Propertytaxrules by Oconnorassociate Issuu Form

Understanding the Voluntary Disclosure Property Form

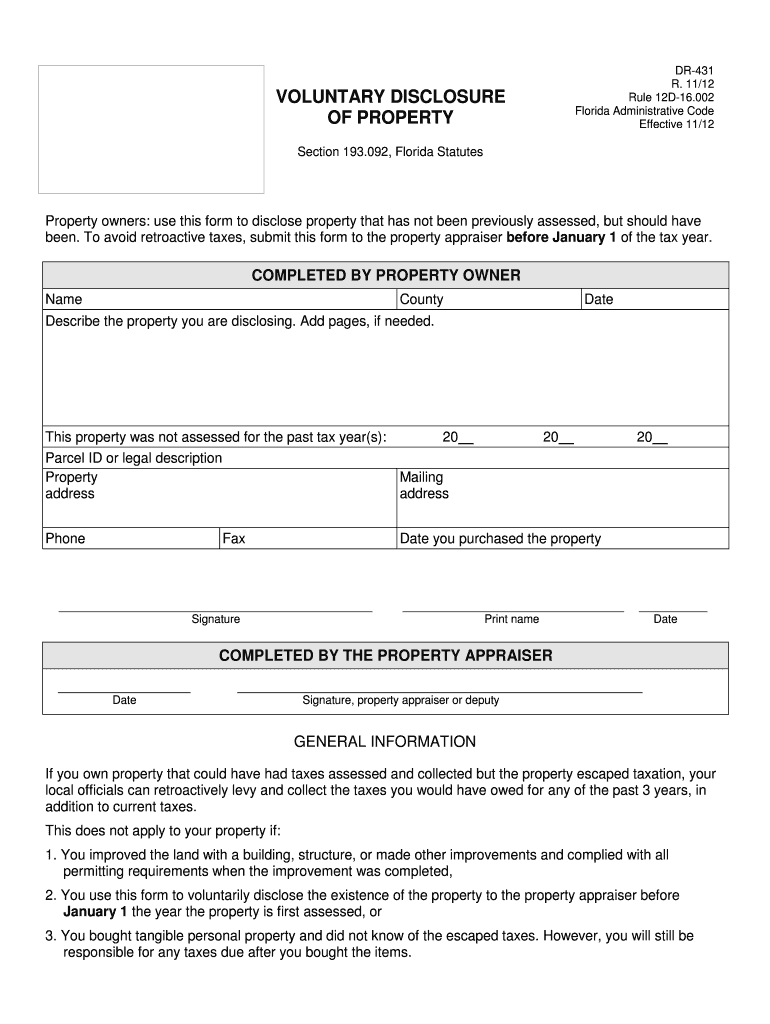

The voluntary disclosure property form is a crucial document for individuals and businesses looking to disclose property ownership or related tax obligations. This form allows taxpayers to voluntarily report previously unreported property, ensuring compliance with state tax laws. By using this form, individuals can rectify past omissions and avoid potential penalties.

Steps to Complete the Voluntary Disclosure Property Form

Completing the voluntary disclosure property form involves several key steps:

- Gather necessary documentation, including property deeds and tax records.

- Fill out the form accurately, providing all required information about the property.

- Review the completed form for accuracy and completeness.

- Submit the form to the appropriate tax authority, either online or via mail.

Eligibility Criteria for Voluntary Disclosure

To qualify for voluntary disclosure, taxpayers must meet specific criteria, which may vary by state. Generally, the following conditions apply:

- The taxpayer must have previously failed to report property ownership or related income.

- The disclosure must be made voluntarily, without any prior notice of an audit.

- All relevant information must be disclosed fully and accurately.

Penalties for Non-Compliance

Failing to disclose property can lead to significant penalties. These may include:

- Fines based on the value of the unreported property.

- Interest on unpaid taxes owed.

- Potential legal action for tax evasion.

Form Submission Methods

Taxpayers can submit the voluntary disclosure property form through various methods, depending on state regulations. Common submission options include:

- Online submission via the state tax authority's website.

- Mailing the completed form to the designated tax office.

- In-person submission at local tax offices, if available.

Key Elements of the Voluntary Disclosure Property Form

When completing the voluntary disclosure property form, it is essential to include the following key elements:

- Taxpayer identification information, such as Social Security number or EIN.

- Detailed description of the property being disclosed.

- Disclosure of any prior tax filings related to the property.

Quick guide on how to complete propertytaxrules by oconnorassociate issuu

Handle Propertytaxrules By Oconnorassociate Issuu effortlessly on any gadget

Web-based document management has become favored among enterprises and individuals alike. It offers a fantastic eco-friendly substitute for conventional printed and signed paperwork, as you can locate the correct template and securely keep it online. airSlate SignNow provides all the tools necessary to create, adjust, and electronically sign your documents quickly without any holdups. Manage Propertytaxrules By Oconnorassociate Issuu on any gadget using airSlate SignNow apps for Android or iOS and streamline any document-related task today.

How to edit and electronically sign Propertytaxrules By Oconnorassociate Issuu with ease

- Locate Propertytaxrules By Oconnorassociate Issuu and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive data with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and then click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from a device of your selection. Revise and electronically sign Propertytaxrules By Oconnorassociate Issuu to ensure seamless communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the propertytaxrules by oconnorassociate issuu

The way to generate an eSignature for your PDF in the online mode

The way to generate an eSignature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

How to generate an eSignature straight from your smart phone

The way to create an electronic signature for a PDF on iOS devices

How to generate an eSignature for a PDF document on Android OS

People also ask

-

What is voluntary disclosure property?

Voluntary disclosure property refers to the process by which property owners proactively disclose information about their property, often to rectify past tax issues. Utilizing services like airSlate SignNow can streamline the documentation needed for voluntary disclosure, ensuring compliance with regulations and simplifying the submission process.

-

How can airSlate SignNow help with voluntary disclosure property?

airSlate SignNow offers a user-friendly platform for preparing, sending, and eSigning documents related to voluntary disclosure property. Our solution enables you to handle all necessary forms efficiently, reducing the chances of errors and expediting the approval process.

-

What are the pricing options for airSlate SignNow in relation to voluntary disclosure property?

Our pricing for airSlate SignNow is designed to be cost-effective, especially for businesses handling voluntary disclosure property cases. We offer various plans based on the number of users and features required, making it accessible for small to large enterprises.

-

Are there any specific features in airSlate SignNow for managing voluntary disclosure property requests?

Yes, airSlate SignNow includes features specifically beneficial for managing voluntary disclosure property requests, such as document templates, real-time collaboration, and automated reminders. These features assist in ensuring that your documents are completed accurately and in a timely manner.

-

Can airSlate SignNow integrate with other tools for voluntary disclosure property management?

Absolutely! airSlate SignNow can seamlessly integrate with various third-party applications that are useful for managing voluntary disclosure property, such as CRM systems and accounting software. This integration helps centralize your workflow and enhances productivity across your business.

-

What are the benefits of using airSlate SignNow for voluntary disclosure property?

Using airSlate SignNow for voluntary disclosure property offers numerous benefits, such as improved efficiency, reduced paperwork, and enhanced security for your sensitive documents. Our electronic signing solutions ensure that your transactions are executed quickly and securely, which is crucial for property disclosure processes.

-

Is it easy to get started with airSlate SignNow for voluntary disclosure property?

Yes, getting started with airSlate SignNow for voluntary disclosure property is straightforward. Simply sign up for an account, choose a pricing plan that suits your needs, and you can begin creating and sending documents for eSignature in minutes.

Get more for Propertytaxrules By Oconnorassociate Issuu

- Sample adoption contract image texalmal form

- Medical technologist skills checklist form

- Solicitud de transmisin de vehculos pdf form

- Concussion symptoms checklist form

- Personalized card meaning form

- Waiver of signature form

- New submission to add the cobas u 411 urine analyzer for use with the chemstrip 10 ua form

- Work experience form portland state university pdx

Find out other Propertytaxrules By Oconnorassociate Issuu

- How Do I Electronic signature Alabama Non-Compete Agreement

- How To eSignature North Carolina Sales Receipt Template

- Can I Electronic signature Arizona LLC Operating Agreement

- Electronic signature Louisiana LLC Operating Agreement Myself

- Can I Electronic signature Michigan LLC Operating Agreement

- How Can I Electronic signature Nevada LLC Operating Agreement

- Electronic signature Ohio LLC Operating Agreement Now

- Electronic signature Ohio LLC Operating Agreement Myself

- How Do I Electronic signature Tennessee LLC Operating Agreement

- Help Me With Electronic signature Utah LLC Operating Agreement

- Can I Electronic signature Virginia LLC Operating Agreement

- Electronic signature Wyoming LLC Operating Agreement Mobile

- Electronic signature New Jersey Rental Invoice Template Computer

- Electronic signature Utah Rental Invoice Template Online

- Electronic signature Louisiana Commercial Lease Agreement Template Free

- eSignature Delaware Sales Invoice Template Free

- Help Me With eSignature Oregon Sales Invoice Template

- How Can I eSignature Oregon Sales Invoice Template

- eSignature Pennsylvania Sales Invoice Template Online

- eSignature Pennsylvania Sales Invoice Template Free