Tax Alaska Form

Understanding the Alaska Motor Fuel Bond

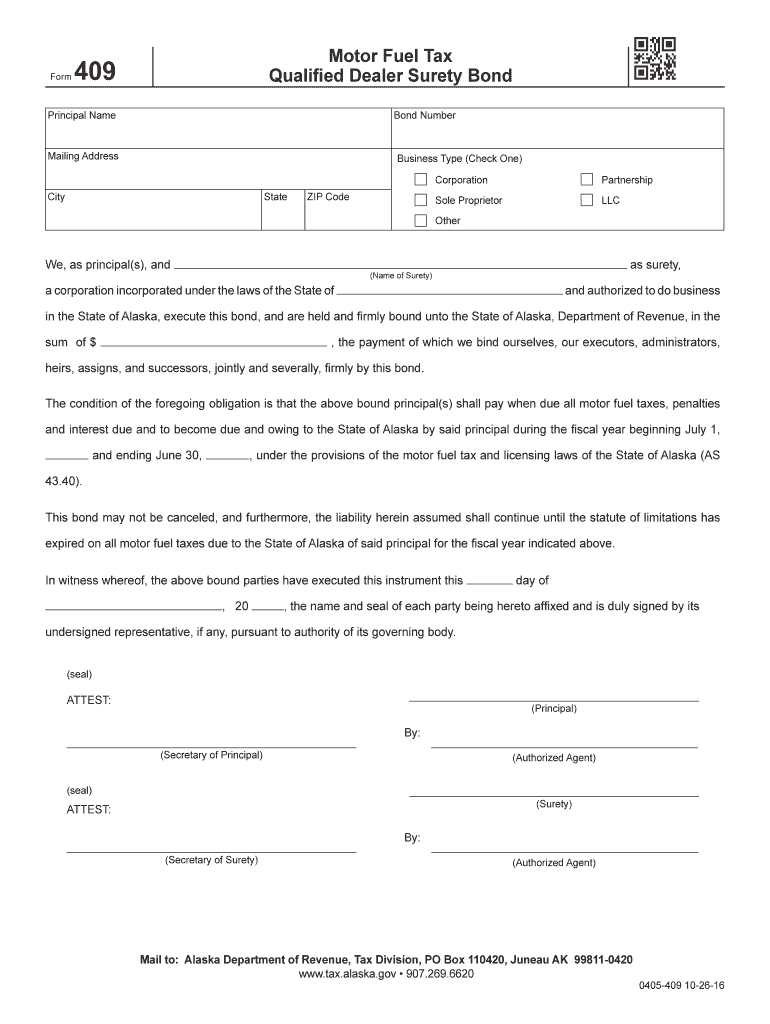

The Alaska motor fuel bond is a financial guarantee required for businesses involved in the distribution or sale of motor fuel in Alaska. This bond ensures compliance with state regulations regarding fuel taxes and helps protect the state from potential revenue losses. By obtaining this bond, businesses demonstrate their commitment to adhering to the laws governing motor fuel transactions.

Steps to Complete the Alaska Motor Fuel Bond

Completing the Alaska motor fuel bond involves several key steps:

- Determine the bond amount required by the state, which is typically based on projected fuel sales.

- Choose a reputable surety company that is licensed to issue bonds in Alaska.

- Complete the bond application, providing necessary business information and financial details.

- Submit the application along with any required documentation to the surety company.

- Once approved, review the bond terms and sign the agreement.

- Pay the bond premium, which is usually a percentage of the total bond amount.

- Receive the bond certificate, which must be filed with the appropriate state agency.

Key Elements of the Alaska Motor Fuel Bond

Several key elements define the Alaska motor fuel bond:

- Principal: The business or individual required to obtain the bond.

- Obligee: The state of Alaska, which is protected by the bond.

- Surety: The surety company that issues the bond and guarantees payment if the principal fails to comply with regulations.

- Bond Amount: The total amount of the bond, which varies based on the business's fuel sales.

- Duration: The bond is typically valid for one year and must be renewed annually.

Legal Use of the Alaska Motor Fuel Bond

The legal use of the Alaska motor fuel bond is crucial for ensuring compliance with state laws. It serves as a safeguard for the state against non-payment of fuel taxes. If a business fails to meet its tax obligations, the state can make a claim against the bond to recover lost revenue. Therefore, maintaining the bond in good standing is essential for the continued operation of any fuel-related business in Alaska.

Required Documents for the Alaska Motor Fuel Bond

When applying for the Alaska motor fuel bond, several documents are typically required:

- Business license or registration documents.

- Financial statements, including income statements and balance sheets.

- Tax identification number (TIN) or Employer Identification Number (EIN).

- Details about the types of fuel sold and estimated sales volume.

- Any additional documentation as requested by the surety company.

Who Issues the Alaska Motor Fuel Bond

The Alaska motor fuel bond is issued by licensed surety companies that operate within the state. These companies assess the financial stability and creditworthiness of the applicant before issuing the bond. It is important to choose a surety provider with a solid reputation and experience in the industry to ensure a smooth bonding process.

Quick guide on how to complete tax alaska 6967275

Complete Tax Alaska effortlessly on any device

Online document management has gained popularity among businesses and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed paperwork, allowing you to easily find the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents promptly without any delays. Manage Tax Alaska on any device using airSlate SignNow's Android or iOS applications and streamline any document-centric process today.

The easiest way to modify and eSign Tax Alaska without stress

- Find Tax Alaska and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Select relevant sections of your documents or obscure sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your alterations.

- Decide how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate the printing of new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you prefer. Edit and eSign Tax Alaska and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax alaska 6967275

The way to create an electronic signature for a PDF in the online mode

The way to create an electronic signature for a PDF in Chrome

How to create an eSignature for putting it on PDFs in Gmail

The way to make an eSignature right from your smart phone

The best way to create an eSignature for a PDF on iOS devices

The way to make an eSignature for a PDF on Android OS

People also ask

-

What is an Alaska motor fuel bond?

An Alaska motor fuel bond is a type of surety bond required for businesses that distribute or sell motor fuel in Alaska. This bond guarantees that these businesses will comply with state laws and regulations concerning the fuel industry. By obtaining an Alaska motor fuel bond, companies ensure they can operate legally and maintain their licenses.

-

How much does an Alaska motor fuel bond cost?

The cost of an Alaska motor fuel bond varies based on several factors, including the applicant's credit score and the bond amount required by the state. Generally, the price can range from 1% to 10% of the total bond amount. It's important to shop around and get quotes from different surety bond providers to find competitive rates.

-

What are the benefits of obtaining an Alaska motor fuel bond?

Obtaining an Alaska motor fuel bond not only allows your business to operate legally but also enhances your credibility with customers and partners. This bond protects consumers by ensuring that fuel businesses comply with regulations and pay necessary taxes. Moreover, having a bond can foster trust and reliability in the eyes of potential customers.

-

Are there specific requirements to obtain an Alaska motor fuel bond?

Yes, to obtain an Alaska motor fuel bond, applicants must meet specific criteria set by the Alaska Department of Revenue. Factors considered include the business's financial stability, credit history, and experience in the fuel industry. It's essential to prepare the required documentation and fulfillment of all legal obligations.

-

Can airSlate SignNow help in managing documents related to Alaska motor fuel bonds?

Absolutely! airSlate SignNow empowers businesses to easily manage, sign, and store documents related to their Alaska motor fuel bond. With our user-friendly platform, you can send important documentation quickly and securely, ensuring compliance and simplifying your administrative processes.

-

What features does airSlate SignNow offer for business document management?

airSlate SignNow offers a range of features that enhance document management, including eSignature functionality, customizable templates, document tracking, and team collaboration tools. These features streamline the process of managing your Alaska motor fuel bond documents and improve efficiency in your overall operations.

-

Does airSlate SignNow integrate with other business tools?

Yes, airSlate SignNow integrates seamlessly with popular business applications such as Salesforce, Google Drive, and Dropbox. This allows you to easily incorporate your Alaska motor fuel bond documents into your existing workflow and enhances productivity by reducing the need to switch between multiple tools.

Get more for Tax Alaska

Find out other Tax Alaska

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document