Ifta Fuel Tax 2019-2026

What is the IFTA Fuel Tax

The International Fuel Tax Agreement (IFTA) is a cooperative agreement among U.S. states and Canadian provinces that simplifies the reporting of fuel use by motor carriers operating in multiple jurisdictions. The IFTA Fuel Tax is designed to ensure that fuel taxes are fairly distributed among the states and provinces where the fuel is consumed. Carriers pay fuel taxes based on the miles driven in each jurisdiction, rather than paying a separate tax in each state or province. This system helps streamline the process for trucking companies and supports equitable tax distribution.

Steps to complete the IFTA Fuel Tax

Completing the IFTA Fuel Tax involves several key steps to ensure compliance and accuracy. Here is a structured approach:

- Gather necessary documentation, including mileage records and fuel purchase receipts.

- Calculate total miles driven in each jurisdiction and total fuel purchased.

- Determine the fuel tax rates for each state or province where the vehicle operated.

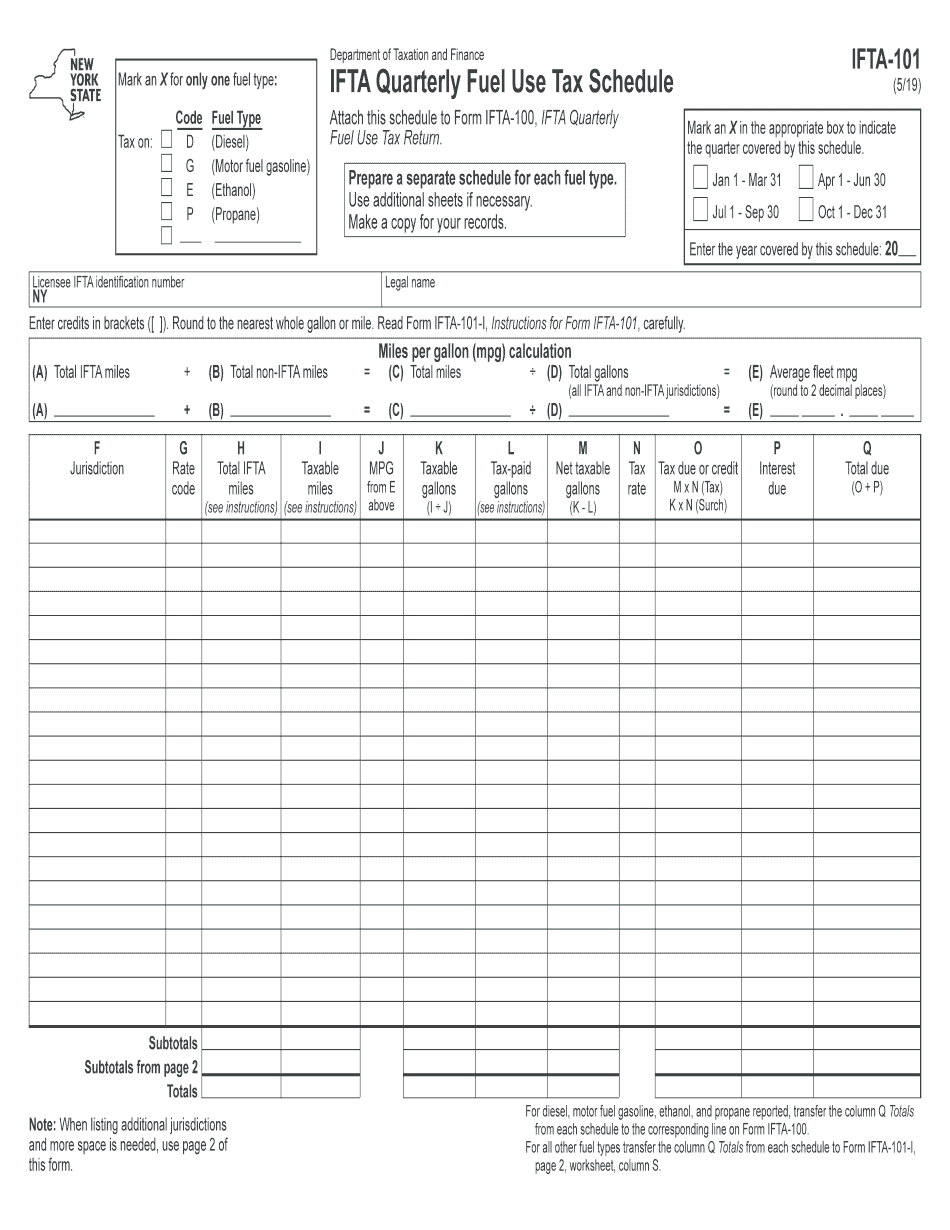

- Complete the IFTA 101 form, ensuring all sections are filled out accurately.

- Review the completed form for any errors or omissions.

- Submit the IFTA 101 form along with any required payments to the appropriate state authority.

Legal use of the IFTA Fuel Tax

The legal use of the IFTA Fuel Tax requires adherence to specific regulations and guidelines set forth by the participating jurisdictions. Carriers must maintain accurate records of their fuel purchases and mileage to substantiate their tax calculations. Compliance with IFTA regulations ensures that carriers are not subject to penalties or audits. Additionally, using an electronic signature solution can enhance the legal standing of submitted documents, as it provides a secure and verifiable method of signing the IFTA 101 form.

Filing Deadlines / Important Dates

Filing deadlines for the IFTA Fuel Tax are critical to avoid penalties and maintain compliance. Typically, the IFTA 101 form is due quarterly, with deadlines falling on the last day of the month following the end of each quarter. Important dates include:

- First Quarter: Due April 30

- Second Quarter: Due July 31

- Third Quarter: Due October 31

- Fourth Quarter: Due January 31

It is essential for carriers to mark these dates on their calendars and prepare their filings in advance to ensure timely submission.

Required Documents

To complete the IFTA 101 form accurately, certain documents are required. These documents help in verifying fuel consumption and mileage. Essential documents include:

- Mileage logs detailing the miles driven in each jurisdiction.

- Fuel purchase receipts showing the amount and type of fuel purchased.

- Previous IFTA filings for reference and consistency.

- Any additional documentation required by specific states or provinces.

Maintaining organized records will facilitate a smoother filing process and help ensure compliance with IFTA regulations.

Form Submission Methods (Online / Mail / In-Person)

The IFTA 101 form can be submitted through various methods, depending on the requirements of the state where the carrier is registered. Common submission methods include:

- Online: Many states offer online submission through their official tax authority websites, allowing for quick and convenient filing.

- Mail: Carriers can print the completed IFTA 101 form and send it via postal service to the appropriate state agency.

- In-Person: Some jurisdictions may allow for in-person submissions at designated offices.

Choosing the right submission method can help streamline the filing process and ensure timely compliance.

Quick guide on how to complete ifta fuel tax

Effortlessly Prepare Ifta Fuel Tax on Any Device

Managing documents online has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to access the necessary form and securely save it online. airSlate SignNow provides all the tools required to create, modify, and eSign your documents quickly and without delays. Manage Ifta Fuel Tax on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

Editing and eSigning Ifta Fuel Tax with Ease

- Obtain Ifta Fuel Tax and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Mark essential parts of the documents or obscure sensitive details with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and click the Done button to save your changes.

- Choose your preferred method to send your form, whether it’s via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require reprinting new copies. airSlate SignNow meets all your document management needs in just a few clicks from your preferred device. Modify and eSign Ifta Fuel Tax and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ifta fuel tax

Create this form in 5 minutes!

How to create an eSignature for the ifta fuel tax

How to make an eSignature for your PDF document online

How to make an eSignature for your PDF document in Google Chrome

The way to make an electronic signature for signing PDFs in Gmail

The best way to create an electronic signature straight from your smart phone

The best way to make an electronic signature for a PDF document on iOS

The best way to create an electronic signature for a PDF document on Android OS

People also ask

-

What is the IFTA 101 form used for?

The IFTA 101 form is a crucial document for transport businesses that operate across multiple states in North America. It is used to report fuel consumption and calculate taxes owed to various jurisdictions. Understanding the IFTA 101 form ensures compliance with interstate tax regulations.

-

How do I fill out the IFTA 101 form correctly?

Filling out the IFTA 101 form involves gathering fuel purchase information and mileage records from different jurisdictions. It requires attention to detail to ensure accuracy and compliance. airSlate SignNow provides features that simplify this process, allowing you to easily enter and manage your data.

-

Is there a fee for filing the IFTA 101 form through airSlate SignNow?

airSlate SignNow offers a cost-effective solution for filing your IFTA 101 form. Pricing varies based on your specific needs, but it is designed to be budget-friendly for businesses of all sizes. By utilizing our platform, you can save both time and money during the filing process.

-

Can I integrate airSlate SignNow with my existing accounting software for the IFTA 101 form?

Yes, airSlate SignNow can seamlessly integrate with various accounting and fleet management software. This integration simplifies the process of gathering data needed for the IFTA 101 form, allowing you to automate your workflows and enhance accuracy.

-

What are the benefits of using airSlate SignNow for the IFTA 101 form?

Using airSlate SignNow for the IFTA 101 form streamlines the filing process and reduces errors. Our easy-to-use platform allows for electronic signatures, efficient data management, and quick access to documents. This ensures you stay compliant while saving time and resources.

-

How can I ensure the security of my IFTA 101 form submissions on airSlate SignNow?

AirSlate SignNow employs robust security measures to protect your sensitive information related to the IFTA 101 form. Our platform uses encryption, secure servers, and compliance with industry standards to ensure that your data remains safe throughout the signing and filing process.

-

Can I track the status of my IFTA 101 form submission with airSlate SignNow?

Absolutely! AirSlate SignNow offers features that allow you to track the status of your IFTA 101 form submission in real-time. This transparency helps you stay informed and proactive in addressing any potential issues during the filing process.

Get more for Ifta Fuel Tax

Find out other Ifta Fuel Tax

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document