Personal Property Tax Waiver Jefferson County Mo 2019

What is the Personal Property Tax Waiver Jefferson County Mo

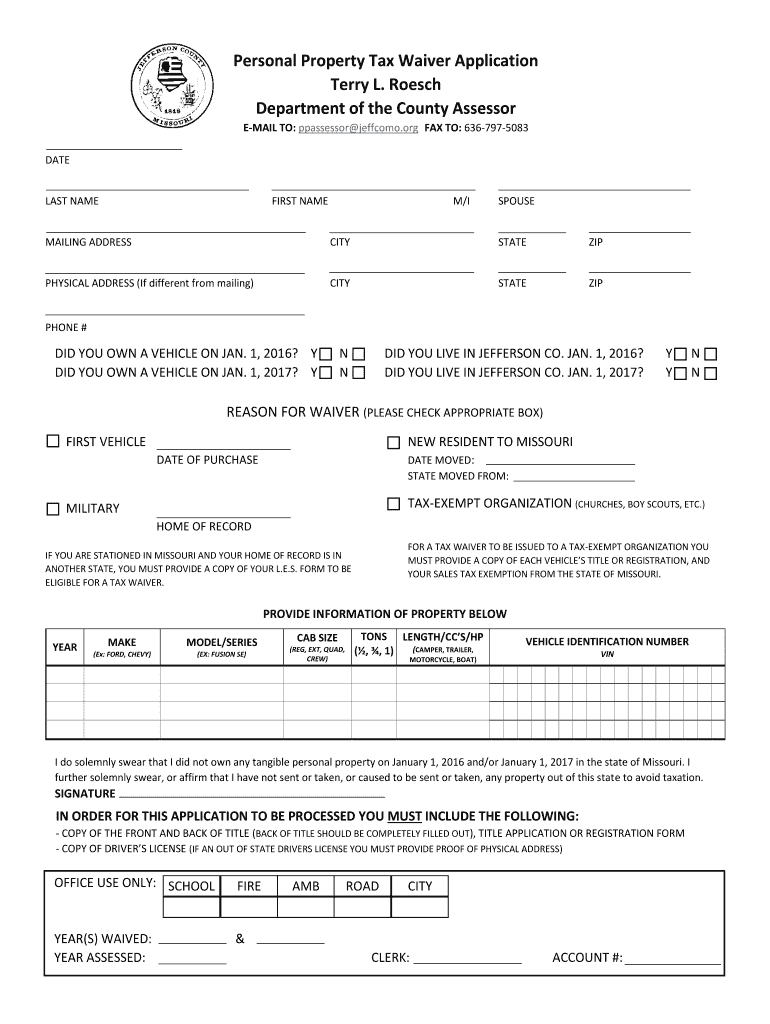

The personal property tax waiver in Jefferson County, Missouri, is a legal document that allows eligible individuals or entities to request an exemption from certain personal property taxes. This waiver is typically applicable to specific categories of personal property, such as vehicles or business equipment, depending on local regulations. Understanding the criteria for eligibility and the implications of the waiver is essential for taxpayers seeking relief from tax obligations.

How to use the Personal Property Tax Waiver Jefferson County Mo

Using the personal property tax waiver involves several steps. First, individuals must determine their eligibility based on the requirements set by Jefferson County. Once eligibility is confirmed, the next step is to obtain the waiver form from the appropriate local authority, such as the Jefferson County Assessor's office. After completing the form, it can be submitted electronically or via mail, depending on the submission methods available. It is crucial to ensure that all required information is accurately provided to avoid delays in processing.

Steps to complete the Personal Property Tax Waiver Jefferson County Mo

Completing the personal property tax waiver involves a systematic approach:

- Review eligibility criteria to confirm qualification for the waiver.

- Obtain the waiver form from the Jefferson County Assessor's office or their official website.

- Fill out the form accurately, ensuring all required sections are completed.

- Gather any necessary supporting documents that may be required.

- Submit the completed form and documents either online or by mail, following the guidelines provided.

Legal use of the Personal Property Tax Waiver Jefferson County Mo

The legal use of the personal property tax waiver requires compliance with local laws and regulations. The waiver must be filled out correctly and submitted within any specified deadlines to be considered valid. Additionally, the document should be signed electronically or physically, depending on the method of submission. Adhering to these legal requirements ensures that the waiver is recognized by the Jefferson County authorities and protects the taxpayer's interests.

Eligibility Criteria

Eligibility for the personal property tax waiver in Jefferson County typically depends on various factors, including the type of property being assessed and the taxpayer's financial situation. Common criteria may include:

- Ownership of the personal property in question.

- Meeting specific income thresholds or financial hardship requirements.

- Property classification as defined by local tax laws.

It is advisable for applicants to review the specific eligibility requirements outlined by the Jefferson County Assessor's office to ensure compliance.

Form Submission Methods

The personal property tax waiver can be submitted through various methods in Jefferson County, including:

- Online submission via the official Jefferson County Assessor's website.

- Mailing the completed form to the designated office address.

- In-person submission at the local Assessor's office, if preferred.

Each method has its own guidelines and processing times, so it is important to choose the one that best fits the taxpayer's needs.

Quick guide on how to complete personal property tax waiver jefferson county mo

Complete Personal Property Tax Waiver Jefferson County Mo effortlessly on any device

Digital document management has gained traction among organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, enabling you to access the right form and securely save it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents quickly without delays. Handle Personal Property Tax Waiver Jefferson County Mo on any platform using airSlate SignNow's Android or iOS applications and streamline any document-focused process today.

The most efficient method to alter and eSign Personal Property Tax Waiver Jefferson County Mo with ease

- Find Personal Property Tax Waiver Jefferson County Mo and click Get Form to begin.

- Use the tools we offer to fill out your form.

- Emphasize important sections of the documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that function.

- Create your signature using the Sign tool, which takes just a few seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to store your modifications.

- Select your preferred method to send your form—by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, exhaustive form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you choose. Modify and eSign Personal Property Tax Waiver Jefferson County Mo while ensuring excellent communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct personal property tax waiver jefferson county mo

Create this form in 5 minutes!

How to create an eSignature for the personal property tax waiver jefferson county mo

The way to make an electronic signature for your PDF file online

The way to make an electronic signature for your PDF file in Google Chrome

The best way to make an eSignature for signing PDFs in Gmail

How to make an eSignature right from your mobile device

The way to generate an electronic signature for a PDF file on iOS

How to make an eSignature for a PDF on Android devices

People also ask

-

What is a personal property tax waiver in Jefferson County, MO?

A personal property tax waiver in Jefferson County, MO, is a document that relieves property owners from paying taxes on certain vehicles and personal properties. This waiver can signNowly reduce the financial burden for eligible individuals. Understanding the criteria for obtaining this waiver is essential for effective tax management.

-

How can I apply for a personal property tax waiver in Jefferson County, MO?

To apply for a personal property tax waiver in Jefferson County, MO, you need to complete the designated application form provided by the local government. Ensure all required documentation is included to streamline the review process. Using airSlate SignNow can help you eSign and submit your application electronically for added convenience.

-

What are the eligibility requirements for a personal property tax waiver in Jefferson County, MO?

Eligibility for a personal property tax waiver in Jefferson County, MO, typically includes factors such as income level, the type of property owned, and the duration of ownership. Specific guidelines can vary, so it's important to review local regulations or consult a tax advisor. Ensuring you meet these criteria can affect your potential approval.

-

What are the benefits of obtaining a personal property tax waiver in Jefferson County, MO?

Obtaining a personal property tax waiver in Jefferson County, MO, can lead to signNow financial savings for property owners. This waiver may allow you to allocate funds toward other essential expenses or investments. Additionally, having the waiver can simplify your tax responsibilities and provide peace of mind.

-

Are there any fees associated with applying for a personal property tax waiver in Jefferson County, MO?

In most cases, there are no fees associated with applying for a personal property tax waiver in Jefferson County, MO. However, it's always advisable to check with local authorities for any potential administrative costs. Utilizing airSlate SignNow can ensure a cost-effective way to manage your tax documents without additional charges.

-

Can the airSlate SignNow platform assist with personal property tax waiver documentation?

Yes, the airSlate SignNow platform can assist you in managing personal property tax waiver documentation by allowing you to eSign and store your documents securely. This easy-to-use solution simplifies the paperwork process and helps you keep track of all necessary submissions. Adopting airSlate SignNow enhances your efficiency as you navigate through tax regulations.

-

How long does it take to receive a response after applying for a personal property tax waiver in Jefferson County, MO?

The response time for a personal property tax waiver application in Jefferson County, MO, can vary depending on the volume of applications. Typically, you can expect to receive a decision within a few weeks. To expedite the process, ensure all required documents are accurately submitted through platforms like airSlate SignNow, which helps avoid delays.

Get more for Personal Property Tax Waiver Jefferson County Mo

- Guarantor letter sample for rental form

- Florida probation community service form 31746362

- Apreasal form

- Sample of bylaws for an association form

- Alaska death certificate request form

- Ohio health financial assistance online application form

- Abs app 14 form

- Wisconsin dot application for bonded certificate of title for a vehicle form

Find out other Personal Property Tax Waiver Jefferson County Mo

- How Can I Electronic signature Oklahoma Courts PDF

- How Do I Electronic signature South Dakota Courts Document

- Can I Electronic signature South Dakota Sports Presentation

- How To Electronic signature Utah Courts Document

- Can I Electronic signature West Virginia Courts PPT

- Send Sign PDF Free

- How To Send Sign PDF

- Send Sign Word Online

- Send Sign Word Now

- Send Sign Word Free

- Send Sign Word Android

- Send Sign Word iOS

- Send Sign Word iPad

- How To Send Sign Word

- Can I Send Sign Word

- How Can I Send Sign Word

- Send Sign Document Online

- Send Sign Document Computer

- Send Sign Document Myself

- Send Sign Document Secure