Tax Alaska Form

What is the Alaska instructions 532 form?

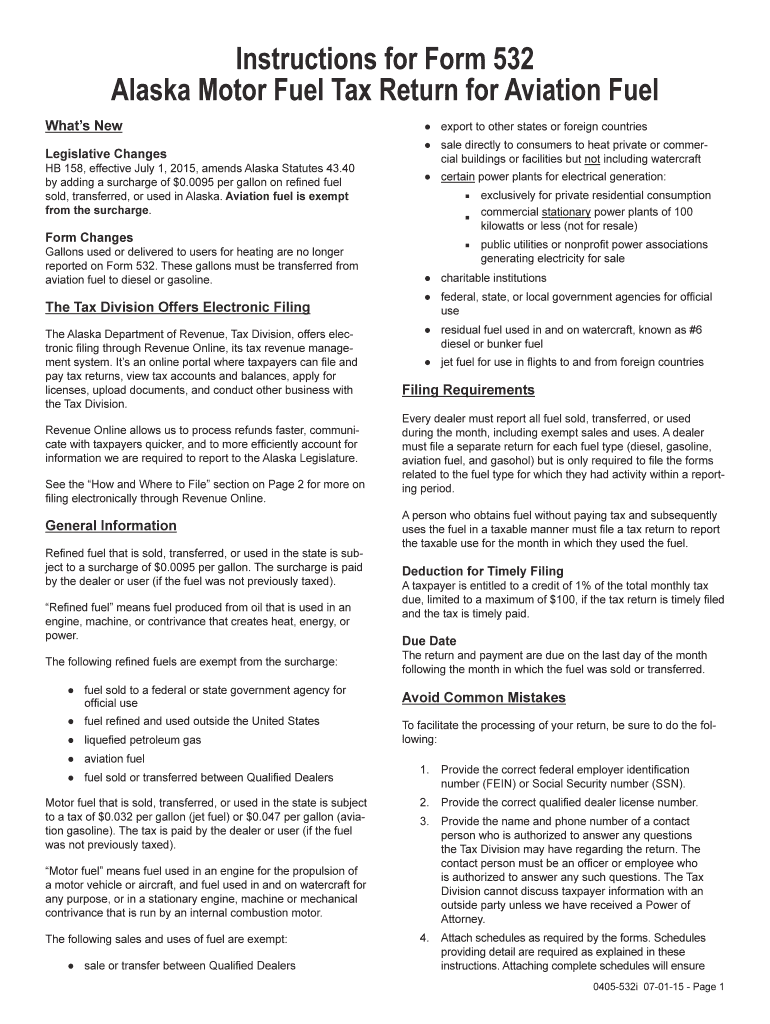

The Alaska instructions 532 form is a document used for specific tax-related purposes within the state of Alaska. It provides guidance on how to report certain types of income, deductions, and credits that are unique to Alaskan taxpayers. Understanding this form is essential for individuals and businesses to ensure compliance with state tax regulations.

Steps to complete the Alaska instructions 532 form

Completing the Alaska instructions 532 form involves several key steps to ensure accuracy and compliance. Follow these steps:

- Gather necessary documents, including income statements, previous tax returns, and any relevant financial records.

- Carefully read the instructions provided with the form to understand the requirements and sections.

- Fill out the form accurately, ensuring all information is complete and correctly entered.

- Review the completed form for any errors or omissions before submission.

- Submit the form by the specified deadline to avoid penalties.

Legal use of the Alaska instructions 532 form

The Alaska instructions 532 form is legally binding when completed and submitted according to state regulations. It is essential for taxpayers to understand that providing false information or failing to file can result in legal consequences. Compliance with the guidelines ensures that the form is accepted by the state and protects taxpayers from potential audits or penalties.

Filing Deadlines / Important Dates

Timely filing of the Alaska instructions 532 form is crucial. Key deadlines typically include:

- Annual filing deadline: Generally, this falls on April 15 for individual taxpayers.

- Extensions: If you require additional time, be aware of the extension request deadlines.

Staying informed about these dates helps prevent late fees and ensures compliance with state tax laws.

Required Documents

To accurately complete the Alaska instructions 532 form, certain documents are necessary. These may include:

- W-2 forms from employers.

- 1099 forms for other income sources.

- Records of any deductions or credits being claimed.

- Previous tax returns for reference.

Having these documents ready will facilitate a smoother filing process.

Form Submission Methods

The Alaska instructions 532 form can be submitted through various methods, allowing flexibility for taxpayers. Options typically include:

- Online submission via the state tax website.

- Mailing a printed copy to the appropriate tax office.

- In-person submission at designated tax offices.

Choosing the right submission method can streamline the filing process and ensure timely receipt by tax authorities.

Quick guide on how to complete tax alaska 6967285

Prepare Tax Alaska effortlessly on any device

Digital document management has gained signNow traction among businesses and individuals alike. It serves as an ideal sustainable alternative to conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the resources necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Tax Alaska on any device with airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to modify and electronically sign Tax Alaska with ease

- Find Tax Alaska and click on Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Emphasize important sections of the documents or obscure sensitive data with tools specifically provided by airSlate SignNow for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and has the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Select how you prefer to send your form, whether via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, frustrating form searches, or errors requiring new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you choose. Modify and electronically sign Tax Alaska to ensure outstanding communication at every stage of the form preparation process using airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax alaska 6967285

The best way to generate an electronic signature for a PDF document in the online mode

The best way to generate an electronic signature for a PDF document in Chrome

The way to generate an eSignature for putting it on PDFs in Gmail

The best way to make an electronic signature right from your mobile device

The way to make an eSignature for a PDF document on iOS devices

The best way to make an electronic signature for a PDF on Android devices

People also ask

-

What are the alaska instructions 532 form requirements?

The alaska instructions 532 form requires specific personal information, including your name, address, and details related to the application or document. It's crucial to follow the guidelines provided in the alaska instructions 532 form carefully to ensure proper submission. Make sure to review all sections before completing your form.

-

How can airSlate SignNow help with the alaska instructions 532 form?

airSlate SignNow simplifies the process of filling out and signing the alaska instructions 532 form. With our user-friendly interface, you can easily create, send, and eSign your documents securely. This streamlines your workflow, ensuring that you meet all your requirements promptly.

-

Is there a cost associated with using airSlate SignNow for the alaska instructions 532 form?

Yes, airSlate SignNow offers various pricing plans, but it remains a cost-effective solution for managing documents like the alaska instructions 532 form. You can choose a plan that best fits your needs, with options for individual users and teams, ensuring you stay within your budget while accessing premium features.

-

What features does airSlate SignNow offer for the alaska instructions 532 form?

airSlate SignNow provides features such as templates, real-time collaboration, and secure eSigning to assist you with the alaska instructions 532 form. Its intuitive platform ensures that you can easily customize your documents and track their status. These features enhance your overall document management experience.

-

Can I integrate airSlate SignNow with other software for the alaska instructions 532 form?

Yes, airSlate SignNow integrates seamlessly with various third-party applications to help you manage the alaska instructions 532 form efficiently. Whether you're using CRM systems, cloud storage, or productivity tools, our integrations enhance your workflow. This flexibility allows you to streamline processes and improve productivity.

-

How secure is airSlate SignNow when handling the alaska instructions 532 form?

Security is a top priority for airSlate SignNow, especially when dealing with documents like the alaska instructions 532 form. We utilize advanced encryption and compliance measures to protect your data. You can confidently eSign and store your documents knowing they are secure and legally binding.

-

Can I access the alaska instructions 532 form on mobile devices with airSlate SignNow?

Absolutely! airSlate SignNow is optimized for mobile use, allowing you to access and manage the alaska instructions 532 form on your smartphone or tablet. This mobility ensures you can complete your documents on the go, making it convenient for busy professionals.

Get more for Tax Alaska

Find out other Tax Alaska

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF