How to Make Sc Quarterly Deposits 2006-2026

How to make SC quarterly deposits

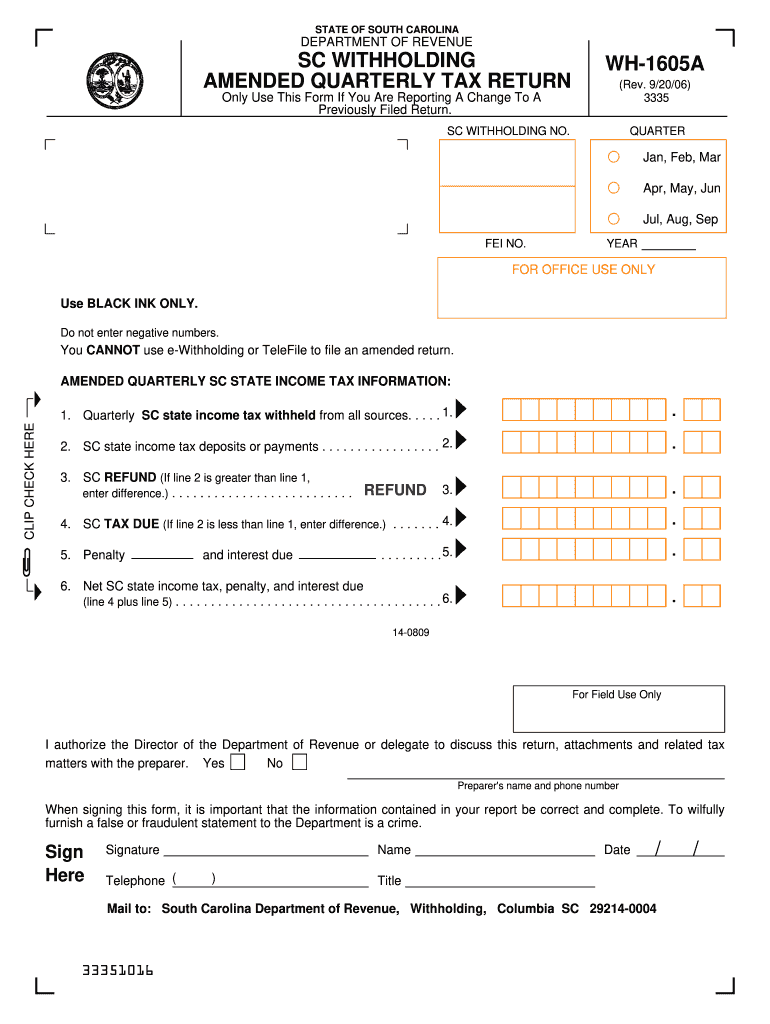

Making SC quarterly deposits is essential for compliance with state tax regulations. These deposits are typically required for businesses and self-employed individuals to ensure that they meet their tax obligations throughout the year. To make these deposits, you will need to calculate your estimated tax liability based on your income and applicable tax rates.

Begin by determining your total income for the quarter. This includes all earnings from your business activities. Next, apply the relevant state tax rates to your income to calculate your estimated tax amount. Once you have your estimated tax, you can make your deposit through the appropriate channels, which may include online payments, mailing a check, or in-person submissions at designated locations.

Steps to complete SC quarterly deposits

Completing SC quarterly deposits involves a series of straightforward steps. First, gather all necessary financial documents, including income statements and any previous tax returns. This information will help you accurately assess your income for the quarter.

Next, calculate your estimated tax liability. Use the current SC tax rates to determine how much you owe. After calculating your tax, choose your payment method. If you opt for online payment, visit the official SC Department of Revenue website to follow their instructions. Alternatively, if you prefer to mail your payment, ensure that you send it to the correct address and allow sufficient time for processing.

Lastly, keep a record of your payment confirmation or any receipts for your records. This documentation is essential for future reference and may be required for your tax filings.

Filing deadlines and important dates

Understanding filing deadlines is crucial for timely compliance with SC tax regulations. Typically, SC quarterly deposits are due on the 15th of the month following the end of each quarter. This means that the deadlines for deposits are April 15, July 15, October 15, and January 15 of the following year.

It is advisable to mark these dates on your calendar to avoid late payments, which may incur penalties and interest. Additionally, be aware of any changes to deadlines that may occur due to holidays or state-specific regulations.

Required documents for SC quarterly deposits

When preparing to make SC quarterly deposits, certain documents are necessary to ensure accurate calculations and compliance. Key documents include your income statements, which detail your earnings for the quarter, and any previous tax returns that may provide context for your current tax situation.

Additionally, you may need to gather any relevant deductions or credits that apply to your business or personal tax situation. Keeping organized records will facilitate the calculation of your estimated tax liability and streamline the deposit process.

Penalties for non-compliance

Failure to comply with SC quarterly deposit requirements can result in significant penalties. If deposits are not made by the due dates, the state may impose late fees and interest on the unpaid amounts. These penalties can accumulate quickly, increasing your overall tax liability.

In some cases, continued non-compliance can lead to more severe consequences, such as legal action or liens against your assets. To avoid these issues, it is essential to stay informed about your tax obligations and adhere to all filing and payment deadlines.

Digital vs. paper version of SC quarterly deposits

When it comes to submitting SC quarterly deposits, taxpayers have the option to choose between digital and paper methods. Digital submissions are often more efficient, allowing for immediate processing and confirmation of payments. Online platforms typically offer secure payment options and can simplify record-keeping.

On the other hand, some individuals may prefer the traditional paper method, which involves mailing checks or completing forms by hand. While this method may feel more familiar, it can lead to delays in processing and requires careful attention to ensure that payments are sent to the correct address.

Ultimately, the choice between digital and paper submissions depends on personal preference and comfort with technology.

Quick guide on how to complete how to make sc quarterly deposits

Complete How To Make Sc Quarterly Deposits effortlessly on any device

Digital document management has become increasingly favored by both businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed papers, as you can obtain the correct form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage How To Make Sc Quarterly Deposits on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to modify and eSign How To Make Sc Quarterly Deposits effortlessly

- Find How To Make Sc Quarterly Deposits and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize signNow sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for such purposes.

- Create your signature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to save your modifications.

- Select how you wish to share your form: via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced files, time-consuming form searches, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Modify and eSign How To Make Sc Quarterly Deposits to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct how to make sc quarterly deposits

Create this form in 5 minutes!

How to create an eSignature for the how to make sc quarterly deposits

The best way to create an eSignature for your PDF online

The best way to create an eSignature for your PDF in Google Chrome

The best way to generate an electronic signature for signing PDFs in Gmail

The best way to make an eSignature right from your smartphone

The way to generate an electronic signature for a PDF on iOS

The best way to make an eSignature for a PDF on Android

People also ask

-

What is tax sc and how can airSlate SignNow help with it?

Tax sc refers to tax-related services that require secure document handling and electronic signatures. airSlate SignNow provides an intuitive platform that allows businesses to easily send, sign, and manage tax documents, ensuring compliance and accuracy in the tax submission process.

-

How much does airSlate SignNow cost for managing tax sc?

airSlate SignNow offers flexible pricing plans tailored to meet different business needs, including those related to tax sc. You can choose between monthly and annual subscriptions, allowing you to find a solution that fits your budget while simplifying your document management.

-

What features of airSlate SignNow are beneficial for tax sc?

Key features of airSlate SignNow include customizable templates, automated workflow, and secure storage, which are especially useful for handling tax sc. These tools help streamline the signing process, reduce errors, and ensure that sensitive tax documents are managed securely.

-

Can I integrate airSlate SignNow with other software for tax sc?

Yes, airSlate SignNow offers seamless integrations with popular accounting software and CRM systems, enhancing your ability to manage tax sc. This allows for a smoother transition of documents and data across platforms, making tax-related processes more efficient.

-

Is airSlate SignNow compliant with tax regulations?

Absolutely, airSlate SignNow is built to comply with various tax regulations, ensuring that your tax sc documentation is handled securely and in accordance with legal standards. This compliance helps protect your business from potential legal issues and ensures the validity of your signed documents.

-

How does airSlate SignNow enhance the eSigning experience for tax sc?

airSlate SignNow enhances the eSigning experience for tax sc by providing a user-friendly interface and mobile accessibility. This allows users to sign tax documents anytime, anywhere, ensuring that your workflow remains uninterrupted, even on the go.

-

What support does airSlate SignNow provide for tax sc inquiries?

airSlate SignNow offers robust customer support to assist with any tax sc inquiries. Our dedicated support team is available via chat, email, or phone to help you navigate the platform and answer any questions regarding your tax document management.

Get more for How To Make Sc Quarterly Deposits

Find out other How To Make Sc Quarterly Deposits

- Electronic signature Utah Outsourcing Services Contract Online

- How To Electronic signature Wisconsin Debit Memo

- Electronic signature Delaware Junior Employment Offer Letter Later

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy