Disclosure of Social Security Number Andor Federal Taxpayer Documents Dgs Ca 2015

Understanding the Disclosure of Social Security Number and Federal Taxpayer Documents DGS Form

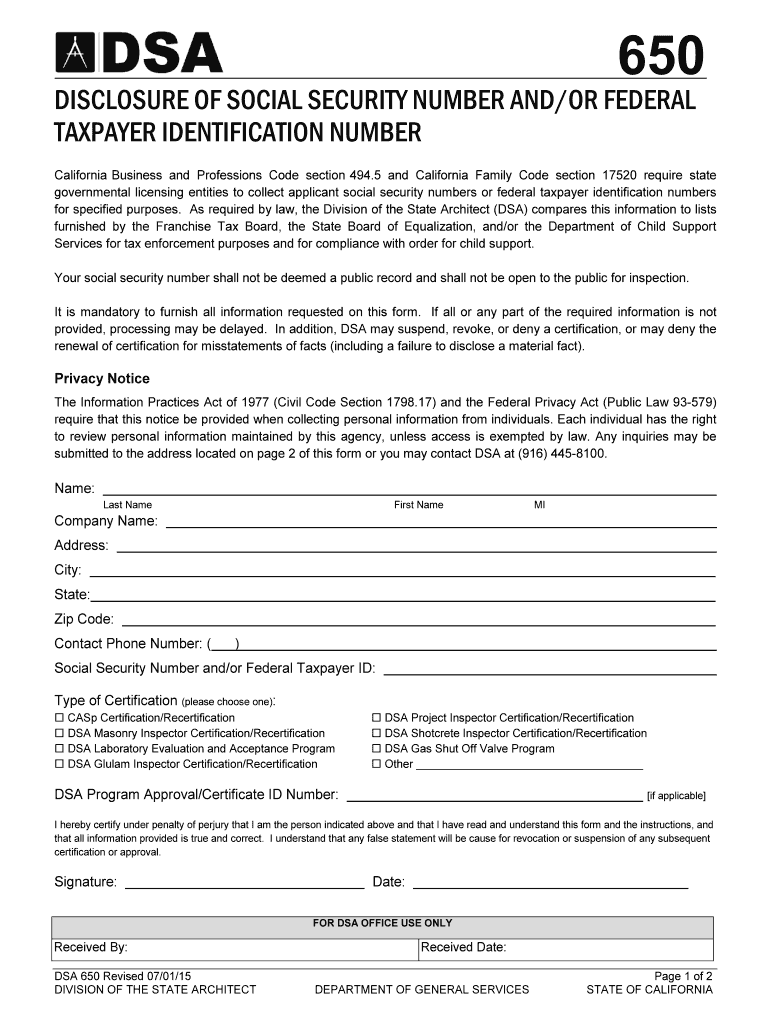

The Disclosure of Social Security Number and Federal Taxpayer Documents DGS form is essential for individuals and businesses in the United States to provide necessary information while ensuring compliance with federal regulations. This form is often required when disclosing sensitive information, such as Social Security numbers and taxpayer identification details, to various governmental entities or financial institutions. Understanding its purpose and the information it requires can help ensure that you complete it accurately and securely.

Steps to Complete the Disclosure of Social Security Number and Federal Taxpayer Documents DGS Form

Completing the Disclosure of Social Security Number and Federal Taxpayer Documents DGS form involves several key steps:

- Gather Required Information: Collect all necessary personal and business information, including Social Security numbers, taxpayer identification numbers, and any relevant financial details.

- Fill Out the Form: Carefully enter the required information in the designated fields. Ensure accuracy to avoid delays or issues.

- Review for Errors: Double-check all entries for accuracy. Errors can lead to complications in processing your disclosure.

- Sign and Date: Provide your signature and the date to validate the form. Electronic signatures are acceptable if using a compliant eSignature solution.

- Submit the Form: Follow the submission guidelines specific to the agency or institution requesting the form, whether online, by mail, or in person.

Legal Use of the Disclosure of Social Security Number and Federal Taxpayer Documents DGS Form

The legal use of the Disclosure of Social Security Number and Federal Taxpayer Documents DGS form is governed by several federal regulations. It is crucial to understand that the form must be filled out accurately and submitted to authorized entities only. Misuse of the form or providing false information can lead to legal consequences, including penalties and fines. Compliance with regulations such as the Privacy Act and the Internal Revenue Code is essential when handling sensitive taxpayer information.

Key Elements of the Disclosure of Social Security Number and Federal Taxpayer Documents DGS Form

Several key elements must be included in the Disclosure of Social Security Number and Federal Taxpayer Documents DGS form:

- Personal Identification: This includes the name, address, and Social Security number of the individual or business entity.

- Taxpayer Identification Number: If applicable, include the taxpayer identification number assigned by the IRS.

- Purpose of Disclosure: Clearly state the reason for providing this sensitive information.

- Signature and Date: Ensure that the form is signed and dated to confirm its validity.

IRS Guidelines for Disclosure of Social Security Number and Federal Taxpayer Documents DGS Form

The IRS provides specific guidelines for the use and submission of the Disclosure of Social Security Number and Federal Taxpayer Documents DGS form. These guidelines emphasize the importance of protecting personal information and ensuring that disclosures are made only to authorized parties. It is advisable to review the IRS publications related to taxpayer information disclosure to remain compliant with all regulations and avoid potential issues.

Form Submission Methods for the Disclosure of Social Security Number and Federal Taxpayer Documents DGS Form

When submitting the Disclosure of Social Security Number and Federal Taxpayer Documents DGS form, there are several methods available:

- Online Submission: Many agencies allow for electronic submission through secure portals, which can expedite processing.

- Mail: If submitting by mail, ensure that you send the form to the correct address and consider using a trackable mailing option.

- In-Person: Some institutions may require or allow for in-person submission. Check their specific requirements for this method.

Quick guide on how to complete disclosure of social security number andor federal taxpayer documents dgs ca

Effortlessly Prepare Disclosure Of Social Security Number Andor Federal Taxpayer Documents Dgs Ca on Any Device

Managing documents online has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed papers, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools you need to create, edit, and eSign your documents swiftly without any delays. Handle Disclosure Of Social Security Number Andor Federal Taxpayer Documents Dgs Ca on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign Disclosure Of Social Security Number Andor Federal Taxpayer Documents Dgs Ca with minimal effort

- Obtain Disclosure Of Social Security Number Andor Federal Taxpayer Documents Dgs Ca and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of the documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature with the Sign tool, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, an invitation link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tiring form searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and eSign Disclosure Of Social Security Number Andor Federal Taxpayer Documents Dgs Ca and guarantee effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct disclosure of social security number andor federal taxpayer documents dgs ca

Create this form in 5 minutes!

How to create an eSignature for the disclosure of social security number andor federal taxpayer documents dgs ca

The way to create an eSignature for a PDF file in the online mode

The way to create an eSignature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

The way to make an electronic signature straight from your smartphone

The best way to generate an eSignature for a PDF file on iOS devices

The way to make an electronic signature for a PDF document on Android

People also ask

-

What is the taxpayer documents dgs form?

The taxpayer documents dgs form is a crucial document used in various tax-related processes. It helps ensure that you provide accurate information to tax authorities. Utilizing this form correctly can streamline your tax submission process.

-

How can airSlate SignNow help with taxpayer documents dgs form?

airSlate SignNow offers a simple solution for signing and managing your taxpayer documents dgs form electronically. With features like eSignatures and document storage, you can handle your tax forms efficiently and securely.

-

Is there a cost associated with using airSlate SignNow for taxpayer documents dgs form?

airSlate SignNow provides a cost-effective solution with various pricing plans tailored to your needs. You can choose a plan that fits your budget while accessing essential features for managing taxpayer documents dgs form.

-

What features are included in airSlate SignNow for handling taxpayer documents dgs form?

airSlate SignNow includes features such as template creation, eSigning, and document tracking to simplify the management of taxpayer documents dgs form. These tools enhance productivity and ensure compliance with tax regulations.

-

Can I integrate airSlate SignNow with other tax software for taxpayer documents dgs form?

Yes, airSlate SignNow offers integration capabilities with various tax software solutions. This allows you to easily upload and manage taxpayer documents dgs form alongside your existing tools, enhancing your workflow.

-

Is using airSlate SignNow for taxpayer documents dgs form secure?

Absolutely! airSlate SignNow employs top-tier security measures to protect your taxpayer documents dgs form. Your data is encrypted and stored securely, ensuring that your sensitive information remains confidential.

-

How can businesses benefit from using airSlate SignNow for taxpayer documents dgs form?

Businesses can benefit from airSlate SignNow by streamlining the process of handling taxpayer documents dgs form. This leads to increased efficiency, reduced turnaround times, and improved compliance with tax regulations.

Get more for Disclosure Of Social Security Number Andor Federal Taxpayer Documents Dgs Ca

Find out other Disclosure Of Social Security Number Andor Federal Taxpayer Documents Dgs Ca

- Sign Arizona Sublease Agreement Template Fast

- How To Sign Florida Sublease Agreement Template

- Sign Wyoming Roommate Contract Safe

- Sign Arizona Roommate Rental Agreement Template Later

- How Do I Sign New York Sublease Agreement Template

- How To Sign Florida Roommate Rental Agreement Template

- Can I Sign Tennessee Sublease Agreement Template

- Sign Texas Sublease Agreement Template Secure

- How Do I Sign Texas Sublease Agreement Template

- Sign Iowa Roommate Rental Agreement Template Now

- How Do I Sign Louisiana Roommate Rental Agreement Template

- Sign Maine Lodger Agreement Template Computer

- Can I Sign New Jersey Lodger Agreement Template

- Sign New York Lodger Agreement Template Later

- Sign Ohio Lodger Agreement Template Online

- Sign South Carolina Lodger Agreement Template Easy

- Sign Tennessee Lodger Agreement Template Secure

- Sign Virginia Lodger Agreement Template Safe

- Can I Sign Michigan Home Loan Application

- Sign Arkansas Mortgage Quote Request Online