Form Ri 100 2016

What is the Form RI-100

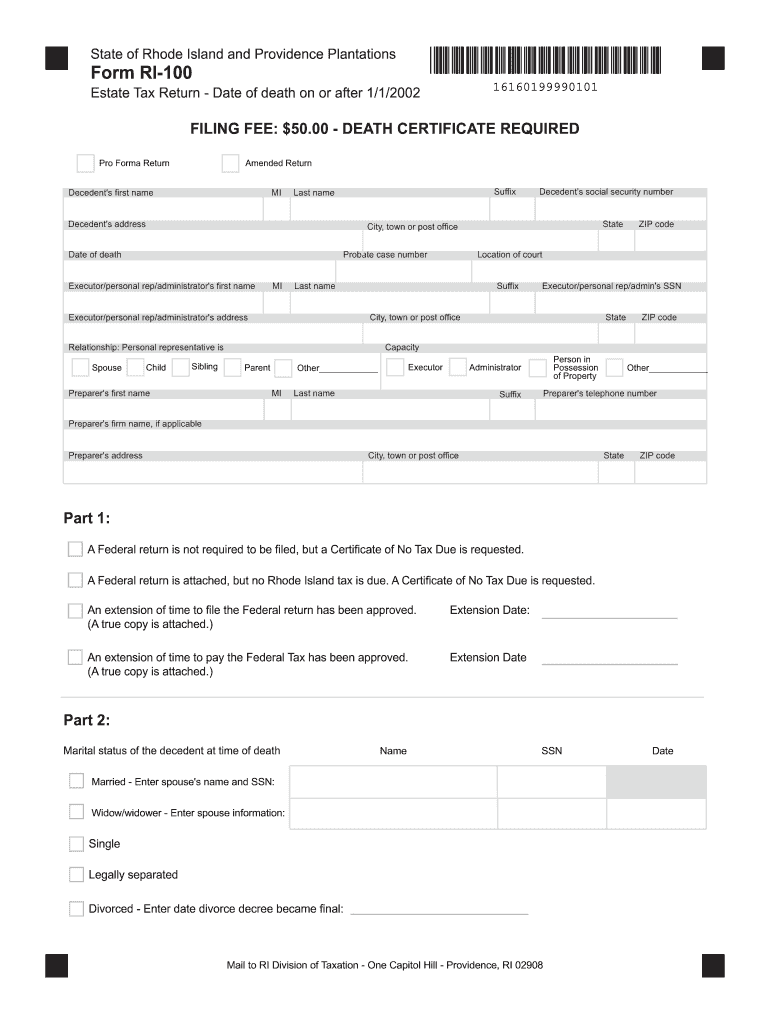

The RI-100, officially known as the Rhode Island Estate Tax Return, is a crucial document for reporting the estate tax obligations of individuals who have passed away with assets exceeding a certain threshold. This form is essential for the estate's executor or administrator to ensure compliance with Rhode Island tax laws. It is designed to calculate the estate tax owed based on the value of the deceased's estate, which includes real estate, bank accounts, stocks, and other assets. Filing this form is necessary for estates that meet the state's minimum value requirement, ensuring that the estate fulfills its tax liabilities before assets can be distributed to heirs.

Steps to Complete the Form RI-100

Completing the RI-100 involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including the death certificate, asset valuations, and any previous tax returns. Next, fill out the form by providing detailed information about the decedent's assets, liabilities, and deductions. It's important to accurately report the fair market value of the estate's assets as of the date of death. After completing the form, review it thoroughly for any errors or omissions. Finally, sign the form and submit it to the Rhode Island Division of Taxation by the specified deadline to avoid penalties.

Legal Use of the Form RI-100

The RI-100 serves as a legal document that must be filed in accordance with Rhode Island law. It is essential for ensuring that the estate tax is calculated and paid correctly. The legal validity of the form hinges on accurate reporting and adherence to filing deadlines. Executors or administrators must ensure that the form is signed and submitted properly to avoid potential legal issues, such as penalties or audits. Additionally, the use of electronic signatures on the RI-100 is permissible, provided that the signer meets the requirements set forth by relevant eSignature laws.

Required Documents for the Form RI-100

When preparing to file the RI-100, several documents are necessary to support the information provided on the form. These include:

- The death certificate of the decedent.

- Documentation of all assets, including appraisals for real estate and valuations for personal property.

- Records of any debts or liabilities owed by the decedent at the time of death.

- Previous tax returns, if applicable, to provide context for the estate's financial situation.

- Any relevant estate planning documents, such as wills or trusts.

Having these documents ready will facilitate a smoother completion of the RI-100 and ensure compliance with state requirements.

Form Submission Methods for the RI-100

The RI-100 can be submitted to the Rhode Island Division of Taxation through various methods. Taxpayers have the option to file the form electronically, which is often the most efficient method. Alternatively, the form can be mailed directly to the Division of Taxation or submitted in person at their office. Each submission method has its own requirements and timelines, so it is essential to choose the one that best fits the circumstances of the estate. Ensuring timely submission is crucial to avoid any penalties associated with late filings.

Filing Deadlines for the RI-100

Filing the RI-100 is subject to specific deadlines that must be adhered to in order to avoid penalties. Generally, the form is due within nine months of the decedent's date of death. However, if an extension is needed, executors can request an extension to file the estate tax return. It is important to note that while an extension may allow additional time to file, it does not extend the time to pay any taxes owed. Therefore, ensuring that the estate tax is paid on time is crucial for compliance with Rhode Island tax laws.

Quick guide on how to complete form ri 100

Prepare Form Ri 100 seamlessly on any device

Managing documents online has gained popularity among companies and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can easily access the correct form and store it securely online. airSlate SignNow equips you with all the necessary tools to create, alter, and eSign your documents promptly without any delays. Manage Form Ri 100 on any device using the airSlate SignNow Android or iOS applications and enhance any document-centered workflow today.

How to alter and eSign Form Ri 100 effortlessly

- Find Form Ri 100 and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow particularly offers for that purpose.

- Create your signature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Decide how you wish to share your form, via email, text message (SMS), an invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and eSign Form Ri 100 and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form ri 100

Create this form in 5 minutes!

How to create an eSignature for the form ri 100

The best way to create an eSignature for a PDF file in the online mode

The best way to create an eSignature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

The best way to generate an electronic signature straight from your smartphone

The way to generate an eSignature for a PDF file on iOS devices

The best way to generate an electronic signature for a PDF document on Android

People also ask

-

What is the RI div of tax form 100?

The RI div of tax form 100 is a specific tax form used for reporting income and other financial information by businesses in Rhode Island. This form is essential for ensuring compliance with state tax regulations and helps businesses accurately report their earnings to the state.

-

How can airSlate SignNow assist with the RI div of tax form 100?

airSlate SignNow provides a streamlined approach to manage the RI div of tax form 100 by allowing businesses to send, eSign, and store documents securely. This not only ensures that forms are completed in compliance with regulations but also enhances the efficiency of the document workflow.

-

Is airSlate SignNow cost-effective for handling tax forms like the RI div of tax form 100?

Yes, airSlate SignNow offers a cost-effective solution for businesses dealing with tax forms, including the RI div of tax form 100. With various pricing plans to fit different business needs, it ensures that companies can manage their document processes without overspending.

-

What features does airSlate SignNow offer for the RI div of tax form 100?

airSlate SignNow includes essential features such as customizable templates, automated workflows, and secure eSigning specifically tailored for the RI div of tax form 100. These features simplify the document management process and enhance accuracy and compliance.

-

Can I integrate airSlate SignNow with other software for RI div of tax form 100 management?

Absolutely! airSlate SignNow seamlessly integrates with a variety of software applications, facilitating the management of the RI div of tax form 100. This integration supports improved data flow and allows for comprehensive document handling across platforms.

-

What are the benefits of using airSlate SignNow for tax document management?

Using airSlate SignNow for tax document management, including the RI div of tax form 100, offers benefits like increased efficiency, enhanced security, and better compliance. Businesses can save time and reduce errors when preparing and submitting tax-related documents.

-

How secure is airSlate SignNow when handling sensitive forms such as the RI div of tax form 100?

airSlate SignNow employs advanced security measures to protect sensitive information, including the RI div of tax form 100. With encrypted data transfer and secure cloud storage, businesses can feel confident sending and storing their tax documents safely.

Get more for Form Ri 100

Find out other Form Ri 100

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter