Ia 2014-2026

What is the IA?

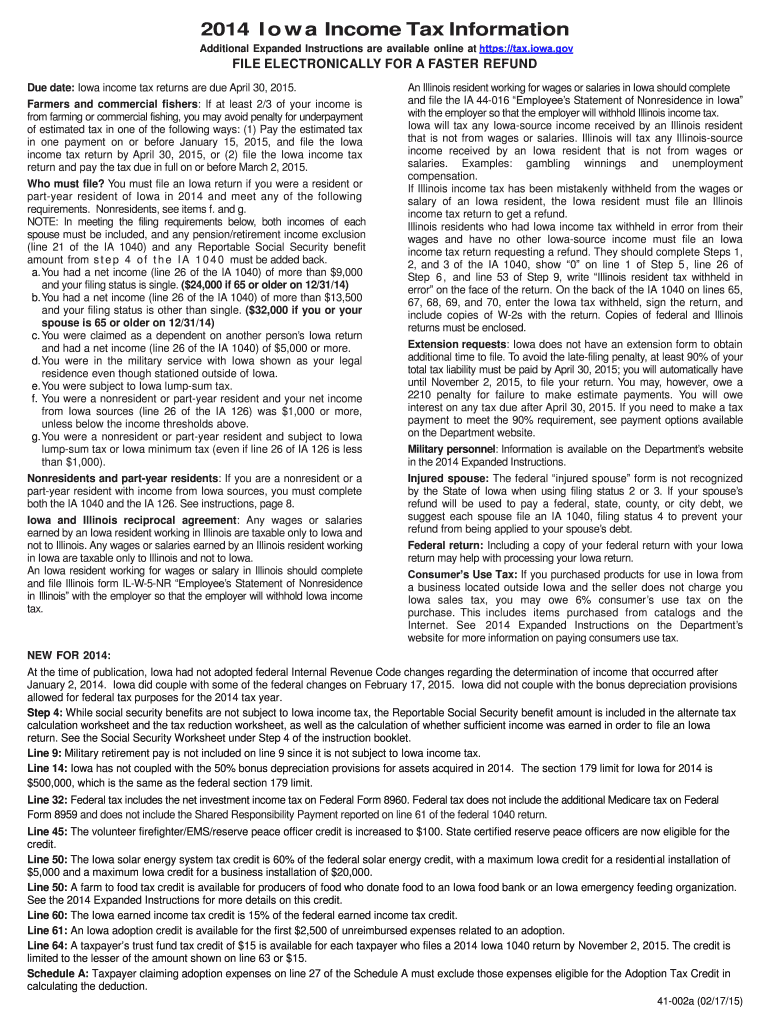

The IA, or Iowa Income Tax form, is a crucial document used by residents of Iowa to report their income and calculate their tax obligations for the year. This form is essential for ensuring compliance with state tax laws and is typically required for individuals who earn income within the state. The IA form encompasses various income sources, deductions, and credits that may apply to taxpayers, allowing them to accurately determine their tax liability.

Steps to Complete the IA

Completing the IA form involves several key steps to ensure accuracy and compliance. First, gather all necessary documents, including W-2s, 1099s, and other income statements. Next, follow these steps:

- Fill out personal information, including your name, address, and Social Security number.

- Report all sources of income, ensuring you include wages, interest, dividends, and any other taxable income.

- Claim applicable deductions and credits, such as education expenses or property tax credits, to reduce your taxable income.

- Calculate your total tax liability based on the income reported and the deductions claimed.

- Review the form for accuracy before submitting it.

Legal Use of the IA

The IA form is legally binding when completed and submitted according to Iowa tax regulations. To ensure its validity, taxpayers must adhere to specific guidelines, including accurate reporting of income and proper documentation of deductions. Utilizing a reliable eSignature solution can further enhance the legal standing of the form, as it provides a digital certificate that verifies the identity of the signer and the integrity of the document.

Filing Deadlines / Important Dates

Timely filing of the IA form is essential to avoid penalties. The deadline for submitting the Iowa Income Tax form typically aligns with the federal tax deadline, which is usually April fifteenth. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of any extensions that may apply, as well as specific dates for estimated tax payments throughout the year.

Required Documents

To complete the IA form accurately, several documents are required. These include:

- W-2 forms from employers, detailing annual earnings.

- 1099 forms for independent contractors or additional income sources.

- Documentation for any deductions, such as receipts for charitable contributions or education expenses.

- Previous year’s tax return for reference and consistency.

Form Submission Methods

The IA form can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online submission through state tax websites or authorized e-filing services.

- Mailing a printed copy of the completed form to the appropriate state tax office.

- In-person submission at designated state tax offices, if preferred.

Examples of Using the IA

Understanding how the IA form is utilized can help taxpayers navigate their obligations effectively. For instance, a self-employed individual may use the IA to report income from freelance work, claiming relevant business expenses to reduce taxable income. Similarly, a retiree may use the form to report pension income while taking advantage of tax credits for seniors. Each taxpayer's situation is unique, and the IA provides a framework for accurately reporting income and calculating taxes owed.

Quick guide on how to complete 2013 ia

Complete Ia effortlessly on any device

Digital document management has gained traction with businesses and individuals alike. It provides an ideal environmentally friendly substitute for conventional printed and signed documents, as you can locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, alter, and eSign your documents promptly without delays. Handle Ia on any platform with airSlate SignNow Android or iOS applications and streamline any document-related process today.

The simplest way to modify and eSign Ia without hassle

- Obtain Ia and click Get Form to begin.

- Make use of the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal significance as a traditional ink signature.

- Verify all the information and click on the Done button to preserve your changes.

- Choose how you wish to deliver your form, via email, text message (SMS), or invitation link, or download it to your computer.

Put aside concerns about lost or misplaced files, tiring document searches, or errors that require new document copies to be printed. airSlate SignNow satisfies all your document management needs in just a few clicks from any device you prefer. Modify and eSign Ia and ensure clear communication at every step of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2013 ia

Create this form in 5 minutes!

How to create an eSignature for the 2013 ia

How to generate an eSignature for your PDF in the online mode

How to generate an eSignature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

How to make an eSignature straight from your smart phone

The best way to create an electronic signature for a PDF on iOS devices

How to make an eSignature for a PDF document on Android OS

People also ask

-

What is 2013 ia and how can airSlate SignNow help my business?

2013 ia refers to a framework for document management and eSigning that is essential for modern business operations. airSlate SignNow provides a user-friendly platform that empowers businesses to seamlessly send and eSign documents in compliance with the best practices of 2013 ia, ensuring efficiency and legal integrity.

-

How does airSlate SignNow ensure compliance with 2013 ia regulations?

airSlate SignNow is designed with compliance in mind, including features that align with 2013 ia regulations. The platform utilizes secure encryption and offers audit trails, ensuring that all signed documents meet legal standards and can withstand scrutiny.

-

What pricing plans does airSlate SignNow offer for features related to 2013 ia?

airSlate SignNow offers several competitive pricing plans tailored to different business needs, all of which include essential features relevant to 2013 ia. From basic to advanced options, each tier provides tools for document management and eSigning, with no hidden fees.

-

Can I integrate airSlate SignNow with other applications for 2013 ia compliance?

Yes, airSlate SignNow supports integrations with numerous applications that can enhance your compliance with 2013 ia. Whether you are using CRM systems, cloud storage, or project management tools, our platform seamlessly connects to streamline your workflow.

-

What are the main features of airSlate SignNow related to 2013 ia?

The main features of airSlate SignNow related to 2013 ia include customizable templates, automated workflows, and robust security measures. These tools allow businesses to simplify document processes and ensure that all eSigned agreements meet 2013 ia standards.

-

How does airSlate SignNow improve efficiency in relation to 2013 ia workflows?

By automating document workflows, airSlate SignNow signNowly increases efficiency while adhering to 2013 ia guidelines. Users can quickly prepare, send, and eSign documents, reducing turnaround times and enhancing overall productivity.

-

What benefits can I expect from using airSlate SignNow for 2013 ia document management?

Using airSlate SignNow for 2013 ia document management delivers numerous benefits, such as improved accuracy, reduced costs, and faster signing processes. This leads to better team collaboration and ensures that your organization complies with essential regulations.

Get more for Ia

- Sf3112b form

- Exclusive right to sell contract sample form

- Printable horse boarding contract form

- Building blocks daycare center employment application date form

- Nyc 208 form pdf

- Dispensary online form

- Uber changing the way the world moves form

- Copia de formularios para inicio de relaciones y anexos xlsx

Find out other Ia

- Electronic signature North Carolina Legal Quitclaim Deed Secure

- How Can I Electronic signature North Carolina Legal Permission Slip

- Electronic signature Legal PDF North Dakota Online

- Electronic signature North Carolina Life Sciences Stock Certificate Fast

- Help Me With Electronic signature North Dakota Legal Warranty Deed

- Electronic signature North Dakota Legal Cease And Desist Letter Online

- Electronic signature North Dakota Legal Cease And Desist Letter Free

- Electronic signature Delaware Orthodontists Permission Slip Free

- How Do I Electronic signature Hawaii Orthodontists Lease Agreement Form

- Electronic signature North Dakota Life Sciences Business Plan Template Now

- Electronic signature Oklahoma Legal Bill Of Lading Fast

- Electronic signature Oklahoma Legal Promissory Note Template Safe

- Electronic signature Oregon Legal Last Will And Testament Online

- Electronic signature Life Sciences Document Pennsylvania Simple

- Electronic signature Legal Document Pennsylvania Online

- How Can I Electronic signature Pennsylvania Legal Last Will And Testament

- Electronic signature Rhode Island Legal Last Will And Testament Simple

- Can I Electronic signature Rhode Island Legal Residential Lease Agreement

- How To Electronic signature South Carolina Legal Lease Agreement

- How Can I Electronic signature South Carolina Legal Quitclaim Deed