Get the Form RI 100 Estate Tax Return Date of Death 2020-2026

Understanding the Rhode Island Estate Tax Return

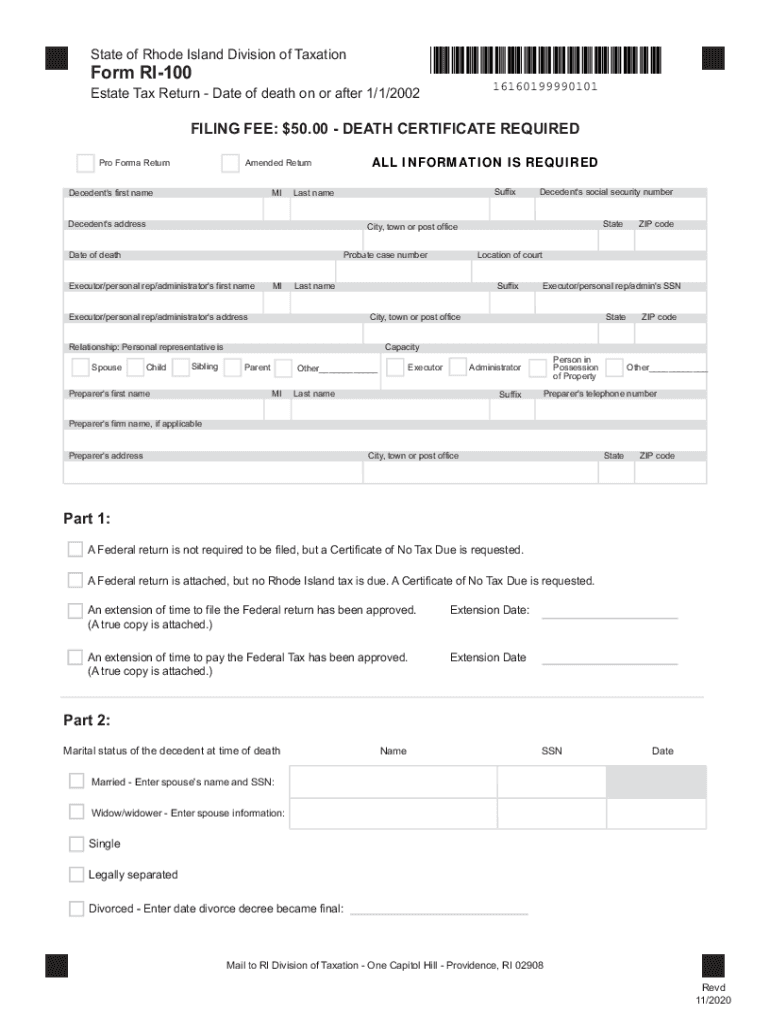

The Rhode Island estate tax return, commonly referred to as form RI-100, is a crucial document for the estates of decedents who pass away with a gross estate exceeding a specific threshold. This form is essential for reporting the value of the estate and calculating the tax owed. The date of death is significant as it determines the value of the estate and the applicable tax rates at that time. Understanding the nuances of this form can help ensure compliance with state tax laws.

Steps to Complete the Rhode Island Estate Tax Return

Completing the RI-100 involves several key steps:

- Gather all necessary documentation, including the death certificate, property appraisals, and financial statements.

- Determine the gross estate value, which includes real estate, bank accounts, investments, and other assets.

- Complete the form by accurately reporting all required information, including deductions and exemptions.

- Review the completed form for accuracy and ensure all necessary signatures are included.

- Submit the form to the Rhode Island Division of Taxation by the established deadline.

Filing Deadlines for the Rhode Island Estate Tax Return

Timely filing of the RI-100 is essential to avoid penalties. The estate tax return must be filed within nine months of the decedent's date of death. If additional time is needed, an extension can be requested, but it is important to note that any taxes owed must still be paid by the original deadline to avoid interest and penalties.

Required Documents for the Rhode Island Estate Tax Return

To successfully file the RI-100, several documents are required:

- Death certificate of the decedent.

- Appraisals for real estate and other significant assets.

- Financial statements from banks and investment accounts.

- Any previous tax returns that may impact the estate's tax liability.

Form Submission Methods for the Rhode Island Estate Tax Return

The RI-100 can be submitted through various methods:

- Online submission through the Rhode Island Division of Taxation’s portal.

- Mailing a physical copy of the completed form to the appropriate tax office.

- In-person submission at designated tax offices, if necessary.

Penalties for Non-Compliance with the Rhode Island Estate Tax Return

Failure to file the RI-100 on time or inaccuracies in the submitted information can result in significant penalties. These may include:

- Late filing penalties, which can accumulate over time.

- Interest on any unpaid taxes, calculated from the original due date.

- Potential legal actions for non-compliance, which can complicate the estate settlement process.

Quick guide on how to complete get the free form ri 100 estate tax return date of death

Complete Get The Form RI 100 Estate Tax Return Date Of Death with ease on any device

Digital document management has gained traction among organizations and individuals. It presents an ideal sustainable alternative to traditional printed and signed documents, enabling you to find the appropriate form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly without delays. Manage Get The Form RI 100 Estate Tax Return Date Of Death on any device using airSlate SignNow Android or iOS applications and enhance any document-centric workflow today.

The easiest way to modify and eSign Get The Form RI 100 Estate Tax Return Date Of Death effortlessly

- Obtain Get The Form RI 100 Estate Tax Return Date Of Death and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your modifications.

- Select your preferred method for sharing your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or errors that require reprinting new document versions. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you choose. Edit and eSign Get The Form RI 100 Estate Tax Return Date Of Death and ensure outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct get the free form ri 100 estate tax return date of death

Create this form in 5 minutes!

How to create an eSignature for the get the free form ri 100 estate tax return date of death

The way to generate an e-signature for a PDF online

The way to generate an e-signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

The way to generate an e-signature right from your smartphone

The way to create an e-signature for a PDF on iOS

The way to generate an e-signature for a PDF on Android

People also ask

-

What is an inheritance tax waiver form RI?

The inheritance tax waiver form RI is a legal document that allows heirs to claim an exemption from inheritance taxes in Rhode Island. This form helps simplify the process of transferring assets without the burden of taxes. Completing the inheritance tax waiver form RI accurately is essential for ensuring that heirs can receive their inheritances smoothly.

-

How can I obtain the inheritance tax waiver form RI?

You can obtain the inheritance tax waiver form RI from the Rhode Island Division of Taxation's website or through their office. Additionally, airSlate SignNow provides an easy platform to access and fill out this form electronically. This streamlines the process, making it more convenient for users.

-

Are there any fees associated with filing the inheritance tax waiver form RI?

Generally, there are no filing fees for the inheritance tax waiver form RI itself. However, consulting with a legal expert may incur costs if you seek assistance in completing the form. Utilizing airSlate SignNow can save you time and money by providing an efficient platform for signing and submitting the form.

-

What features does airSlate SignNow offer for managing the inheritance tax waiver form RI?

airSlate SignNow offers features such as electronic signatures, document templates, and secure cloud storage, tailored for managing the inheritance tax waiver form RI seamlessly. These features enable you to fill out, eSign, and store your document all in one place. With airSlate SignNow, you can ensure a hassle-free process for your inheritance tax waiver.

-

Can I track the status of my inheritance tax waiver form RI using airSlate SignNow?

Yes, with airSlate SignNow, you can track the status of your inheritance tax waiver form RI in real-time. This feature allows you to see when the form has been sent, viewed, and signed. Tracking ensures you remain informed and helps you manage your documents effectively.

-

Is the inheritance tax waiver form RI compatible with mobile devices?

Absolutely! airSlate SignNow's platform is fully optimized for mobile devices, allowing you to fill out and eSign your inheritance tax waiver form RI on-the-go. This mobile compatibility ensures you can manage important documents anytime, anywhere, enhancing your overall experience.

-

What are the benefits of using airSlate SignNow for the inheritance tax waiver form RI?

Using airSlate SignNow for the inheritance tax waiver form RI offers several benefits, including time efficiency, enhanced security, and user-friendly features. It simplifies document management with easy eSigning and cloud storage, allowing you to complete the process quickly. Additionally, the platform is cost-effective, making it accessible for all users.

Get more for Get The Form RI 100 Estate Tax Return Date Of Death

Find out other Get The Form RI 100 Estate Tax Return Date Of Death

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors