Tax Alaska Form

Understanding the Alaska Cigarette Tax

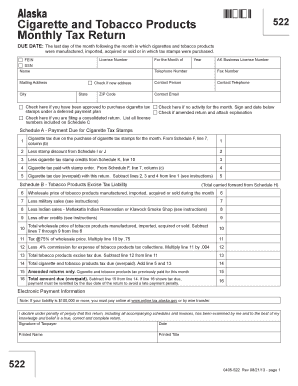

The Alaska cigarette tax is a state-imposed tax on the sale of cigarettes and other tobacco products. This tax is designed to generate revenue for the state and discourage smoking by increasing the cost of tobacco products. As of now, the tax rate for cigarettes in Alaska is set at a specific amount per pack, which may be subject to change based on state legislation. It is essential for businesses and individuals to stay informed about the current tax rates and regulations to ensure compliance.

Steps to Complete the Alaska Cigarette Tobacco Tax Form

Completing the Alaska cigarette tobacco tax form involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including the number of cigarettes sold, the tax rate, and any applicable deductions. Next, accurately fill out the form, ensuring that all sections are completed. After filling out the form, review it for any errors or omissions. Once confirmed, submit the form by the designated deadline, either electronically or via mail, depending on the submission method you choose.

Filing Deadlines and Important Dates

Filing deadlines for the Alaska cigarette tax are crucial for compliance. Typically, the tax return is due on a monthly basis, with specific dates set by the state. It is important to mark these dates on your calendar to avoid late fees or penalties. Additionally, any changes in tax rates or regulations may also affect your filing schedule, so staying updated through official state communications is advisable.

Required Documents for Filing

When filing the Alaska cigarette tobacco tax return, certain documents are required to support your submission. These may include sales records, inventory reports, and any documentation related to tax-exempt sales. Ensuring you have all required documents ready will streamline the filing process and help avoid delays or complications with your tax return.

Penalties for Non-Compliance

Failure to comply with the Alaska cigarette tax regulations can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is vital for businesses and individuals to understand the implications of non-compliance and take proactive measures to file their returns accurately and on time.

Legal Use of the Alaska Cigarette Tax Form

The Alaska cigarette tax form is legally binding when completed correctly and submitted in accordance with state laws. To ensure its legal standing, it is important to use a reliable method for signing and submitting the form. Utilizing digital solutions that comply with eSignature laws can enhance the validity of your submission, providing a secure and legally recognized way to complete the process.

Quick guide on how to complete tax alaska 6967180

Complete Tax Alaska effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents promptly without any holdups. Manage Tax Alaska on any platform using airSlate SignNow's Android or iOS applications and enhance any document-based workflow today.

How to modify and eSign Tax Alaska with ease

- Find Tax Alaska and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of the documents or obscure sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details carefully and click on the Done button to save your modifications.

- Choose your preferred method for sending your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, frustrating form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign Tax Alaska to ensure seamless communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax alaska 6967180

The best way to generate an electronic signature for a PDF document online

The best way to generate an electronic signature for a PDF document in Google Chrome

The way to generate an eSignature for signing PDFs in Gmail

The best way to make an electronic signature right from your smart phone

The way to make an eSignature for a PDF document on iOS

The best way to make an electronic signature for a PDF on Android OS

People also ask

-

What is the Alaska cigarette tax and how does it affect my business?

The Alaska cigarette tax is a state-imposed levy on the sale of cigarettes, which can signNowly impact your business costs. Understanding this tax is essential for compliance and budgeting. If your business sells tobacco products, it's critical to familiarize yourself with current rates and regulations to avoid penalties.

-

How does airSlate SignNow assist with compliance regarding the Alaska cigarette tax?

airSlate SignNow simplifies the process of documenting compliance with the Alaska cigarette tax through efficient eSignature workflows. You can easily create and store digital records of tax-related documents, ensuring you meet state regulations. This streamlining can save time and reduce errors in your tax filings.

-

What are the pricing plans for airSlate SignNow in relation to managing the Alaska cigarette tax?

airSlate SignNow offers flexible pricing plans that cater to various business needs, including those related to the Alaska cigarette tax. By selecting the appropriate plan, you can access features that help manage documentation and compliance affordably. Each plan is designed to provide excellent value, particularly for businesses in regulated industries.

-

Are there features in airSlate SignNow that directly help with tracking the Alaska cigarette tax?

Yes, airSlate SignNow includes features that assist with tracking and documenting transactions related to the Alaska cigarette tax. You can automate reminders for tax filing deadlines and keep all related documents organized in one place. This simplifies the tracking process and helps ensure compliance.

-

Can airSlate SignNow integrate with accounting tools, especially for managing the Alaska cigarette tax?

airSlate SignNow integrates seamlessly with various accounting tools, enhancing your ability to track the Alaska cigarette tax efficiently. These integrations allow you to synchronize data between platforms, making it easier to manage financial records and tax obligations. This connectivity streamlines your overall financial workflow.

-

What benefits does airSlate SignNow provide for businesses dealing with the Alaska cigarette tax?

Using airSlate SignNow offers several benefits for businesses navigating the Alaska cigarette tax landscape. Its user-friendly interface and automated processes facilitate easier management of compliance-related documents. Additionally, the ability to eSign and store important records securely can reduce administrative burdens and enhance efficiency.

-

How can I ensure my documents related to the Alaska cigarette tax are secure with airSlate SignNow?

airSlate SignNow prioritizes document security, particularly for sensitive tax-related information such as records pertaining to the Alaska cigarette tax. The platform employs state-of-the-art encryption and secure cloud storage to protect your data. This ensures that all your documentation remains confidential and accessible only to authorized users.

Get more for Tax Alaska

- Echs temporary slip download form

- Peeposign form

- Derriford physio self referral form

- Group attendance sheet pdf literacy volunteers of monmouth lvmonmouthnj form

- Bupa uplift form

- University of virginia health system contrast reaction virginia form

- T 1 department of veterans affairs vha directive 1070 form

- Arcadia dog license application pasadenahumane org form

Find out other Tax Alaska

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile

- Can I eSign Nebraska Finance & Tax Accounting Business Plan Template

- eSign Nebraska Finance & Tax Accounting Business Letter Template Online

- eSign Nevada Finance & Tax Accounting Resignation Letter Simple

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple