Sc Form Ati

What is the SC Form ATI?

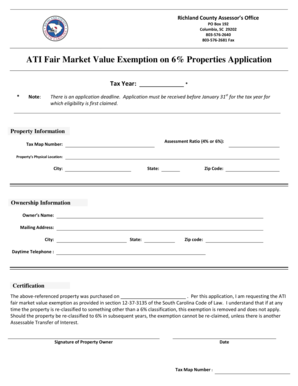

The SC Form ATI is an essential document used in South Carolina for applying for the ATI exemption. This exemption allows eligible property owners to receive tax relief based on specific criteria set by the state. The form is designed to streamline the application process for individuals seeking to benefit from reduced property taxes due to qualifying circumstances. Understanding the purpose of the SC Form ATI is crucial for homeowners looking to navigate their property tax obligations effectively.

Steps to Complete the SC Form ATI

Completing the SC Form ATI involves several key steps to ensure accuracy and compliance with state regulations. First, gather all necessary personal and property information, including your name, address, and details about the property in question. Next, carefully fill out the form, ensuring that all sections are completed, including any required signatures. It is important to double-check the information for accuracy before submission. Finally, submit the form according to the specified submission methods, which may include online, by mail, or in person.

Eligibility Criteria

To qualify for the ATI exemption in South Carolina, applicants must meet specific eligibility criteria. Generally, the exemption is available to property owners who meet certain income thresholds or possess specific types of properties, such as those used for agricultural purposes. Additionally, applicants must provide documentation that supports their eligibility, including proof of income or property usage. Understanding these criteria is essential for applicants to determine their qualification for the exemption.

Required Documents

When applying for the SC Form ATI, several documents are required to support your application. These may include proof of income, property tax statements, and any relevant identification documents. It is advisable to compile these documents in advance to facilitate a smooth application process. Ensuring that all required documents are submitted can significantly impact the approval time and overall success of your application.

Form Submission Methods

Submitting the SC Form ATI can be done through various methods, depending on the preferences of the applicant. The form can typically be submitted online through the South Carolina Department of Revenue's website, which offers a convenient way to complete the process. Alternatively, applicants may choose to mail the completed form to the appropriate local tax office or deliver it in person. Understanding the available submission methods can help applicants choose the most efficient way to file their exemption application.

Legal Use of the SC Form ATI

The SC Form ATI is legally recognized as a valid application for the ATI exemption, provided it is completed and submitted according to state guidelines. The form must be filled out accurately, and all necessary supporting documents must be included to ensure compliance with South Carolina tax laws. Failure to adhere to these legal requirements may result in the denial of the exemption or other penalties. Understanding the legal implications of the form is crucial for applicants seeking to benefit from the exemption.

Quick guide on how to complete sc form ati

Prepare Sc Form Ati effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to locate the proper form and securely keep it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Sc Form Ati on any device using airSlate SignNow apps for Android or iOS and streamline your document-related tasks today.

How to modify and eSign Sc Form Ati easily

- Obtain Sc Form Ati and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to deliver your form: via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes that require new document copies. airSlate SignNow manages your document administration needs with just a few clicks from any device you choose. Edit and eSign Sc Form Ati to ensure seamless communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sc form ati

The best way to create an eSignature for a PDF document in the online mode

The best way to create an eSignature for a PDF document in Chrome

The best way to generate an eSignature for putting it on PDFs in Gmail

The best way to generate an electronic signature straight from your mobile device

The way to generate an eSignature for a PDF document on iOS devices

The best way to generate an electronic signature for a PDF document on Android devices

People also ask

-

What is an ati exemption in the context of airSlate SignNow?

The ati exemption refers to a specific regulation that allows certain organizations to bypass traditional document signing requirements. With airSlate SignNow, users can easily navigate these regulations and streamline their document signing process, ensuring compliance while saving time.

-

How does airSlate SignNow support businesses in utilizing the ati exemption?

airSlate SignNow provides comprehensive templates and features designed to facilitate the use of the ati exemption. Businesses can create, send, and electronically sign documents while adhering to legal standards, making it easier to leverage the advantage of this exemption within their operations.

-

What pricing plans are available for using airSlate SignNow regarding the ati exemption?

airSlate SignNow offers several pricing plans tailored to meet different business needs, including those looking to utilize the ati exemption. Each plan provides various features and capabilities that support compliance and efficient document management, allowing businesses to choose the right solution for their budget.

-

What features does airSlate SignNow offer to enhance efficiency with the ati exemption?

airSlate SignNow offers features such as document templates, automated workflows, and secure cloud storage to enhance efficiency. By utilizing these features, businesses can leverage the ati exemption effectively, ensuring quick and secure signing processes while maintaining compliance.

-

Can I integrate airSlate SignNow with other software to manage the ati exemption?

Yes, airSlate SignNow seamlessly integrates with various software solutions to enhance document management related to the ati exemption. Integration options include CRM systems, project management tools, and storage platforms, allowing for a holistic approach to managing your documents and compliance needs.

-

What benefits does airSlate SignNow provide for businesses considering the ati exemption?

By using airSlate SignNow, businesses benefit from increased speed and reduced costs when executing documents under the ati exemption. The platform's ease of use and powerful features empower teams to handle document workflows efficiently, ultimately improving operational productivity and compliance.

-

Is airSlate SignNow secure for managing documents under the ati exemption?

Absolutely! airSlate SignNow prioritizes security and ensures that all documents handled under the ati exemption are protected by advanced encryption and compliance measures. This commitment to security gives users peace of mind when executing sensitive documents.

Get more for Sc Form Ati

Find out other Sc Form Ati

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online