Tax Alaska Form

What is the Tax Alaska

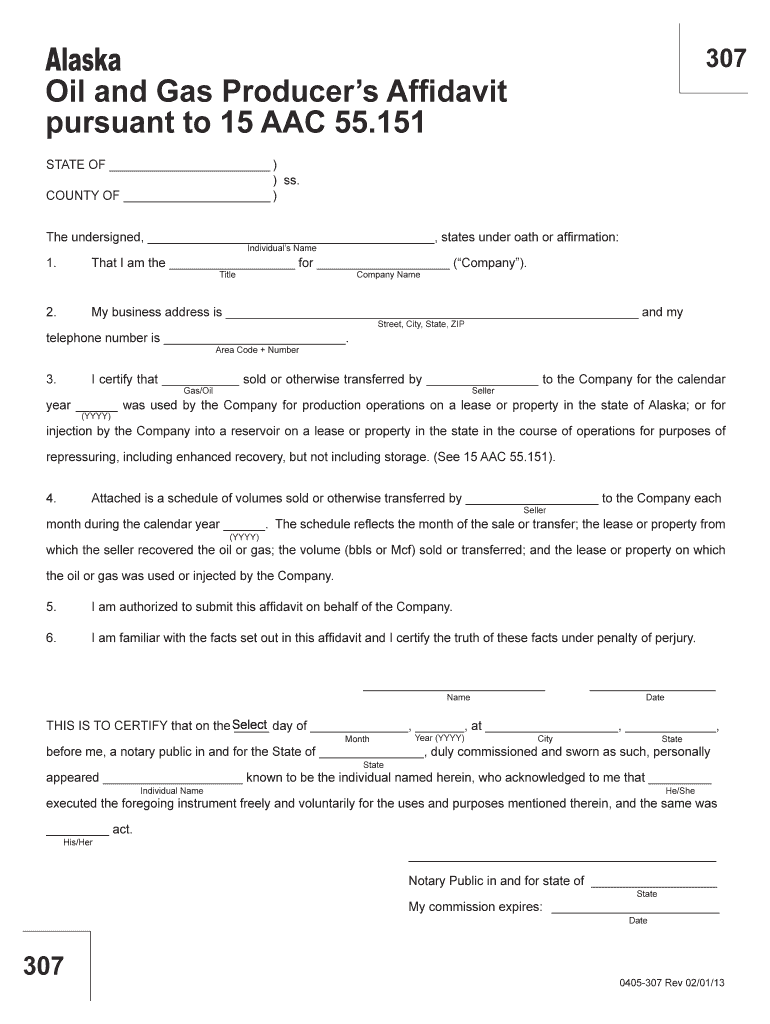

The Tax Alaska form is a specific document used for various tax-related purposes within the state of Alaska. It serves as a means for residents and businesses to report income, claim deductions, and fulfill their tax obligations. This form is essential for ensuring compliance with state tax laws and regulations, making it a vital part of the financial responsibilities of individuals and organizations operating in Alaska.

How to use the Tax Alaska

Utilizing the Tax Alaska form involves several key steps. First, gather all necessary financial documents, including income statements and receipts for deductions. Next, accurately fill out the form, ensuring that all information is complete and correct. After completing the form, review it for any errors before submitting it to the appropriate state tax authority. This process can be streamlined by using digital tools, which allow for easy editing and eSigning, ensuring a smooth submission experience.

Steps to complete the Tax Alaska

Completing the Tax Alaska form requires careful attention to detail. Follow these steps for an efficient process:

- Collect all relevant financial documents.

- Access the Tax Alaska form through official state resources or digital platforms.

- Fill out the form, ensuring accuracy in all entries.

- Review the completed form for any discrepancies.

- Submit the form electronically or via mail, as per your preference.

Legal use of the Tax Alaska

The legal use of the Tax Alaska form is governed by state tax laws. To ensure that the form is legally binding, it must be completed accurately and submitted within the designated timeframes. Utilizing a reliable eSigning platform can enhance the legal standing of the document, as it provides a digital certificate that verifies the identity of the signer and complies with relevant eSignature laws.

Filing Deadlines / Important Dates

Filing deadlines for the Tax Alaska form are crucial to avoid penalties. Typically, the due date aligns with federal tax deadlines, but specific state requirements may vary. It is important to stay informed about these dates to ensure timely submission. Mark your calendar with important dates, such as the start of the filing season and the final deadline for submissions, to maintain compliance.

Required Documents

To complete the Tax Alaska form, several documents are typically required. These may include:

- W-2 forms for wage earners.

- 1099 forms for independent contractors.

- Receipts for deductible expenses.

- Previous year’s tax return for reference.

Having these documents ready will facilitate a smoother completion process.

Who Issues the Form

The Tax Alaska form is issued by the Alaska Department of Revenue. This state agency is responsible for administering tax laws and ensuring compliance among residents and businesses. For any inquiries or assistance regarding the form, individuals can contact the department directly for guidance and support.

Quick guide on how to complete tax alaska 6967294

Effortlessly Prepare Tax Alaska on Any Device

The management of online documents has become increasingly favored by both businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to locate the necessary form and store it securely online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents promptly without any delays. Handle Tax Alaska on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric procedure today.

How to Modify and Electronically Sign Tax Alaska with Ease

- Locate Tax Alaska and click on Get Form to initiate the process.

- Utilize the tools we offer to fill out your form.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Select how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Edit and electronically sign Tax Alaska while ensuring clear communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax alaska 6967294

The best way to generate an electronic signature for your PDF in the online mode

The best way to generate an electronic signature for your PDF in Chrome

The way to generate an electronic signature for putting it on PDFs in Gmail

The best way to make an electronic signature from your smart phone

The way to make an electronic signature for a PDF on iOS devices

The best way to make an electronic signature for a PDF file on Android OS

People also ask

-

What is Tax Alaska and how can airSlate SignNow assist with it?

Tax Alaska refers to the specific tax regulations and filing processes relevant to residents and businesses in Alaska. airSlate SignNow can streamline your tax documentation process by allowing you to easily create, send, and eSign documents required for tax submissions in Alaska, saving you time and reducing errors.

-

How does airSlate SignNow ensure compliance with Tax Alaska requirements?

airSlate SignNow offers customizable templates and workflows that align with Tax Alaska regulations, ensuring that your documents meet all necessary compliance standards. This helps mitigate the risks of non-compliance and ensures that all your tax-related documents are properly managed.

-

What features does airSlate SignNow offer to simplify the Tax Alaska filing process?

airSlate SignNow includes features such as document templates, bulk sending, and in-app signing, which help simplify the Tax Alaska filing process. These functionalities allow you to efficiently prepare and manage your tax documents, making it easier to meet deadlines and requirements.

-

Can I integrate airSlate SignNow with other tools for managing Tax Alaska documentation?

Yes, airSlate SignNow offers integrations with various business tools and software platforms that you may be using for managing your Tax Alaska documentation. This allows for seamless data transfer and enhances your workflow efficiency, making tax management simpler and more organized.

-

What is the pricing structure for airSlate SignNow when using it for Tax Alaska purposes?

airSlate SignNow offers flexible pricing plans that can suit various business sizes and needs, including those specifically dealing with Tax Alaska. You can choose a plan that fits your budget while still benefiting from all the essential features required for effective tax management.

-

Is airSlate SignNow user-friendly for individuals unfamiliar with Tax Alaska documentation?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, making it easy for anyone, including those unfamiliar with Tax Alaska documentation, to navigate and utilize its features. The intuitive interface and accessible support resources help users quickly learn how to manage their tax documents effectively.

-

Does airSlate SignNow offer customer support for Tax Alaska-related issues?

Yes, airSlate SignNow provides comprehensive customer support to assist with any Tax Alaska-related inquiries or issues. Our dedicated support team is available to help guide you through the process of using the platform for your tax requirements.

Get more for Tax Alaska

Find out other Tax Alaska

- How Do I Electronic signature Iowa Construction Document

- How Can I Electronic signature South Carolina Charity PDF

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT