Mn St3 2019-2026

What is the Mn St3?

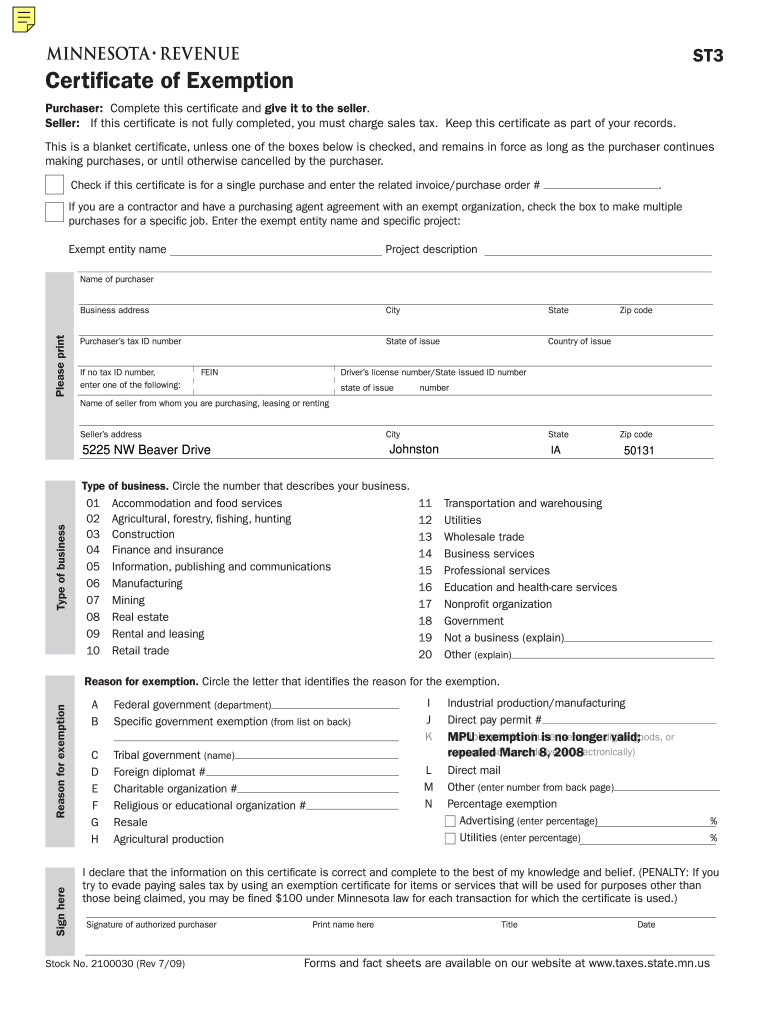

The Mn St3 form, also known as the Certificate of Exemption for Sales Tax in Minnesota, is a crucial document for businesses and individuals seeking to make tax-exempt purchases. This form allows eligible buyers to avoid paying sales tax on certain transactions, which can significantly reduce costs for qualifying purchases. It is primarily used by organizations that are exempt from sales tax, such as non-profits, government entities, and specific educational institutions.

How to use the Mn St3

Using the Mn St3 form involves a straightforward process. First, the buyer must complete the form by providing their name, address, and the reason for the exemption. It is essential to accurately fill out all required fields to ensure the validity of the certificate. Once completed, the buyer presents the Mn St3 to the seller at the time of purchase. The seller retains the form for their records, which serves as proof that the transaction is exempt from sales tax.

Steps to complete the Mn St3

Completing the Mn St3 form requires attention to detail. Here are the steps to follow:

- Download the Mn St3 form from a reliable source.

- Fill in your name and address accurately.

- Indicate the specific reason for the exemption, such as being a non-profit organization.

- Provide any additional information requested, such as a tax identification number.

- Sign and date the form to certify its accuracy.

After completing these steps, ensure that you keep a copy for your records before presenting it to the seller.

Legal use of the Mn St3

The legal use of the Mn St3 form is governed by Minnesota state law. To be considered valid, the form must be completed accurately and presented at the time of purchase. Sellers are required to keep the certificate on file to demonstrate compliance with tax regulations. Misuse of the Mn St3, such as using it for ineligible purchases, can lead to penalties for both the buyer and seller, including potential audits or fines from the Minnesota Department of Revenue.

Eligibility Criteria

Eligibility to use the Mn St3 form is primarily determined by the nature of the buyer's organization. Generally, the following entities may qualify:

- Non-profit organizations recognized under IRS regulations.

- Government agencies at the federal, state, or local level.

- Educational institutions that meet specific criteria.

It is essential for applicants to verify their eligibility before using the form to ensure compliance with state tax laws.

Form Submission Methods

The Mn St3 form does not require formal submission to a state agency; instead, it is presented directly to the seller at the point of sale. However, businesses should maintain their own copies of the completed forms for record-keeping purposes. This practice helps ensure compliance and provides documentation in case of future audits.

Quick guide on how to complete mn st3

Effortlessly Prepare Mn St3 on Any Device

Digital document management has gained traction among businesses and individuals. It offers an excellent environmentally-friendly substitute for conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents swiftly without unnecessary delays. Conduct Mn St3 operations on any device with the airSlate SignNow applications for Android or iOS, and enhance any document-centric process today.

Steps to Modify and Electronically Sign Mn St3 with Ease

- Obtain Mn St3 and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information using the tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes just seconds and has the same legal validity as a traditional handwritten signature.

- Review all details and click the Done button to save your changes.

- Choose your preferred method of delivering your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors that require reprinting new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Alter and electronically sign Mn St3 to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct mn st3

Create this form in 5 minutes!

How to create an eSignature for the mn st3

The way to make an electronic signature for a PDF document in the online mode

The way to make an electronic signature for a PDF document in Chrome

The best way to generate an eSignature for putting it on PDFs in Gmail

How to generate an electronic signature straight from your mobile device

The way to generate an eSignature for a PDF document on iOS devices

How to generate an electronic signature for a PDF document on Android devices

People also ask

-

What is the st3 form 2024 and who needs it?

The st3 form 2024 is a tax form used in specific states for reporting business income. It is primarily required for individuals and business entities that operate in states that mandate filing this form each year. Ensuring you have the correct version of the st3 form 2024 is crucial for compliance and accurate reporting.

-

How can airSlate SignNow help with the st3 form 2024?

airSlate SignNow offers a streamlined solution to electronically sign and share the st3 form 2024, ensuring that you can complete your tax submissions quickly and securely. With its easy-to-use interface, users can fill, sign, and send their st3 forms without hassle. This saves time and reduces the risk of errors in the filing process.

-

What are the pricing options for using airSlate SignNow for the st3 form 2024?

airSlate SignNow provides competitive pricing plans based on your business needs, including options suitable for individuals and large teams. Pricing varies depending on features like document storage and the number of users, making it a flexible solution for managing the st3 form 2024 and other documents. You can visit our website for detailed pricing information.

-

Is airSlate SignNow compliant with regulations for the st3 form 2024?

Yes, airSlate SignNow is fully compliant with the electronic signature regulations and security standards required for submitting the st3 form 2024. Our platform ensures that all signed documents are legally valid and secure, giving users peace of mind as they manage their tax documents electronically.

-

Can I integrate airSlate SignNow with other tools for managing the st3 form 2024?

Absolutely! airSlate SignNow easily integrates with a variety of business tools, such as CRM systems and accounting software, making it convenient to manage the st3 form 2024 alongside other business processes. This integration enhances workflow efficiency, allowing you to collect signatures and manage documents seamlessly.

-

What features does airSlate SignNow offer for the st3 form 2024?

airSlate SignNow provides features like customizable templates, automated workflows, and cloud storage specifically designed for documents like the st3 form 2024. Users can also track document status in real-time and receive notifications when their forms are signed, ensuring efficient management of all tax-related paperwork.

-

How secure is airSlate SignNow when handling the st3 form 2024?

Security is a top priority for airSlate SignNow, especially when handling sensitive documents like the st3 form 2024. Our platform uses advanced encryption protocols and industry-standard security measures to protect your information, ensuring that your documents remain confidential and secure throughout the signing process.

Get more for Mn St3

Find out other Mn St3

- How To eSign Illinois Business Operations Stock Certificate

- Can I eSign Louisiana Car Dealer Quitclaim Deed

- eSign Michigan Car Dealer Operating Agreement Mobile

- Can I eSign Mississippi Car Dealer Resignation Letter

- eSign Missouri Car Dealer Lease Termination Letter Fast

- Help Me With eSign Kentucky Business Operations Quitclaim Deed

- eSign Nevada Car Dealer Warranty Deed Myself

- How To eSign New Hampshire Car Dealer Purchase Order Template

- eSign New Jersey Car Dealer Arbitration Agreement Myself

- eSign North Carolina Car Dealer Arbitration Agreement Now

- eSign Ohio Car Dealer Business Plan Template Online

- eSign Ohio Car Dealer Bill Of Lading Free

- How To eSign North Dakota Car Dealer Residential Lease Agreement

- How Do I eSign Ohio Car Dealer Last Will And Testament

- Sign North Dakota Courts Lease Agreement Form Free

- eSign Oregon Car Dealer Job Description Template Online

- Sign Ohio Courts LLC Operating Agreement Secure

- Can I eSign Michigan Business Operations POA

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later