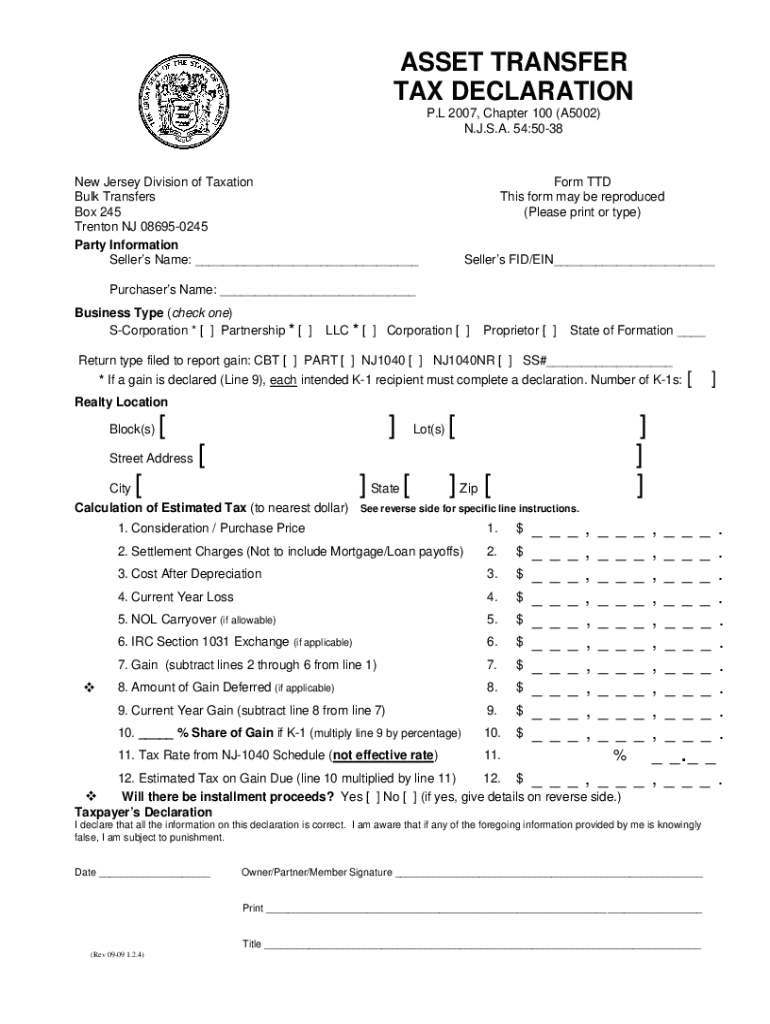

Asset Nj Transfer Form

What is the Asset Nj Transfer

The Asset Nj Transfer refers to the legal process of transferring ownership of assets in New Jersey. This process is crucial for various transactions, including real estate transfers, business asset transfers, and personal property transfers. It ensures that the ownership is officially recognized and documented, which is essential for legal and tax purposes. The transfer can involve different types of assets, such as real estate, vehicles, and financial accounts, and must comply with state regulations to be valid.

Steps to complete the Asset Nj Transfer

Completing the Asset Nj Transfer involves several key steps to ensure that the process is legally binding and compliant with state laws. Here are the essential steps:

- Identify the assets to be transferred and gather necessary documentation.

- Consult with a transferor business attorney to understand the legal implications and requirements.

- Prepare the appropriate transfer documents, such as a deed for real estate or a bill of sale for personal property.

- Obtain signatures from all parties involved in the transfer.

- File the completed documents with the relevant state or local authorities, if required.

- Keep copies of all documents for your records.

Legal use of the Asset Nj Transfer

The legal use of the Asset Nj Transfer is governed by New Jersey state laws. This process is essential for ensuring that the transfer of ownership is recognized by the state and protects the rights of both the transferor and the transferee. Proper documentation and adherence to legal requirements help prevent disputes and ensure compliance with tax obligations. It is advisable to work with a transferor business attorney to navigate the complexities of these legal requirements.

Required Documents

To complete the Asset Nj Transfer, specific documents are typically required. These may include:

- Transfer documents such as a deed or bill of sale.

- Proof of identity for all parties involved.

- Any existing agreements related to the assets.

- Tax identification numbers, if applicable.

- Additional documentation as required by local authorities.

State-specific rules for the Asset Nj Transfer

New Jersey has specific rules governing the Asset Nj Transfer that must be adhered to for the transfer to be valid. These rules include requirements for notarization, filing deadlines, and specific forms that may need to be completed. Understanding these state-specific regulations is crucial for ensuring compliance and avoiding potential legal issues. Consulting with a knowledgeable transferor business attorney can provide clarity on these regulations.

Quick guide on how to complete asset nj transfer

Accomplish Asset Nj Transfer effortlessly on any gadget

Online document handling has gained widespread acceptance among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed papers, as you can locate the correct form and securely archive it on the internet. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage Asset Nj Transfer on any gadget using airSlate SignNow Android or iOS applications and enhance any document-related task today.

The simplest method to modify and eSign Asset Nj Transfer without any hassle

- Obtain Asset Nj Transfer and click Obtain Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight relevant sections of your documents or obscure sensitive data with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Finish button to save your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, frustrating form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Asset Nj Transfer and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the asset nj transfer

How to make an eSignature for a PDF file online

How to make an eSignature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

The best way to create an eSignature straight from your mobile device

The best way to make an eSignature for a PDF file on iOS

The best way to create an eSignature for a PDF document on Android devices

People also ask

-

What is the nj ttd form and how can airSlate SignNow help with it?

The nj ttd form is a critical document for applying for temporary disability benefits in New Jersey. airSlate SignNow streamlines the process by allowing you to complete, sign, and send the nj ttd form electronically, ensuring a quicker turnaround time and secure document handling.

-

Are there any costs associated with using airSlate SignNow for the nj ttd form?

airSlate SignNow offers competitive pricing plans that fit various budgets, making it a cost-effective solution for handling the nj ttd form. You can choose from different subscription levels, each providing essential features tailored for your document signing needs.

-

Can I integrate airSlate SignNow with other software to manage the nj ttd form?

Yes, airSlate SignNow supports various integrations with popular applications, which can help you manage the nj ttd form more efficiently. This means you can connect your existing tools and streamline your workflow, reducing the time spent on document management.

-

What features does airSlate SignNow offer that are beneficial for the nj ttd form?

airSlate SignNow offers a range of features such as customizable templates, real-time tracking, and automatic reminders that enhance the process of completing the nj ttd form. These features ensure that you stay organized and on top of your document submissions.

-

Is it easy to use airSlate SignNow for someone unfamiliar with digital signing?

Absolutely! airSlate SignNow is designed to be user-friendly, making it easy for anyone, regardless of technical expertise, to complete and eSign the nj ttd form. Comprehensive guides and support are also available to help you get started.

-

How secure is airSlate SignNow for handling the nj ttd form?

Security is a top priority at airSlate SignNow. The platform employs advanced encryption and compliance measures to ensure that your nj ttd form and other documents are protected from unauthorized access and data bsignNowes.

-

Can I use airSlate SignNow on mobile devices for the nj ttd form?

Yes, airSlate SignNow is fully optimized for mobile use. You can easily complete and eSign the nj ttd form from your smartphone or tablet, giving you the flexibility to manage your documents on the go.

Get more for Asset Nj Transfer

Find out other Asset Nj Transfer

- Can I eSign North Carolina Courts Limited Power Of Attorney

- eSign North Dakota Courts Quitclaim Deed Safe

- How To eSign Rhode Island Sports Quitclaim Deed

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later