Michigan Wine Tax Report Lcc 3890 Form 2020

What is the Michigan Wine Tax Report Lcc 3890 Form

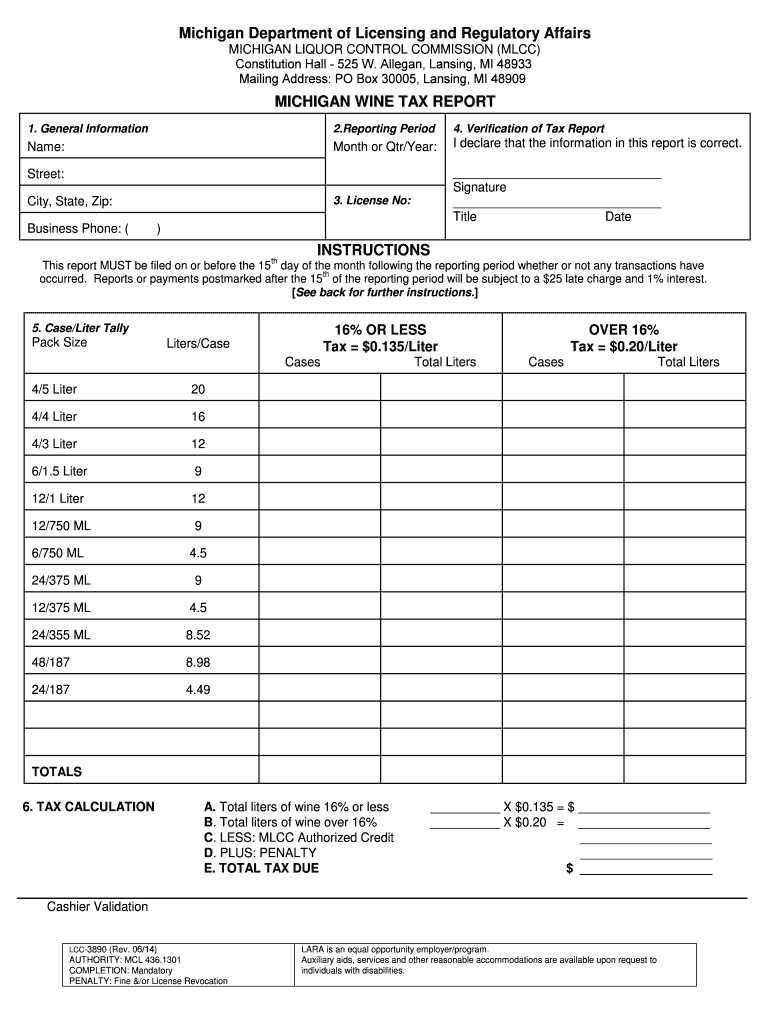

The Michigan Wine Tax Report Lcc 3890 Form is a specific document used by businesses involved in the production, distribution, or sale of wine within Michigan. This form is essential for reporting the state wine tax, which is imposed on the sale of wine products. It is a crucial component for compliance with Michigan tax regulations, ensuring that businesses accurately report their wine sales and remit the appropriate taxes to the state. Understanding this form is vital for maintaining legal operations within the wine industry.

How to use the Michigan Wine Tax Report Lcc 3890 Form

Using the Michigan Wine Tax Report Lcc 3890 Form involves a series of steps to ensure accurate reporting. First, gather all necessary sales data related to wine transactions for the reporting period. This includes sales volumes, types of wine sold, and any applicable exemptions. Next, fill out the form with the required information, ensuring that all figures are accurate and reflect your sales records. After completing the form, review it for any errors before submission to avoid potential penalties. The form can be submitted electronically or via mail, depending on the preferred method of the filing entity.

Steps to complete the Michigan Wine Tax Report Lcc 3890 Form

Completing the Michigan Wine Tax Report Lcc 3890 Form requires careful attention to detail. Follow these steps for successful completion:

- Collect all relevant sales data for the reporting period.

- Access the Michigan Wine Tax Report Lcc 3890 Form from the official source or authorized provider.

- Fill in your business information, including name, address, and license number.

- Report the total volume of wine sold, categorized by type.

- Calculate the total tax owed based on the reported sales volume.

- Review the form for accuracy and completeness.

- Submit the form electronically or via mail, ensuring it is sent by the deadline.

Legal use of the Michigan Wine Tax Report Lcc 3890 Form

The Michigan Wine Tax Report Lcc 3890 Form is legally binding when completed and submitted in accordance with state regulations. It serves as an official record of wine sales and tax obligations. To ensure its legal standing, the form must be filled out accurately, with all required signatures and certifications included. Compliance with relevant tax laws and regulations is essential to avoid penalties and maintain good standing with state authorities.

Filing Deadlines / Important Dates

Filing deadlines for the Michigan Wine Tax Report Lcc 3890 Form are critical for compliance. Typically, the form must be submitted on a quarterly basis, with specific due dates determined by the Michigan Department of Treasury. It is important to stay informed about these deadlines to avoid late fees or penalties. Mark your calendar with the due dates for each quarter to ensure timely submission and adherence to state regulations.

Form Submission Methods

The Michigan Wine Tax Report Lcc 3890 Form can be submitted through various methods, providing flexibility for businesses. The available submission methods include:

- Online submission via the Michigan Department of Treasury's e-filing system.

- Mailing a physical copy of the completed form to the designated address.

- In-person submission at local tax offices, if applicable.

Choosing the right submission method can help streamline the filing process and ensure compliance with state requirements.

Quick guide on how to complete michigan wine tax report lcc 3890 form

Effortlessly prepare Michigan Wine Tax Report Lcc 3890 Form on any device

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely save it online. airSlate SignNow equips you with all the resources required to generate, edit, and electronically sign your documents swiftly without any holdups. Manage Michigan Wine Tax Report Lcc 3890 Form from any device using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

The simplest approach to edit and electronically sign Michigan Wine Tax Report Lcc 3890 Form with ease

- Find Michigan Wine Tax Report Lcc 3890 Form and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize key sections of your documents or conceal sensitive data with features that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form navigation, or errors that require new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you select. Edit and electronically sign Michigan Wine Tax Report Lcc 3890 Form and ensure seamless communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct michigan wine tax report lcc 3890 form

Create this form in 5 minutes!

How to create an eSignature for the michigan wine tax report lcc 3890 form

The way to generate an eSignature for your PDF file in the online mode

The way to generate an eSignature for your PDF file in Chrome

How to make an eSignature for putting it on PDFs in Gmail

How to generate an electronic signature right from your smartphone

The way to create an electronic signature for a PDF file on iOS devices

How to generate an electronic signature for a PDF on Android

People also ask

-

What is the Michigan Wine Tax Report Lcc 3890 Form?

The Michigan Wine Tax Report Lcc 3890 Form is a required document for wineries operating in Michigan to report their wine production and taxes owed. This form ensures compliance with state regulations and helps in the accurate calculation of taxes. Utilizing this form can simplify accounting practices for wine businesses.

-

How can I easily complete the Michigan Wine Tax Report Lcc 3890 Form?

You can easily complete the Michigan Wine Tax Report Lcc 3890 Form by utilizing airSlate SignNow's online e-signature solution. Our platform offers templates and guidance to streamline the process, making it hassle-free and efficient. This ensures that your form is completed accurately and submitted on time.

-

Is there a fee for using airSlate SignNow to file the Michigan Wine Tax Report Lcc 3890 Form?

While there may be fees associated with using airSlate SignNow's services, we provide competitive pricing options to suit various business needs. Our plans are designed to be cost-effective, helping you save money while ensuring compliance with the Michigan Wine Tax Report Lcc 3890 Form. You can choose a plan that best fits your workflow.

-

What features does airSlate SignNow offer for the Michigan Wine Tax Report Lcc 3890 Form?

airSlate SignNow offers features such as customizable templates, digital signatures, and secure document storage specifically for the Michigan Wine Tax Report Lcc 3890 Form. Our platform is designed for ease of use, allowing for quick edits and updates as necessary. Additionally, our audit trail feature ensures every action on the document is tracked for compliance.

-

How does airSlate SignNow improve the filing process for the Michigan Wine Tax Report Lcc 3890 Form?

airSlate SignNow streamlines the filing process for the Michigan Wine Tax Report Lcc 3890 Form by simplifying document preparation and e-signatures. The intuitive interface allows users to fill out and sign the form digitally, minimizing errors and delays. This efficiency translates to timely submissions and reduces the risk of penalties.

-

Can I integrate airSlate SignNow with my existing accounting software for the Michigan Wine Tax Report Lcc 3890 Form?

Yes, airSlate SignNow offers seamless integration with various accounting software, enhancing the efficiency of filing the Michigan Wine Tax Report Lcc 3890 Form. This integration ensures that all your financial data works together, allowing for a more streamlined filing process. You can easily sync information and maintain accuracy across platforms.

-

What are the benefits of using airSlate SignNow for the Michigan Wine Tax Report Lcc 3890 Form?

Using airSlate SignNow for the Michigan Wine Tax Report Lcc 3890 Form provides numerous benefits, including time savings, enhanced accuracy, and legal compliance. Our digital solution reduces paperwork and fosters collaboration among team members. Additionally, you can enjoy the peace of mind that comes with secure document handling.

Get more for Michigan Wine Tax Report Lcc 3890 Form

Find out other Michigan Wine Tax Report Lcc 3890 Form

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple

- eSign Oklahoma Sports Rental Application Easy