APPLICATION and RETURN for CLASSIFICATIONEXEMPTION of PROPERTY as HISTORIC PROPERTY USED for COMMERCIAL or CERTAIN NONPROFIT PUR Form

Understanding the application classification exemption for commercial property

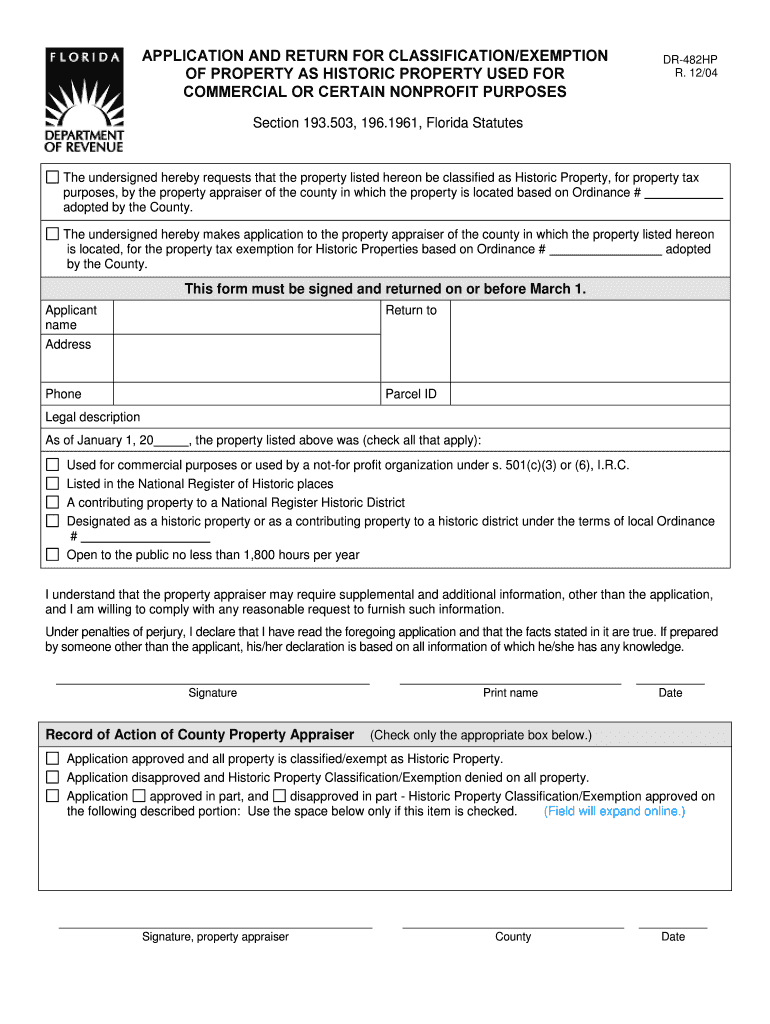

The application classification exemption for property used as historic property for commercial purposes is a legal mechanism that allows property owners to benefit from reduced property taxes. This exemption is designed to encourage the preservation of historic properties while enabling their use for commercial activities. The criteria for qualifying include the property's historical significance and its intended use for commercial or certain nonprofit purposes. Understanding these criteria is crucial for property owners seeking to take advantage of this exemption.

Steps to complete the application classification exemption

Completing the application for classification exemption requires careful attention to detail. The following steps outline the process:

- Gather necessary documentation that proves the property's historic status.

- Complete the application form accurately, ensuring all required fields are filled.

- Submit the application by the specified deadline, which varies by state.

- Provide any additional information requested by the reviewing authority.

Each step is essential to ensure that the application is processed smoothly and efficiently.

Eligibility criteria for the application classification exemption

To qualify for the classification exemption, certain eligibility criteria must be met. These include:

- The property must be officially designated as historic by a recognized authority.

- The intended use of the property must align with commercial or nonprofit purposes.

- Compliance with local, state, and federal regulations regarding historic preservation.

Meeting these criteria is vital for a successful application and to maintain the benefits of the exemption.

Required documents for the application classification exemption

When applying for the classification exemption, specific documents are necessary to support your application. These may include:

- Proof of the property's historic designation, such as a certificate or listing.

- Documentation of the intended use, including business plans or nonprofit missions.

- Financial statements that demonstrate the commercial viability of the property.

Providing comprehensive and accurate documentation strengthens the application and aids in the review process.

Legal considerations for the application classification exemption

Understanding the legal implications of the application classification exemption is crucial for property owners. This includes:

- Familiarity with local and state laws governing historic properties and their use.

- Awareness of the potential penalties for non-compliance with exemption requirements.

- Understanding the rights and responsibilities associated with maintaining the historic status of the property.

Legal compliance ensures that property owners can fully benefit from the exemption without facing unexpected legal challenges.

Form submission methods for the application classification exemption

Submitting the application for classification exemption can typically be done through various methods. These may include:

- Online submission via the appropriate state or local government portal.

- Mailing a physical copy of the application to the designated office.

- In-person submission at local government offices, if available.

Choosing the correct submission method is essential to ensure that the application is received and processed in a timely manner.

Quick guide on how to complete application and return for classificationexemption of property as historic property used for commercial or certain nonprofit

Complete APPLICATION AND RETURN FOR CLASSIFICATIONEXEMPTION OF PROPERTY AS HISTORIC PROPERTY USED FOR COMMERCIAL OR CERTAIN NONPROFIT PUR effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers a perfect eco-friendly substitute to traditional printed and signed documents, allowing you to obtain the correct form and securely archive it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage APPLICATION AND RETURN FOR CLASSIFICATIONEXEMPTION OF PROPERTY AS HISTORIC PROPERTY USED FOR COMMERCIAL OR CERTAIN NONPROFIT PUR on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign APPLICATION AND RETURN FOR CLASSIFICATIONEXEMPTION OF PROPERTY AS HISTORIC PROPERTY USED FOR COMMERCIAL OR CERTAIN NONPROFIT PUR without hassle

- Find APPLICATION AND RETURN FOR CLASSIFICATIONEXEMPTION OF PROPERTY AS HISTORIC PROPERTY USED FOR COMMERCIAL OR CERTAIN NONPROFIT PUR and click on Get Form to begin.

- Utilize the tools we offer to finish your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Decide how you want to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign APPLICATION AND RETURN FOR CLASSIFICATIONEXEMPTION OF PROPERTY AS HISTORIC PROPERTY USED FOR COMMERCIAL OR CERTAIN NONPROFIT PUR and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the application and return for classificationexemption of property as historic property used for commercial or certain nonprofit

The way to generate an electronic signature for your PDF file online

The way to generate an electronic signature for your PDF file in Google Chrome

The way to make an eSignature for signing PDFs in Gmail

How to create an electronic signature from your mobile device

The best way to make an electronic signature for a PDF file on iOS

How to create an electronic signature for a PDF file on Android devices

People also ask

-

What is application classification property commercial?

Application classification property commercial refers to the categorization of properties used for commercial purposes in relation to their specific applications. Understanding this classification helps businesses comply with local regulations and maximize the value of their commercial assets.

-

How does airSlate SignNow support application classification property commercial?

airSlate SignNow offers a streamlined process for managing documents related to application classification property commercial. With eSigning capabilities, businesses can easily sign and send necessary legal documents, ensuring compliance and efficiency in their property management.

-

What are the pricing options for airSlate SignNow's services?

airSlate SignNow provides several pricing plans tailored to different business needs, including options for startups and large enterprises. Our plans are designed to be cost-effective, enabling businesses involved in application classification property commercial to choose a solution that fits their budget.

-

What features does airSlate SignNow offer for managing commercial property documents?

airSlate SignNow offers features like customizable templates, bulk sending, and secure storage, ideal for handling documents related to application classification property commercial. These features help streamline workflows and enhance collaboration among teams.

-

Can airSlate SignNow integrate with other tools I use for managing commercial properties?

Yes, airSlate SignNow can seamlessly integrate with various CRM, project management, and document management tools. This integration is particularly beneficial for businesses focused on application classification property commercial, as it enhances overall efficiency.

-

How can airSlate SignNow improve the signing process for commercial agreements?

With airSlate SignNow, businesses can accelerate the signing process for commercial agreements related to application classification property commercial. The platform allows for instant eSigning, tracking of document status, and automated reminders, ensuring timely completions.

-

Is airSlate SignNow compliant with legal standards for commercial documents?

Absolutely! airSlate SignNow complies with all necessary legal standards and regulations, making it a secure choice for application classification property commercial. Our platform uses advanced encryption and authentication methods to protect sensitive documents.

Get more for APPLICATION AND RETURN FOR CLASSIFICATIONEXEMPTION OF PROPERTY AS HISTORIC PROPERTY USED FOR COMMERCIAL OR CERTAIN NONPROFIT PUR

Find out other APPLICATION AND RETURN FOR CLASSIFICATIONEXEMPTION OF PROPERTY AS HISTORIC PROPERTY USED FOR COMMERCIAL OR CERTAIN NONPROFIT PUR

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors