan Template Computer

- Sign Georgia Real Estate Last Will And Testament Computer

- How To Sign Georgia Real Estate LLC Operating Agreement

- Sign Georgia Real Estate Residential Lease Agreement Simple

- Sign Colorado Sports Lease Agreement Form Simple

- How To Sign Iowa Real Estate LLC Operating Agreement

- Sign Iowa Real Estate Quitclaim Deed Free

- How To Sign Iowa Real Estate Quitclaim Deed

- Sign Mississippi Orthodontists LLC Operating Agreement Safe

- Sign Delaware Sports Letter Of Intent Online

- How Can I Sign Kansas Real Estate Job Offer

- Sign Florida Sports Arbitration Agreement Secure

- How Can I Sign Kansas Real Estate Residential Lease Agreement

- Sign Hawaii Sports LLC Operating Agreement Free

- Sign Georgia Sports Lease Termination Letter Safe

- Sign Kentucky Real Estate Warranty Deed Myself

- Sign Louisiana Real Estate LLC Operating Agreement Myself

- Help Me With Sign Louisiana Real Estate Quitclaim Deed

- Sign Indiana Sports Rental Application Free